Nordson Corp (NDSN) Reports Growth in Q1 Fiscal 2024, Narrows Full-Year Guidance

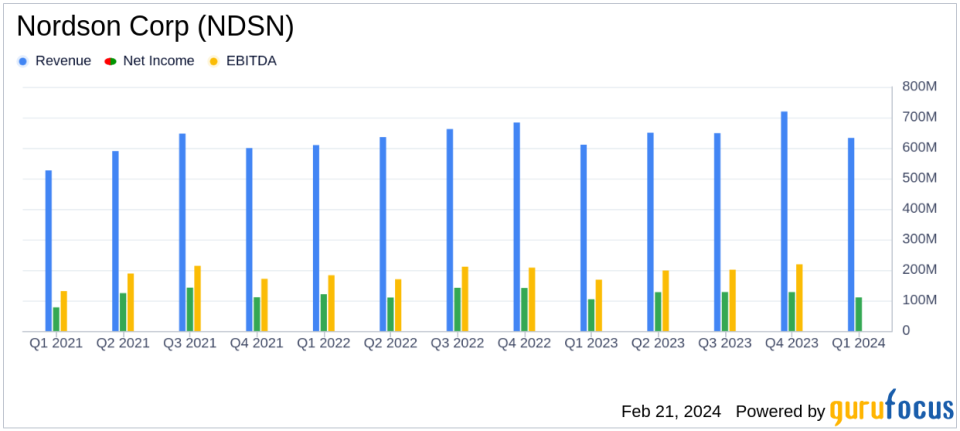

Sales Growth: Reported a 4% increase to $633 million in Q1 fiscal 2024.

Net Income: Achieved $110 million, with earnings per diluted share of $1.90.

Adjusted Earnings: Adjusted earnings per diluted share rose to $2.21, a 3% increase year-over-year.

EBITDA: Improved to $197 million, representing 31% of sales.

Full-Year Guidance: Narrowed to 4-7% revenue growth with adjusted earnings per share of $10.00 to $10.50.

Segment Performance: Industrial Precision Solutions and Medical and Fluid Solutions segments showed strength, while Advanced Technology Solutions faced challenges.

On February 21, 2024, Nordson Corp (NASDAQ:NDSN) released its 8-K filing, detailing the financial outcomes for the first quarter of fiscal year 2024. Nordson, a leading manufacturer of equipment used for dispensing adhesives, coatings, sealants, and other materials, serves a diverse range of end markets, including packaging, medical, electronics, and industrial. The company operates through three segments: Industrial Precision Solutions, Medical and Fluid Solutions, and Advanced Technology Solutions. With a revenue generation of approximately $2.6 billion in fiscal 2023, Nordson continues to be a significant player in the Industrial Products industry.

Financial Performance and Challenges

Nordson's first quarter of fiscal 2024 saw a sales increase of 4% to $633 million, compared to the previous year's $610 million. This growth included a favorable impact from acquisitions, although partially offset by a 2% organic sales decrease, mainly due to ongoing pressure in electronics product lines. Despite these challenges, the company's net income rose to $110 million, translating to $1.90 earnings per diluted share, up from the prior year's $104 million or $1.81 per diluted share.

Adjusted earnings per diluted share also saw an uptick to $2.21, a 3% increase from the prior year's $2.14, driven by higher operating profit despite increased interest expenses. EBITDA for the quarter stood at $197 million, or 31% of sales, marking a 9% increase from the previous year's $181 million, or 30% of sales, due to improved gross margins year-over-year.

Segment Analysis and Outlook

The Industrial Precision Solutions segment reported a 14% sales increase to $355 million, including an 11% acquisition impact. The Medical and Fluid Solutions segment saw a 3% increase to $160 million, driven by growth in medical interventional solutions. However, the Advanced Technology Solutions segment experienced an 18% decrease to $119 million, primarily due to weakness in electronics dispense products.

Looking ahead, Nordson has narrowed its full-year fiscal 2024 revenue guidance to 4-7% growth over the previous fiscal year, with adjusted earnings per diluted share projected to be between $10.00 and $10.50. The company enters the second quarter with a backlog of approximately $750 million, which continues to normalize and is concentrated in systems businesses.

"Sales results were in line with our first quarter expectations. The segments delivered a strong operating performance exceeding our first quarter earnings guidance. This is a great example of our entrepreneurial teams using NBS Next to meet the needs of our customers, while also taking strategic actions that position them for future profitable growth," said Sundaram Nagarajan, Nordson President and Chief Executive Officer.

For investors and potential GuruFocus.com members seeking detailed insights into Nordson's financial health, the company's earnings report reflects a resilient performance in a challenging market, with strategic acquisitions contributing positively to the overall financial results. The company's ability to navigate market pressures and deliver growth in key segments underscores its robust business model and operational efficiency, making it a noteworthy entity for value investors to consider.

Explore the complete 8-K earnings release (here) from Nordson Corp for further details.

This article first appeared on GuruFocus.