NORTHERN TRUST CORP Bolsters Holdings in WK Kellogg Co

Overview of NORTHERN TRUST CORP (Trades, Portfolio)'s Latest Investment Move

On October 31, 2023, NORTHERN TRUST CORP (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 13,978,003 shares of WK Kellogg Co (NYSE:KLG), a key player in the consumer packaged goods industry. This transaction, which had a trade impact of 0.03% on the firm's portfolio, was executed at a trade price of $10.02 per share. Following this purchase, NORTHERN TRUST CORP (Trades, Portfolio) now holds a total of 13,988,125 shares in KLG, representing a substantial 16.34% position in the company's outstanding stock.

Insight into NORTHERN TRUST CORP (Trades, Portfolio)

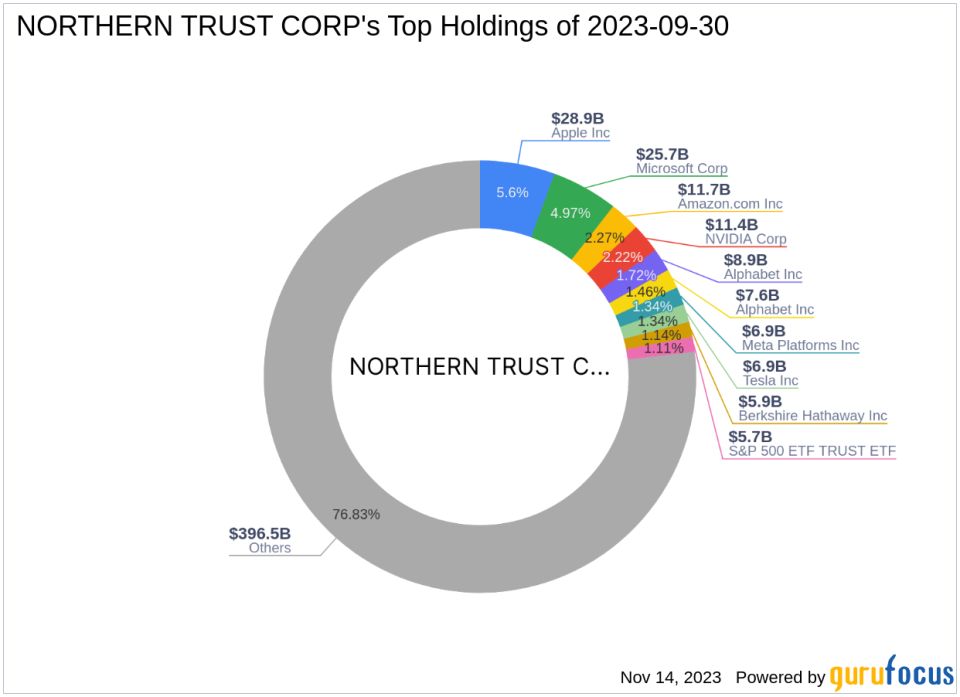

Founded in 1889, NORTHERN TRUST CORP (Trades, Portfolio) has evolved from a single-room operation to a global financial institution with over 14,000 employees and nearly a trillion in assets under management. The firm has a rich history of innovation and resilience, having introduced pioneering services such as the first life insurance trust and weathering the challenges of the 1929 stock market crash. With a focus on technology and expansion, NORTHERN TRUST CORP (Trades, Portfolio) has established a strong presence in the financial sector, boasting top holdings in major companies like Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN). The firm's investment philosophy centers on delivering focused investment management capabilities to both personal and institutional clients.

WK Kellogg Co at a Glance

WK Kellogg Co, trading under the symbol KLG, is a prominent name in the North American cereal market, offering popular brands such as Special K and Frosted Flakes. Since its spin-off and IPO on September 27, 2023, the company has faced a volatile market, with its stock price currently standing at $10.78. Despite a challenging start, with a 48.67% decrease from its IPO price and a year-to-date performance drop of 36.59%, WK Kellogg Co remains a key player in its industry.

Trade Impact on NORTHERN TRUST CORP (Trades, Portfolio)'s Portfolio

The recent acquisition of WK Kellogg Co shares by NORTHERN TRUST CORP (Trades, Portfolio) has modestly increased the firm's equity and sector distribution within the consumer packaged goods industry. With a trade impact of 0.03%, this move reflects a strategic investment decision by the firm, potentially aiming to capitalize on the long-term growth prospects of KLG.

