Do North European Oil Royalty Trust's (NYSE:NRT) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like North European Oil Royalty Trust (NYSE:NRT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for North European Oil Royalty Trust

North European Oil Royalty Trust's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that North European Oil Royalty Trust has managed to grow EPS by 31% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

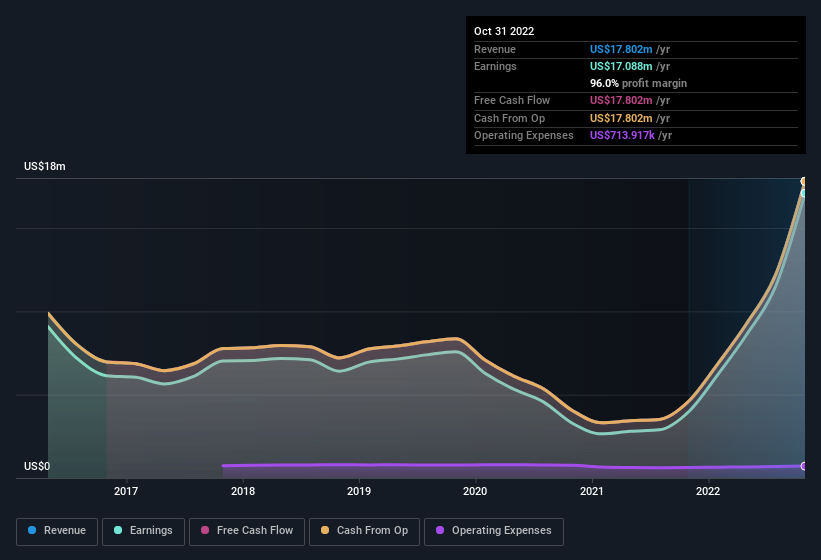

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of North European Oil Royalty Trust shareholders is that EBIT margins have grown from 86% to 96% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

North European Oil Royalty Trust isn't a huge company, given its market capitalisation of US$123m. That makes it extra important to check on its balance sheet strength.

Are North European Oil Royalty Trust Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in North European Oil Royalty Trust in the previous 12 months. Add in the fact that Nancy J. Prue, the Independent Trustee of the company, paid US$12k for shares at around US$12.40 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Recent insider purchases of North European Oil Royalty Trust stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations under US$200m, like North European Oil Royalty Trust, the median CEO pay is around US$726k.

The CEO of North European Oil Royalty Trust only received US$140k in total compensation for the year ending October 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add North European Oil Royalty Trust To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into North European Oil Royalty Trust's strong EPS growth. To add to the positives, North European Oil Royalty Trust has recorded instances of insider buying and a modest executive pay to boot. The overriding message from this quick rundown is yes, this stock is worth investigating further. Still, you should learn about the 1 warning sign we've spotted with North European Oil Royalty Trust.

The good news is that North European Oil Royalty Trust is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here