No Surprises In Skyworks Solutions's (NASDAQ:SWKS) Q1 Sales Numbers, Stock Soars

Wireless chips maker Skyworks Solutions (NASDAQ: SWKS) reported results in line with analysts' expectations in Q1 FY2024, with revenue down 9.6% year on year to $1.20 billion. The company expects next quarter's revenue to be around $1.05 billion, in line with analysts' estimates. It made a non-GAAP profit of $1.97 per share, down from its profit of $2.59 per share in the same quarter last year.

Is now the time to buy Skyworks Solutions? Find out by accessing our full research report, it's free.

Skyworks Solutions (SWKS) Q1 FY2024 Highlights:

Market Capitalization: $16.98 billion

Revenue: $1.20 billion vs analyst estimates of $1.20 billion (small miss)

EPS (non-GAAP): $1.97 vs analyst estimates of $1.95 (small beat)

Revenue Guidance for Q2 2024 is $1.05 billion at the midpoint, roughly in line with what analysts were expecting (EPS guidance also roughly in line)

Free Cash Flow of $752.7 million, up 155% from the previous quarter

Inventory Days Outstanding: 121, down from 138 in the previous quarter

Gross Margin (GAAP): 42.2%, down from 48% in the same quarter last year

“Skyworks continues to execute well and generate robust profitability in light of ongoing macroeconomic volatility,” said Liam K. Griffin, chairman, chief executive officer and president of Skyworks.

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

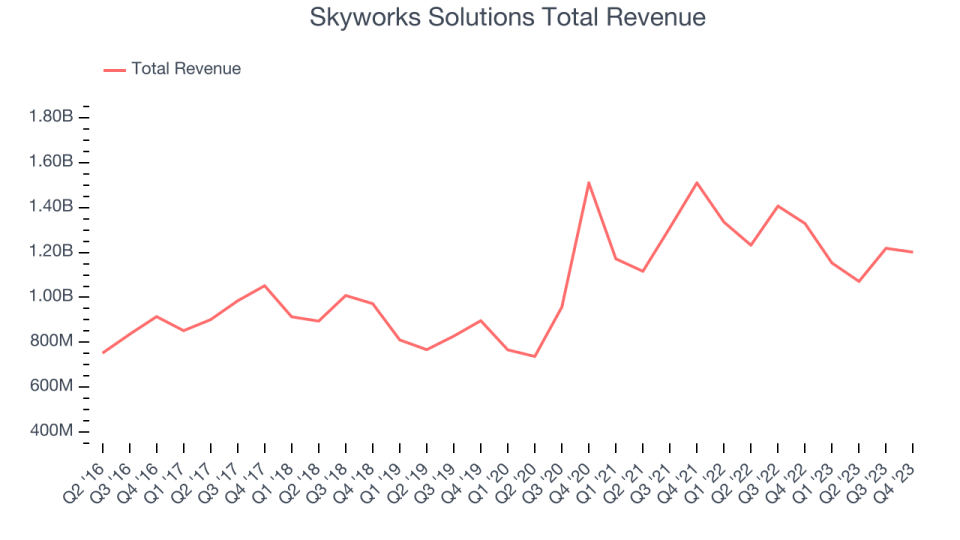

Sales Growth

Skyworks Solutions's revenue growth over the last three years has been unremarkable, averaging 9.3% annually. This quarter, its revenue declined from $1.33 billion in the same quarter last year to $1.20 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Skyworks Solutions had a difficult quarter as revenue dropped 9.6% year on year, missing analysts' estimates by 0.2%. This could mean that the current downcycle is deepening.

Skyworks Solutions looks like it's headed into the trough of the semiconductor cycle, as it's guiding for a year-on-year revenue decline of 9.4% next quarter. Analysts are also estimating a 1.4% decline over the next 12 months.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Skyworks Solutions's DIO came in at 121, which is 15 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Skyworks Solutions's Q1 Results

We were impressed by Skyworks Solutions's strong improvement in inventory levels. That stood out as a positive in these results. While revenue guidance was roughly in line, EPS guidance was slightly below. Management added some constructive commentary, saying "We are seeing signs that the Android smartphone market is recovering. In broad markets, we are well positioned for long-term growth in edge-connected IoT devices, automotive electrification and advanced safety systems, and AI-enabled workloads driving cloud and data center upgrades." Overall, this was a mixed quarter for Skyworks Solutions. The stock is up 5.5% after reporting and currently trades at $110 per share, likely due to muted expectations after some other semis stocks performed much worse.

Skyworks Solutions may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.