Northern Oil and Gas' (NYSE:NOG) Dividend Will Be Increased To $0.38

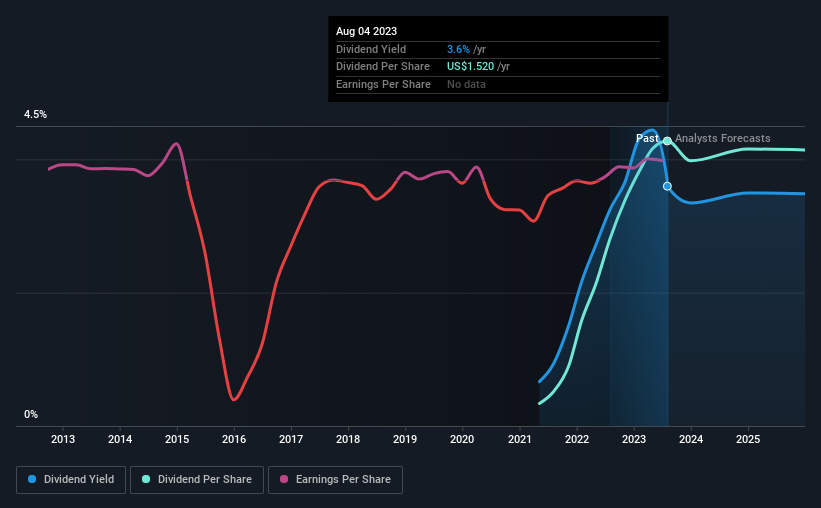

Northern Oil and Gas, Inc.'s (NYSE:NOG) dividend will be increasing from last year's payment of the same period to $0.38 on 31st of October. This takes the annual payment to 3.6% of the current stock price, which unfortunately is below what the industry is paying.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Northern Oil and Gas' stock price has increased by 33% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Northern Oil and Gas

Northern Oil and Gas' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Prior to this announcement, Northern Oil and Gas' earnings easily covered the dividend, but free cash flows were negative. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Looking forward, earnings per share is forecast to fall by 56.6% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 24%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Northern Oil and Gas Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2021, the annual payment back then was $0.12, compared to the most recent full-year payment of $1.52. This works out to be a compound annual growth rate (CAGR) of approximately 256% a year over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Northern Oil and Gas has impressed us by growing EPS at 25% per year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

An additional note is that the company has been raising capital by issuing stock equal to 18% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Northern Oil and Gas will make a great income stock. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. To that end, Northern Oil and Gas has 5 warning signs (and 1 which is a bit concerning) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.