Northern Right Capital Management, L.P. Bolsters Position in Great Elm Group Inc

Overview of Northern Right Capital's Recent Trade

Northern Right Capital Management, L.P. (Trades, Portfolio), an investment firm known for its strategic portfolio choices, has recently expanded its holdings by adding shares of Great Elm Group Inc (NASDAQ:GEG). On November 15, 2023, the firm increased its stake in GEG by acquiring an additional 223,384 shares. This transaction, executed at a price of $1.99 per share, has raised Northern Right Capital's total share count in GEG to 4,193,168, marking a significant move with a 0.18% trade impact on its portfolio. The firm now holds a 3.36% position in its portfolio and a 14.04% stake in the traded company.

Investment Philosophy of Northern Right Capital Management, L.P. (Trades, Portfolio)

Northern Right Capital Management, L.P. (Trades, Portfolio) operates from its headquarters at 9 Old Kings Hwy. S., Darien, CT, and is known for its discerning investment approach. The firm's philosophy is to identify undervalued opportunities that can deliver sustainable returns. With 26 stocks in its portfolio, Northern Right Capital has significant holdings in various sectors, with a particular focus on Financial Services and Communication Services. Its top holdings include prominent names such as Apollo Global Management Inc (NYSE:APO), Ares Management Corp (NYSE:ARES), and MGM Resorts International (NYSE:MGM). The firm manages an equity portfolio valued at approximately $248 million.

Introduction to Great Elm Group Inc

Great Elm Group Inc, operating under the stock symbol GEG, is a holding company based in the USA. Since its IPO on June 11, 1999, GEG has focused on developing a diversified portfolio of long-duration, permanent capital vehicles in various asset classes, including corporate credit, specialty finance, and real estate. The company's business operations generate revenue through administration and service fees, management fees, property management fees, and incentive fees. With a market capitalization of $59.737 million and a current stock price of $2, GEG is navigating the asset management industry landscape.

Financial Analysis of Great Elm Group Inc

Great Elm Group Inc's financial health presents a mixed picture. The company's PE ratio stands at a modest 1.96%, indicating profitability, but the GF Value suggests the stock is significantly overvalued with a price to GF Value ratio of 5.41. The stock has seen a slight gain of 0.5% since the transaction date, yet it has experienced a dramatic decline of 99.69% since its IPO. Year-to-date, the stock's performance has dipped by 5.21%, reflecting the challenges faced in the current market.

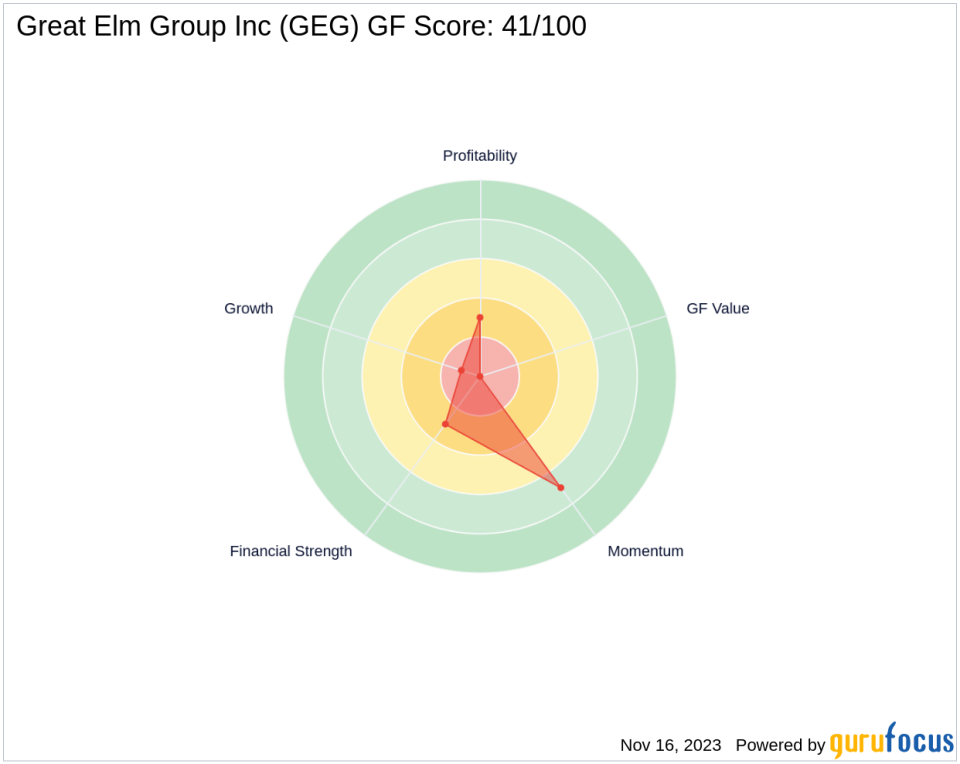

Performance Indicators and Future Outlook for GEG

The GF Score of 41/100 for Great Elm Group Inc suggests poor future performance potential. The company's balance sheet and profitability ranks are both at a low 3/10, while its growth rank is even lower at 1/10. The GF Value Rank is not applicable, indicating a lack of sufficient data. However, the stock's Momentum Rank is relatively higher at 7/10, which could signal some positive movement in the short term. Despite these indicators, the firm's financial strength, as measured by its Financial Strength, and its Altman Z score of -30.98, raise concerns about its stability.

Impact of the Trade on Northern Right Capital's Portfolio

The recent acquisition of Great Elm Group Inc shares by Northern Right Capital Management, L.P. (Trades, Portfolio) has increased the firm's exposure to the asset management industry. This move aligns with the firm's strategy of investing in undervalued opportunities, despite GEG's current financial metrics. The firm's significant position in GEG now accounts for 3.36% of its portfolio, indicating a strong belief in the company's potential for recovery or long-term growth.

Market and Industry Context

The asset management industry is highly competitive and subject to market fluctuations. Great Elm Group Inc's stock momentum and relative strength index (RSI) rankings reflect the volatile nature of the industry. With an RSI 14 Day Rank of 1,124 and a Momentum Index 6 - 1 Month Rank of 553, GEG's stock shows some signs of short-term strength, which could be a factor in Northern Right Capital's decision to increase its stake.

Concluding Thoughts on Northern Right Capital's Strategy and GEG's Prospects

Northern Right Capital Management, L.P. (Trades, Portfolio)'s recent trade indicates a strategic move to capitalize on Great Elm Group Inc's potential. Despite the company's low GF Score and challenging financial metrics, the firm's increased stake could be a sign of confidence in GEG's long-term prospects. Investors will be watching closely to see how this investment plays out in the context of the broader asset management industry and market trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.