North American Construction (NOA) Acquires MacKellar Group

North American Construction Group Ltd. NOA or NACG has acquired MacKellar Group for a total expected consideration of $395 million, with an effective date of Oct 1, 2023. The final consideration amount is yet to be determined based on Mackellar’s audited financial statements as of Sep 30, 2023.

The cash funding for the closing was considered from the Credit Facility, which was amended and restated simultaneously with the closing of the acquisition. From the upsized overall lending capacity of $430 million, an upfront payment of Australian $75 million and the payout of existing equipment financing of approximately Australian $105 million was drawn in regard to the funding. This buyout transaction was previously announced on Jul 26, 2023.

For the facilitation of the transaction, National Bank Financial has acted as exclusive financial advisor, Fasken Martineau DuMoulin LLP has acted as Canadian legal counsel and Corrs Chambers Westgarth has acted as Australian legal counsel to NACG.

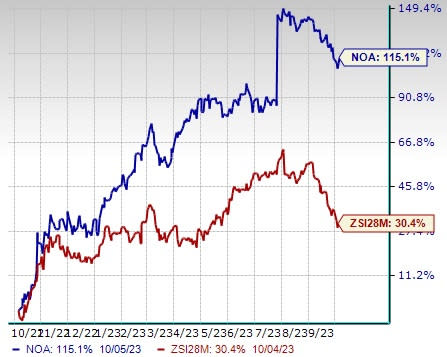

Image Source: Zacks Investment Research

Shares of this heavy equipment and mining contractor gained 1.4% on Oct 4 during the trading session. Furthermore, the stock has surged 115.1% in the past year, outperforming the Zacks Building Products - Heavy Construction industry’s 30.4% growth.

Joint Ventures & Acquisitions – NOA’s Growth Drivers

North American Construction pivots around corporate strategies, which ensure profitable growth and diversification. The primary strategies include indulging in joint ventures (JVs), especially First Nation alliances and accretive acquisitions. The company is committed to the early involvement as well as the collaborative participation of First Nations communities, thus sparking successful partnerships, which help to deliver high value construction and mining services.

Considering the JVs, North American Construction benefits immensely from its two largest alliances, Nuna Logistics and Mikisew Group of Companies. On November 2018, the company acquired 49% ownership interest in Nuna Logistics, which offered it access to broader equipment fleets, experienced field personnel, and expanded services such as growing its external maintenance offering. Also, on the above-mentioned time, it formed a partnership with the Mikisew Group of Companies to deliver construction and mining services to oilsands customers.

Coming to acquisitions, on Oct 1, 2022, the company acquired ML Northern Services Ltd., considering its fuel and lube fleet. This acquisition benefited the company’s second-quarter 2023 results through increased fuel and lube delivery, lower internal costs as well as strong margin from services provided to external customers. North American Construction looks forward to create accretive partnerships on large scale mining and construction projects.

Zacks Rank

North American Construction currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Some better-ranked stocks from the Construction sector are TopBuild Corp. BLD, Sterling Infrastructure, Inc. STRL and Fluor Corporation FLR.

TopBuild currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 31.5% in the past year. The Zacks Consensus Estimate for BLD’s 2023 sales and earnings per share (EPS) indicates growth of 3.3% and 8.4%, respectively, from the previous year’s reported levels.

Sterling presently flaunts a Zacks Rank of 1. STRL delivered a trailing four-quarter earnings surprise of 14.9%, on average. Shares of the company have surged 217.3% in the past year.

The Zacks Consensus Estimate for STRL’s 2023 sales and EPS indicates growth of 3.9% and 29.4%, respectively, from the previous year’s reported levels.

Fluor currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 22% in the past year.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

North American Construction Group Ltd. (NOA) : Free Stock Analysis Report