Northern Trust Corp (NTRS) Reports Q4 Earnings Amid Market Challenges

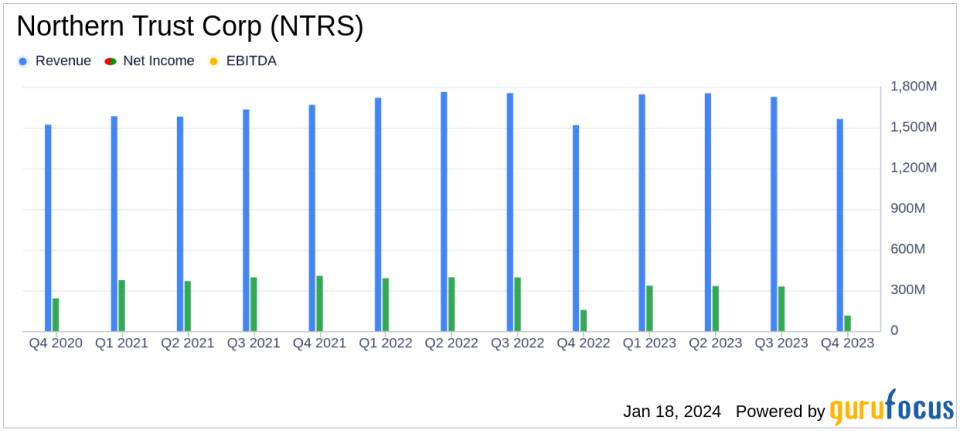

Net Income: Reported at $113.1 million, a significant decrease from $327.8 million in Q3 2023 and $155.7 million in Q4 2022.

Earnings Per Share (EPS): Diluted EPS fell to $0.52, compared to $1.49 in the previous quarter and $0.71 in the same quarter last year.

Trust, Investment and Other Servicing Fees: Slight increase to $1,090.0 million, up 5% from Q4 2022.

Assets Under Management (AUM): Grew to $1.4 trillion, marking a 15% increase from the previous year.

Noninterest Expense: Rose to $1,388.5 million, a 5% increase year-over-year.

Provision for Credit Losses: Recorded at $11.0 million, reflecting an increase in reserves evaluated on a collective basis.

On January 18, 2024, Northern Trust Corp (NASDAQ:NTRS) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a leading provider of wealth management, asset servicing, asset management, and banking services, faced a challenging quarter with net income dropping to $113.1 million from $327.8 million in the previous quarter and $155.7 million in the same quarter of the previous year. Earnings per diluted common share also decreased to $0.52, down from $1.49 in Q3 2023 and $0.71 in Q4 2022.

The quarter's results were impacted by a $176.4 million pre-tax loss on available for sale debt securities sold as part of a portfolio repositioning, and an $84.6 million pre-tax FDIC special assessment. Despite these challenges, trust fee growth accelerated compared to the prior year, and average deposit levels remained resilient. Credit quality continued to be strong, and the company improved its capital and liquidity levels while returning over $300 million to shareholders.

Financial Performance and Key Metrics

Trust, investment, and other servicing fees, the largest component of noninterest income, saw a slight increase to $1,090.0 million, up 5% from the fourth quarter of 2022. This growth was driven by favorable markets and new business, partially offset by asset outflows. Other noninterest income experienced a significant drop, primarily due to lower client volumes and an unfavorable impact from foreign exchange swap activity.

Net interest income on a fully taxable equivalent (FTE) basis increased sequentially due to a favorable balance sheet mix and higher average interest rates, although it decreased compared to the prior-year quarter due to lower average earning assets. The provision for credit losses was primarily due to an increase in the reserve evaluated on a collective basis and a small number of borrowers.

Noninterest expense rose to $1,388.5 million, a 9% increase from the previous quarter and a 5% increase year-over-year. This was partly due to the FDIC special assessment and higher technical services costs. The effective tax rate decreased sequentially, mainly due to a higher level of tax benefits from tax-credit investments and tax-exempt income.

Capital and Liquidity

Northern Trust Corp (NASDAQ:NTRS) continued to maintain strong capital ratios, exceeding the minimum requirements for classification as "well-capitalized" under U.S. regulatory requirements. The company returned approximately $302.4 million to common shareholders through dividends and share repurchases during the quarter.

As Northern Trust Corp (NASDAQ:NTRS) moves into 2024, the focus is on accelerating profitable organic growth, maintaining expense discipline, and driving greater resiliency and efficiency in the operating model to create sustained long-term shareholder value.

For a detailed analysis of Northern Trust Corp (NASDAQ:NTRS)'s fourth quarter performance and the full financial statements, investors and interested parties can access the complete 8-K filing.

Explore the complete 8-K earnings release (here) from Northern Trust Corp for further details.

This article first appeared on GuruFocus.