Northern (NOG) Stock Pops Since Easy Q2 Beat, Production Grows

The stock of independent oil and gas producer Northern Oil and Gas NOG has gained 6.7% since its second-quarter earnings announcement on Aug 2. The positive response could be attributed the company’s comfortable earnings beat, dividend hike and encouraging guidance.

What Did NOG’s Earnings Unveil?

Independent oil and gas producer Northern Oil and Gas (NOG) reported second-quarter 2023 adjusted earnings per share of $1.49, comfortably beating the Zacks Consensus Estimate of $1.35. The outperformance reflects strong production.

However, the company’s bottom line fell from the year-ago adjusted profit of $1.72 due to weaker oil realizations and an increase in costs.

NOG’s oil and gas sales of $416.5 million beat the Zacks Consensus Estimate of $411 million though the top line fell from the year-ago figure of $549.6 million.

In good news for investors, the company instituted a 2.7% dividend hike for the third quarter and saw its adjusted EBITDA improve 15.8% to $132.8 million.

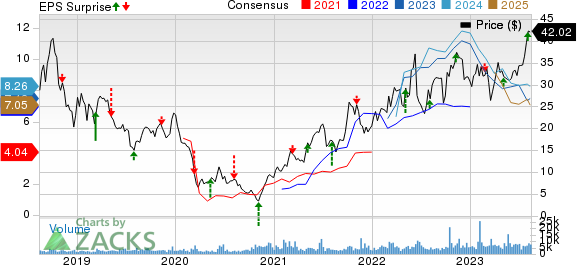

Northern Oil and Gas, Inc. Price, Consensus and EPS Surprise

Northern Oil and Gas, Inc. price-consensus-eps-surprise-chart | Northern Oil and Gas, Inc. Quote

Production & Price Realizations

Second-quarter production (comprising 60% oil) increased 25% from the year-ago level to 90,878 barrels of oil equivalent per day (Boe/d) and surpassed our estimate of 90,577 Boe/d. While oil volume came in at 54,738 barrels per day (up 31% year over year), natural gas (and NGLs) totaled 216,838 thousand cubic feet per day (up 17%). We called for 54,307 daily barrels of oil and 217,622 thousand cubic feet of natural gas.

The average sales price for crude during the second quarter was $71.03 per barrel, reflecting a 33% decrease from the prior-year realization of $106.26 and marginally less than our expectation of $71.60. The average realized natural gas price was $3.18 per thousand cubic feet compared to $8.63 in the year-earlier period and $1.94 as per our model.

Costs & Expenses

Total operating expenses in the quarter rose to $241.8 million from the year-ago quarter’s $171.3 million and exceeded our projection of $223.9 million. This was mainly on account of a surge in depreciation and production expenses. In particular, the company’s lease operating (or production) expenses rose to $10.20 per barrel of oil equivalent (Boe) from the year-ago figure of $9.77 per Boe. Meanwhile, depreciation outlay increased by 55% year over year on a per barrel basis.

Financial Position

Excluding working capital, cash flow from operations went up 11% to $280.4 million, while Northern’s organic drilling and development capital expenditures totaled $184.8 million. The company’s free cash flow for the quarter was $47.6 million.

As of Jun 30, this owner of non-operating, minority interests in thousands of oil and gas wells had $83 million in cash and cash equivalents. The company had long-term debt of $1.7 billion, reflecting a debt-to-capitalization of 54.2%.

Guidance

Taking into account the recent acquisitions, Northern's output for 2023 will now come in at 98,000 Boe/d, as per the midpoint of the latest guidance. The company gave this year's oil mix guidance in the range of 62-63%, while its annual capital spending guidance is between $764 million and $800 million.

Zacks Rank & Key Picks

Northern Oil and Gas carries a Zacks Rank #3 (Hold) at present.

Meanwhile, investors interested in the energy sector might look at operators like Solaris Oilfield Infrastructure SOI, Murphy USA MUSA and CVR Energy CVI. Each of these companies has a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Solaris Oilfield Infrastructure: SOI beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters at an average of 18.8%.

SOI is valued at around $483 million. Solaris Oilfield Infrastructure has seen its shares inch up 1.8% in a year.

Murphy USA: Murphy USA beat the Zacks Consensus Estimate for earnings in two of the last four quarters and missed in the other two. MUSA has a trailing four-quarter earnings surprise of 5.1%, on average.

Murphy USA is valued at around $6.8 billion. MUSA has seen its shares gain 8% in a year.

CVR Energy: CVI beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters. Over the past 30 days, CVR Energy saw the Zacks Consensus Estimate for 2023 move up 22.9%.

CVR Energy is valued at around $3.7 billion. CVI has seen its shares gain 19.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

Solaris Oilfield Infrastructure, Inc. (SOI) : Free Stock Analysis Report