Nordson (NDSN) Closes ARAG Deal, Boosts Industrial Precision Unit

Nordson Corporation NDSN has completed its previously announced acquisition of ARAG Group and its subsidiaries, expanding its core dispense capabilities into the precision agriculture end market. The transaction was valued at €960 million (approximately $1050.98 million).

Based in Rubiera, Italy, ARAG is a provider of precision control systems and smart fluid components for agricultural spraying.

ARAG’s precision spraying, dispensing and software solutions will help Nordson customers increase crop yields while lowering the usage of fertilizers and chemicals. The acquired entity is part of NDSN’s Industrial Precision Solutions segment. Continued strength in polymer processing product lines is aiding the Industrial Precision Solutions segment.

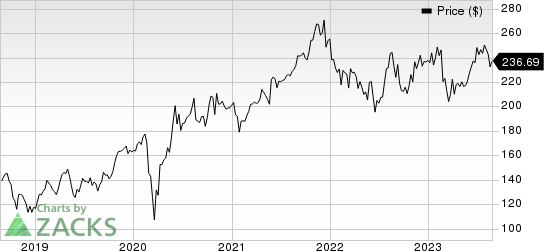

Nordson Corporation Price

Nordson Corporation price | Nordson Corporation Quote

Nordson aims to expand its market share, product offerings and customer base through strategic acquisitions. In November 2022, the company acquired CyberOptics Corporation. The buyout expanded Nordson’s semiconductor test and inspection capabilities with the help of CyberOptics’ 3D optical sensing technology and wireless measurement sensors. The acquisition contributed 11% to Advanced Technology Solutions revenues in the fiscal third quarter.

Zacks Rank & Key Picks

Nordson presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the Industrial Products sector are as follows:

Graham Corporation GHM currently flaunts a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 243.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Graham has an estimated earnings growth rate of 400% for the current fiscal year. The stock has rallied 70.4% so far this year.

Flowserve Corporation FLS is also a #1 Ranked player. The company delivered a trailing four-quarter earnings surprise of 6.2%, on average.

Flowserve has an estimated earnings growth rate of 79.1% for the current year. The stock has jumped 24% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report