Northern Oil (NOG) Q3 Earnings Miss Estimates, Revenues Beat

Northern Oil and Gas, Inc. NOG reported third-quarter 2023 adjusted earnings per share (EPS) of $1.73, which lagged the Zacks Consensus Estimate of $1.76. The bottom line also decreased from the year-ago quarter’s level of $1.80. This was primarily due to weaker oil realizations and a 57.4% increase in operating expenses.

Oil and natural gas sales of $511.7 million beat the Zacks Consensus Estimate of $504 million. The top line, however, declined from the prior-year quarter’s figure of $534.1 million.

In good news for investors, Northern Oil instituted a 5% dividend hike compared with the previous quarter’s level. The company declared a regular quarterly cash dividend of 40 cents per share for NOG’s common stock, payable on Dec 1, 2023, to stockholders of record as of Nov 10, 2023. Its adjusted EBITDA rose about 2% sequentially to $385.5 million.

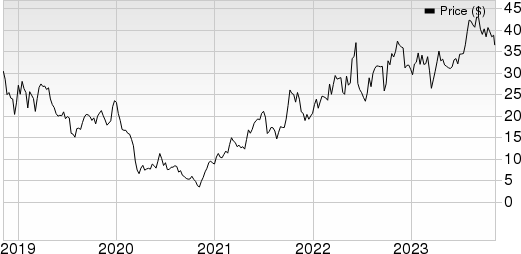

Northern Oil and Gas, Inc. Price, Consensus and EPS Surprise

Northern Oil and Gas, Inc. price-consensus-eps-surprise-chart | Northern Oil and Gas, Inc. Quote

Production & Price Realizations

Third-quarter production (comprising 62% oil) increased 29% from the year-ago level to 102,327 barrels of oil equivalent per day (Boe/d). The figure also surpassed our estimate of 101,012 Boe/d. While oil volume totaled 63,564 barrels per day (up 41% year over year), natural gas (and NGLs) amounted to 232,576 thousand cubic feet per day (up 14%). Our model estimate for oil volume and natural gas production is pegged at 63,683 Boe/d and 223,976 thousand cubic feet per day, respectively.

The average sales price for crude during the third quarter was $79.48 per barrel, indicating a 12% decrease from the prior-year quarter’s level of $90.54. The figure was higher than our expectation of $78.77 per barrel.

The average realized natural gas price was $2.19 per thousand cubic feet compared with $8.43 in the year-earlier period. Our model estimate for the same was pinned at $1.28 per thousand cubic feet.

Costs & Expenses

Total operating expenses in the quarter rose to $271.5 million from $187 million in the year-ago quarter. The figure missed our projection of $273.3 million. This was mainly on account of a surge in depreciation and production expenses.

In particular, the company’s lease operating (or production) expenses decreased to $8.76 per Boe from the year-ago figure of $9.41. Meanwhile, depreciation outlay increased 57% year over year on a per-barrel basis.

Financial Position

Excluding working capital, cash flow from operations went up 29% year over year to $347.0 million, while organic drilling and development capital expenditures totaled $216.6 million. The company’s free cash flow for the quarter amounted to $127.8 million.

As of Sep 30, Northern Oil had $78 million in cash and cash equivalents. It had a long-term debt of $2.1 billion with a debt-to-capitalization of 59.4%.

Guidance

Northern Oil's output is now anticipated in the 96,000-100,000 Boe/d range for 2023 compared with the previous guidance of 97,000-99,000 Boe/d. NOG anticipates growth in its 2023 well spud count in the band of 76-79.

NOG updated its total capital spending projection for 2023 to the $764-$800 million range from the previously estimated band of $790-$820. The company expects this year's oil mix to be in the range of 62-63%.

Zacks Rank and Key Picks

Currently, NOG carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at some better-ranked stocks like Liberty Energy Inc. LBRT, sporting a Zacks Rank #1 (Strong Buy), and CVR Energy, Inc. CVI and Delek US Holdings, Inc. DK, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty Energy is valued at $3.41 billion. LBRT currently pays a dividend of 20 cents per share, or 0.99% on an annual basis.

LBRT is a leading provider of hydraulic fracturing and other auxiliary services to North American onshore exploration and production companies.

CVR Energy is valued at $3.28 billion. In the past year, its shares have lost 19%.

CVI currently pays a dividend of $2 per share or 6.13% on an annual basis. Its payout ratio currently sits at 30% of earnings.

Delek US Holdings is worth approximately $1.69 billion. DK currently pays a dividend of 94 cents per share, or 3.61% on an annual basis.

The company operates in the integrated downstream energy business in the United States. It operates under three segments — refining, logistics and retail.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Delek US Holdings, Inc. (DK) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report