Norfolk Southern Corp Reports Mixed 2023 Financial Results Amidst Ohio Incident Charges

Income from Railway Operations: Reported at $808 million for Q4, adjusted to $958 million excluding incident charges.

Diluted Earnings Per Share (EPS): Q4 EPS of $2.32, adjusted to $2.83 after excluding incident-related costs.

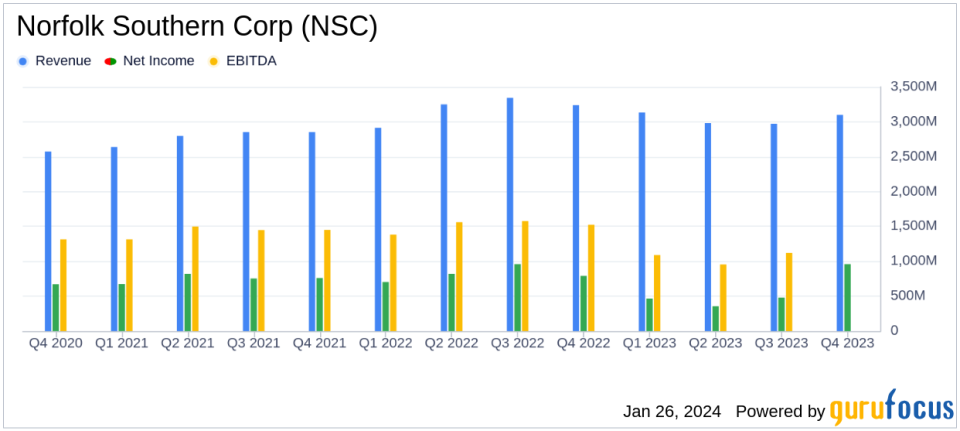

Revenue: Q4 railway operating revenues declined by 5% year-over-year to $3.1 billion.

Annual Performance: Full-year income from railway operations down 41%, with diluted EPS decreasing by 42% due to the Ohio incident.

Operational Expenses: Railway operating expenses increased by 17% in 2023, inclusive of the $1.1 billion charge related to the incident.

Adjusted Financials: Excluding the incident, adjusted income from railway operations for the year stood at $3.967 billion, with adjusted diluted EPS at $11.74.

On January 26, 2024, Norfolk Southern Corp (NYSE:NSC) released its 8-K filing, disclosing its fourth quarter and full-year financial results for 2023. The company, a premier Class-I railroad operator in the Eastern United States, faced a significant challenge this year due to an incident in Eastern Ohio. Despite this, NSC demonstrated resilience, adjusting its financials to reflect underlying operational performance.

Company Overview

Norfolk Southern Corp (NYSE:NSC) is a critical player in the transportation sector, operating over 20,000 miles of track and hauling a diverse range of products including coal, intermodal traffic, and various commodities. Its network is essential for the movement of goods across the Eastern United States, connecting major ports and facilitating trade.

Financial Performance and Challenges

The fourth quarter results were significantly impacted by a $150 million charge related to the Eastern Ohio incident, which included $76 million in insurance recoveries. Adjusting for this charge, income from railway operations for the quarter would have been $958 million, and diluted earnings per share would have been $2.83. The incident also affected the full-year results, with a $1.1 billion charge leading to a 41% decrease in income from railway operations and a 42% decrease in diluted earnings per share compared to the previous year.

Despite these challenges, NSC's adjusted financials highlight the company's ability to maintain operational efficiency and financial stability. The adjusted income from railway operations for the year was nearly $4 billion, and the adjusted diluted earnings per share was $11.74, showcasing the company's resilience in the face of adversity.

Key Financial Metrics

Understanding the importance of key financial metrics for investors, NSC's performance in these areas is crucial. Railway operating revenues for the fourth quarter stood at $3.1 billion, a 5% decrease from the same period in 2022. The full-year railway operating expenses were $9.3 billion, inclusive of the incident charge, marking a 17% increase from the previous year. These figures are essential for evaluating the company's cost management and revenue generation capabilities.

"The fourth quarter marked the end of a challenging, yet transformational year for Norfolk Southern. We invested in our people, enhanced our service performance and made a safe railroad even safer," said Norfolk Southern President and CEO Alan H. Shaw. "We see growth on the horizon, and we are confident in our ability to deliver industry-competitive margins over time."

Analysis of Performance

The incident in Eastern Ohio posed a significant setback for NSC, yet the company's adjusted figures indicate a strong underlying performance. The ability to generate substantial income from railway operations and maintain a solid earnings per share figure, even after adjusting for the incident, suggests that NSC is well-positioned to capitalize on future growth opportunities.

As the company moves into 2024, the focus on driving further productivity gains and operational discipline through aggressive cost management is expected to fortify its financial position. The commitment to enhancing service performance and safety will also play a pivotal role in ensuring long-term success and industry-competitive margins.

For value investors and potential GuruFocus.com members, Norfolk Southern Corp's ability to navigate through challenges while laying the groundwork for future growth presents a compelling narrative. The company's strategic investments and operational enhancements are key factors to consider when assessing its potential for sustained financial performance.

For more detailed analysis and up-to-date financial news, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Norfolk Southern Corp for further details.

This article first appeared on GuruFocus.