Noodles (NASDAQ:NDLS) Reports Sales Below Analyst Estimates In Q4 Earnings, Stock Drops

Casual restaurant chain Noodles & Company (NASDAQ:NDLS) missed analysts' expectations in Q4 FY2023, with revenue down 8.9% year on year to $124.3 million. The company's full-year revenue guidance of $517.5 million at the midpoint also came in 2.6% below analysts' estimates. It made a non-GAAP loss of $0.07 per share, down from its profit of $0.03 per share in the same quarter last year.

Is now the time to buy Noodles? Find out by accessing our full research report, it's free.

Noodles (NDLS) Q4 FY2023 Highlights:

Revenue: $124.3 million vs analyst estimates of $125.3 million (0.8% miss)

EPS (non-GAAP): -$0.07 vs analyst estimates of -$0.01 (-$0.06 miss)

Management's revenue guidance for the upcoming financial year 2024 is $517.5 million at the midpoint, missing analyst estimates by 2.6% and implying 2.8% growth (vs -0.6% in FY2023)

Gross Margin (GAAP): 16.4%, down from 17% in the same quarter last year

Same-Store Sales were down 4.2% year on year

Store Locations: 470 at quarter end, increasing by 9 over the last 12 months

Market Capitalization: $112.8 million

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ:NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Noodles is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

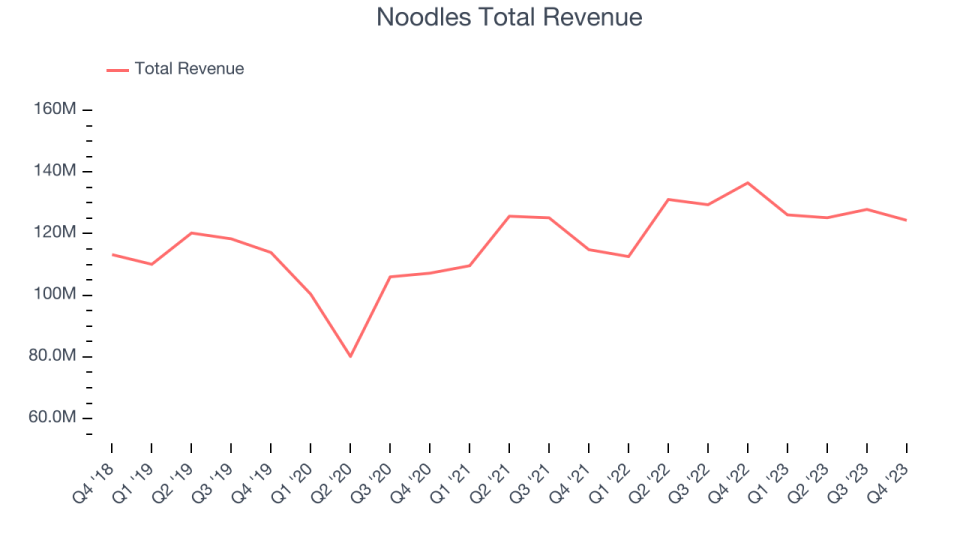

As you can see below, the company's annualized revenue growth rate of 2.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Noodles missed Wall Street's estimates and reported a rather uninspiring 8.9% year-on-year revenue decline, generating $124.3 million in revenue. Looking ahead, Wall Street expects sales to grow 5.4% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for restaurants.

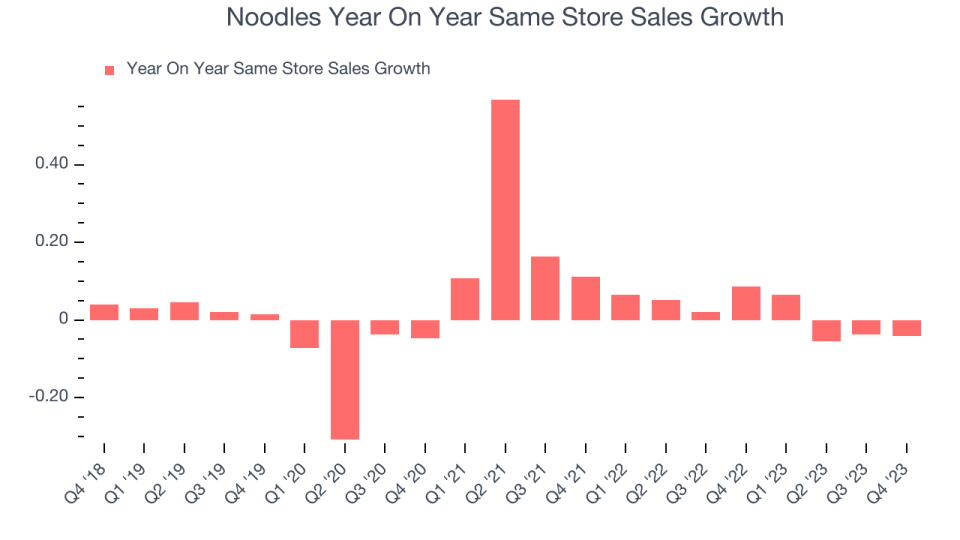

Noodles's demand within its existing restaurants has been relatively stable over the last eight quarters but fallen behind the broader sector. On average, the company's same-store sales have grown by 1.9% year on year. With positive same-store sales growth amid an increasing number of restaurants, Noodles is reaching more diners and growing sales.

In the latest quarter, Noodles's same-store sales fell 4.2% year on year. This decline was a reversal from the 8.7% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Noodles's Q4 Results

We enjoyed seeing Noodles exceed analysts' gross margin expectations this quarter. On the other hand, its revenue and EPS fell short thanks to worse-than-expected same-store sales performance (4.2% system-wide declines compared to estimates of 3.9%). Furthermore, its full-year revenue guidance fell short as the company expects to build fewer new restaurants than Wall Street had forecasted. Overall, this was a bad quarter for Noodles. The company is down 5.5% on the results and currently trades at $2.32 per share.

Noodles may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.