Northern Oil & Gas Inc (NOG) Reports Strong Q4 and Full Year 2023 Results; Sets Positive ...

Production Surge: Q4 production increased by 45% year-over-year, reaching 114,363 Boe per day.

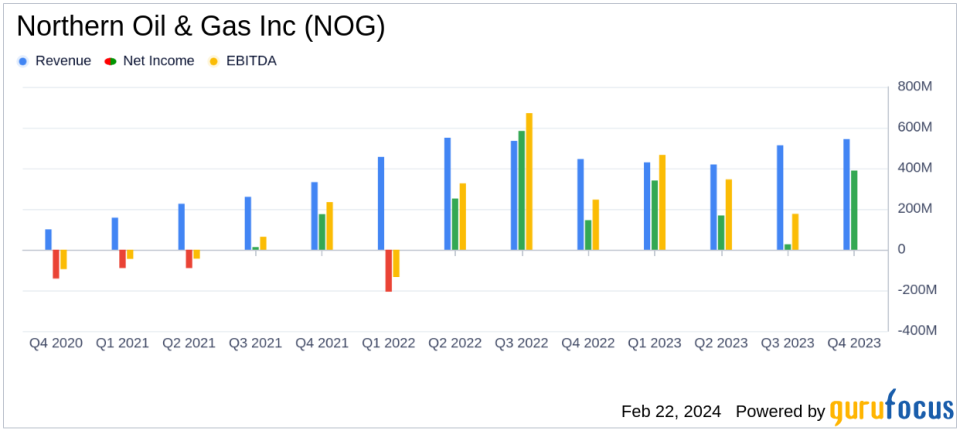

Financial Performance: Full year 2023 GAAP net income soared to $923.0 million, with a 31% increase in Adjusted EBITDA.

Capital Efficiency: Capital expenditures were tightly managed at $260.0 million for Q4, excluding non-budgeted acquisitions.

Dividend Growth: NOG declared a $0.40 per share common dividend for Q1 2024, marking an 18% increase from Q1 2023.

2024 Guidance: Anticipates 20% production growth with total capital spending projected between $825 - $900 million.

Reserve Expansion: Total proved reserves increased by 3% year-over-year, with a pre-tax PV-10 value of $5.0 billion.

On February 22, 2024, Northern Oil & Gas Inc (NYSE:NOG) released its 8-K filing, announcing the companys fourth quarter and full year 2023 results, along with detailed guidance for 2024. NOG, an independent energy company focused on the exploration and production of crude oil and natural gas, has reported significant growth in production and financial metrics, despite facing a year of lower commodity prices.

Record-Breaking Production and Financial Outcomes

NOG's fourth quarter production marked a 45% increase from the previous year, with a daily production of 114,363 barrels of oil equivalent (Boe). This growth was attributed to strategic acquisitions and increased well activity. The company's financial achievements were equally impressive, with GAAP net income for the full year reaching $923.0 million, or $10.03 per diluted share, and Adjusted EBITDA growing by 31% to $1.4 billion.

Strategic Capital Allocation and Shareholder Returns

Capital expenditures for the fourth quarter were managed at $260.0 million, excluding non-budgeted acquisitions, reflecting NOG's disciplined approach to capital allocation. The company also demonstrated its commitment to shareholder returns by declaring a first-quarter 2024 dividend of $0.40 per share, an 18% increase from the first quarter of 2023.

2024 Outlook and Proved Reserves

Looking ahead to 2024, NOG anticipates a production range of 115,000 to 120,000 Boe per day, representing a 20% increase from 2023. The company expects capital expenditures to be between $825 and $900 million. Additionally, NOG reported a 3% increase in total proved reserves, with a pre-tax PV-10 value of $5.0 billion, underscoring the company's robust asset base and future growth potential.

Operational and Financial Metrics

Key financial details from the income statement and balance sheet include a 22% increase in oil and natural gas sales for the fourth quarter to $543.4 million, and a 56% increase in cash flow from operations to $365.9 million. The balance sheet reflects strong liquidity, with $8.2 million in cash and $161.0 million of borrowings outstanding on its revolving credit facility as of December 31, 2023.

"NOG closed out 2023 in record fashion," commented Nick OGrady, NOGs Chief Executive Officer. "Our oil and total volumes grew to all-time highs and we generated record cash flow from operations, while we saw our leverage levels decline meaningfully year over year, even in a year of lower commodity prices."

NOG's performance in 2023, despite challenges in commodity pricing, demonstrates the company's operational efficiency and strategic growth initiatives. The company's focus on increasing production, managing capital expenditures, and delivering shareholder returns positions it well for continued success in 2024.

For detailed insights into Northern Oil & Gas Inc's financial performance and strategic outlook, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Northern Oil & Gas Inc for further details.

This article first appeared on GuruFocus.