WK Kellogg Co's Financial Health and Performance Metrics

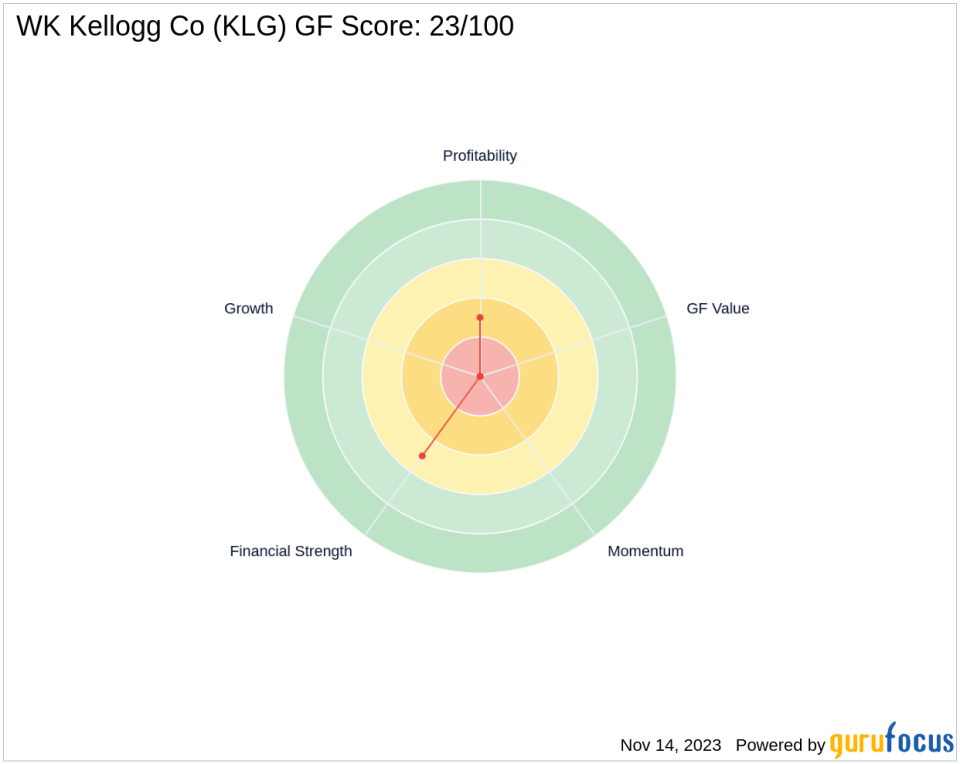

WK Kellogg Co's financial health is a mixed bag, with a Financial Strength rank of 5/10 and a Profitability Rank of 3/10. The company's interest coverage ratio stands at 3.67, indicating its ability to cover interest expenses. However, with a negative return on equity (ROE) of -22.51% and return on assets (ROA) of -6.52%, there are concerns about its profitability and asset utilization.

Market Performance and Valuation Metrics

Since the trade, WK Kellogg Co's stock has seen a gain of 7.58%, suggesting a positive short-term investor response. However, the lack of sufficient data prevents a comprehensive evaluation of the stock's GF Score and valuation metrics. The company's current GF Score is 23/100, indicating potential challenges in future performance.

Comparative Analysis with Largest Shareholder

GAMCO Investors currently stands as the largest guru shareholder in WK Kellogg Co. While specific share percentage data is not available, NORTHERN TRUST CORP (Trades, Portfolio)'s recent acquisition positions it as a significant investor in the company, with a 16.34% holding in KLG's traded stock.

Conclusion

NORTHERN TRUST CORP (Trades, Portfolio)'s investment in WK Kellogg Co marks a notable expansion of its portfolio within the consumer packaged goods sector. Despite WK Kellogg Co's mixed financial metrics and market performance, NORTHERN TRUST CORP (Trades, Portfolio)'s move could be indicative of a long-term strategy betting on the company's recovery and growth. As the market continues to evolve, investors will be watching closely to see how this trade influences both NORTHERN TRUST CORP (Trades, Portfolio)'s portfolio and WK Kellogg Co's trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.