NNN REIT Inc. Reports Solid Annual Results and Provides Optimistic 2024 Guidance

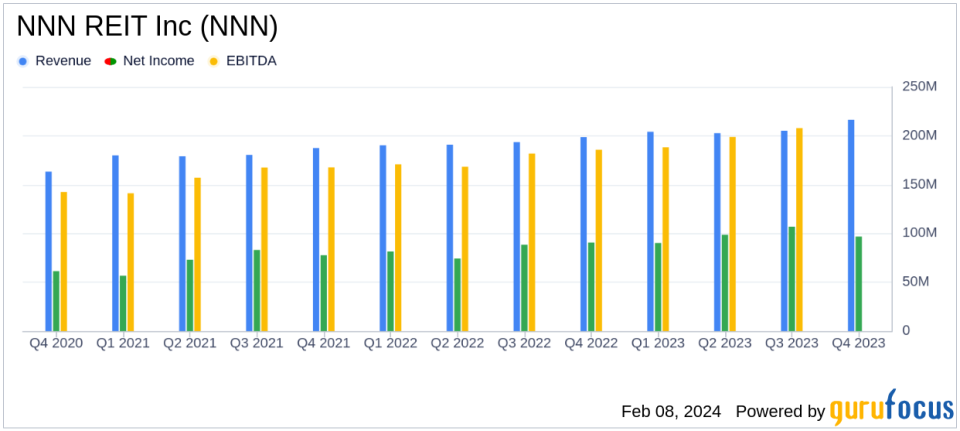

Revenue: Increased to $828.1 million in 2023 from $773.1 million in 2022.

Net Earnings: Grew to $392.3 million, or $2.16 per diluted share, up from $334.6 million, or $1.89 per diluted share in the previous year.

FFO: Rose to $589.1 million, or $3.24 per diluted share, compared to $548.9 million, or $3.10 per diluted share in 2022.

Dividend: Increased annual dividend per common share to $2.23, marking the 34th consecutive year of dividend growth.

Occupancy: Maintained high occupancy levels at 99.5% with a weighted average remaining lease term of 10.1 years.

Investments: Acquired 165 properties and sold 45 properties, generating substantial gains on sales.

2024 Guidance: Core FFO is projected to be between $3.25 and $3.31 per share, with AFFO estimated between $3.29 and $3.35 per share.

On February 8, 2024, NNN REIT Inc (NYSE:NNN), a prominent real estate investment trust, announced its operating results for the quarter and year ended December 31, 2023. The company released its 8-K filing, showcasing a year of robust financial growth and strategic acquisitions. NNN REIT Inc specializes in high-quality retail properties, often subject to long-term net leases, and has a significant presence in the South and Southeast United States.

Financial Highlights and Performance

For the year 2023, NNN REIT Inc reported a revenue increase to $828.1 million, up from $773.1 million in the previous year. Net earnings available to common stockholders also saw a significant rise to $392.3 million, or $2.16 per diluted share, compared to $334.6 million, or $1.89 per diluted share in 2022. Funds From Operations (FFO) increased to $589.1 million, or $3.24 per diluted share, from $548.9 million, or $3.10 per diluted share in the prior year. Core FFO and Adjusted Funds From Operations (AFFO) per common share also experienced growth, indicating a solid operational performance.

The company's financial achievements are critical, as they reflect the successful management of its property portfolio and the ability to generate consistent rental income. The increase in dividends for the 34th consecutive year underscores NNN REIT Inc's commitment to delivering shareholder value and its confidence in the company's financial stability and growth prospects.

Strategic Investments and Capital Allocation

In 2023, NNN REIT Inc made significant property investments totaling $819.7 million, including the acquisition of 165 properties with a weighted average remaining lease term of 18.8 years. The company also sold 45 properties for $115.7 million, producing $47.5 million in gains on sales. These strategic transactions demonstrate the company's adeptness in capitalizing on market opportunities to optimize its portfolio.

The company's ability to maintain high occupancy levels at 99.5% and a weighted average remaining lease term of 10.1 years is a testament to the strength of its property management and the attractiveness of its real estate assets. The high occupancy rate is particularly important for a REIT, as it directly impacts the stability and predictability of cash flows from rental income.

Looking Ahead: 2024 Guidance

Looking forward to 2024, NNN REIT Inc has provided Core FFO guidance of $3.25 to $3.31 per share and AFFO estimates of $3.29 to $3.35 per share. This guidance reflects the company's positive outlook and its strategic initiatives aimed at sustaining growth and profitability.

Steve Horn, Chief Executive Officer, expressed confidence in the company's execution and strategic positioning. He highlighted the successful deployment of capital in new real estate investments and the company's ability to raise capital and generate strong free cash flow, even in a challenging capital market environment.

NNN continues to execute with excellence. In 2023, we grew Core FFO 3.8 percent, deployed over $800 million of capital in new real estate investments and successfully executed the NNN REIT name change and branding campaign. We ended the year with $132.0 million drawn on our $1.1 billion credit facility, accentuating our ability to raise capital and generate strong free cash flow and proceeds from selective asset dispositions, even in a challenging capital market environment. NNN maintains a multi-year view and is well-positioned to execute the 2024 strategy." - Steve Horn, CEO

Overall, NNN REIT Inc's 2023 performance and 2024 outlook present a compelling narrative for value investors seeking stable and growing income streams. The company's consistent track record of dividend growth and strategic portfolio management positions it as a notable player in the REIT sector.

For a more detailed analysis of NNN REIT Inc's financials and future prospects, investors are encouraged to review the full earnings report and listen to the management conference call, which can be accessed on the company's website.

Explore the complete 8-K earnings release (here) from NNN REIT Inc for further details.

This article first appeared on GuruFocus.