NMI Holdings Inc (NMIH) Reports Solid Year-Over-Year Earnings Growth

Net Income: Q4 net income rose to $83.4 million, a year-over-year increase of 14%.

Insurance-in-Force: Reached $197.0 billion, marking a 7% growth from the previous year.

Book Value per Share: Increased by 17% year-over-year to $25.54, excluding net unrealized gains and losses.

Return on Equity: Annualized return on equity for Q4 was 18.0%, maintaining strong profitability.

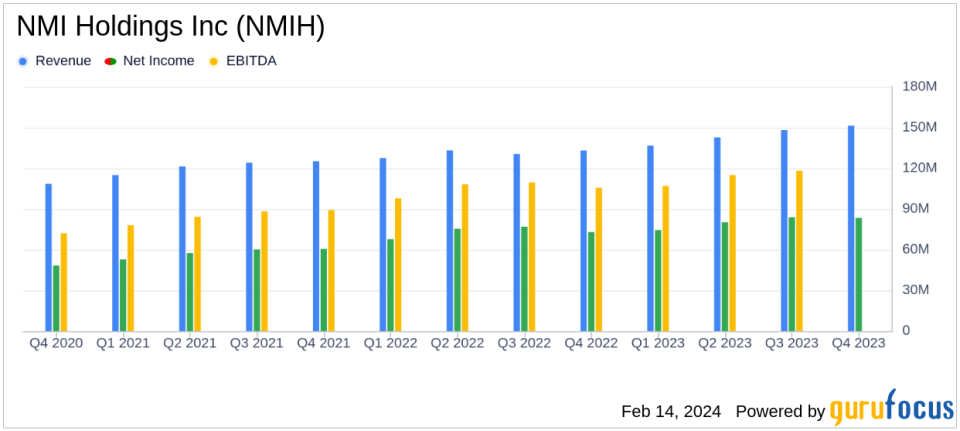

Revenue: Total revenue for Q4 climbed to $151.4 million, up from $133.1 million in the same quarter last year.

Claims and Expenses: Insurance claims and claim expenses saw a significant increase, rising 139% year-over-year in Q4.

On February 14, 2024, NMI Holdings Inc (NASDAQ:NMIH) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a provider of private mortgage guaranty insurance through its subsidiaries, reported a net income of $83.4 million for Q4, translating to $1.01 per diluted share. This performance represents a slight decrease from the previous quarter but a 14% increase from the fourth quarter of the previous year. For the full year, net income reached $322.1 million, or $3.84 per diluted share, compared to $292.9 million in the previous year.

Financial Performance Highlights

NMIH's primary insurance-in-force (IIF) stood at $197.0 billion at the end of Q4, showing consistent growth from $194.8 billion in the previous quarter and a 7% increase from the end of 2022. The company's total revenue for the quarter was $151.4 million, up from $133.1 million in the same quarter of the previous year. Net premiums earned also saw an uptick, reaching $132.9 million compared to $119.6 million in Q4 of 2022.

However, the company faced challenges with rising underwriting and operating expenses, which increased to $29.7 million from $26.7 million in the prior year's quarter. Insurance claims and claim expenses also surged to $8.2 million, a significant rise from $3.4 million in Q4 of 2022.

Strategic Positioning and Outlook

Adam Pollitzer, President and CEO of National MI, expressed confidence in the company's strategic positioning, citing "standout success" and "strong operating performance" throughout 2023. Pollitzer highlighted the company's high-quality book and comprehensive risk transfer solutions, robust balance sheet, and significant earnings power as key factors underpinning NMIH's ability to deliver growth and value for shareholders.

"The fourth quarter capped another year of standout success for National MI. In 2023, we delivered strong operating performance, generated significant NIW volume and consistent growth in our insured portfolio, and achieved record financial results and an 18.2% return on equity," said Adam Pollitzer.

Balance Sheet and Shareholder Equity

Shareholders equity was reported at $1.9 billion at quarter end, with book value per share at $23.81. Excluding the impact of net unrealized gains and losses in the investment portfolio, the book value per share was $25.54, reflecting a 4% increase from the third quarter and a 17% increase year-over-year. The company's annualized return on equity for the quarter was 18.0%, slightly down from 19.0% in the previous quarter but still indicative of strong profitability.

NMIH's performance demonstrates its resilience and strategic growth in a competitive insurance industry. The company's ability to increase its insurance-in-force, coupled with a solid rise in net income, positions it favorably for future growth. However, investors should be mindful of the increased claims and expenses, which could impact profitability if they continue to rise. NMI Holdings Inc's commitment to delivering value to shareholders remains evident in its robust financial achievements and strategic initiatives.

For a more detailed analysis of NMI Holdings Inc's financial results, including full income statements, balance sheets, and cash flow statements, please visit the company's website or access the full 8-K filing.

Explore the complete 8-K earnings release (here) from NMI Holdings Inc for further details.

This article first appeared on GuruFocus.