Northrim BanCorp Inc (NRIM) Reports Decline in Q4 Earnings Amidst Market Challenges

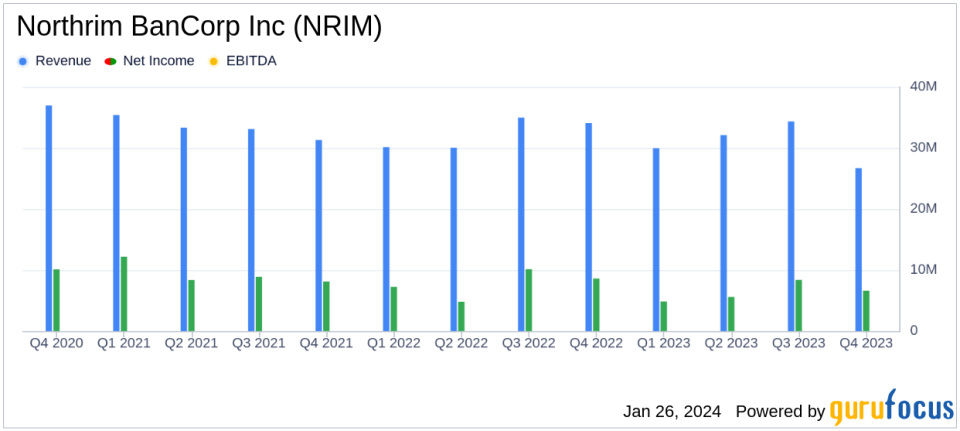

Net Income: Q4 net income fell to $6.6 million, or $1.19 per diluted share, compared to $8.6 million, or $1.48 per diluted share, in Q4 of the previous year.

Annual Performance: Full-year net income decreased by 17% to $25.4 million, or $4.49 per diluted share, from $30.7 million, or $5.27 per diluted share, in the prior year.

Interest Income and Expense: Q4 net interest income rose slightly from the previous quarter but saw a year-over-year decrease, with a significant increase in interest expense.

Loan and Deposit Growth: Portfolio loans grew by 19% year-over-year, while total deposits increased by 4%.

Dividends: Dividends per share in Q4 remained at $0.60, marking a 20% increase from the same quarter last year.

Market Share: Northrim expanded its branch network and market share, contributing to solid loan and deposit growth.

Asset Quality: Nonperforming assets net of government guarantees were $5.8 million at the end of Q4, with a decrease in nonperforming loans.

On January 26, 2024, Northrim BanCorp Inc (NASDAQ:NRIM) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The bank holding company, which operates primarily through its Community Banking and Home Mortgage Lending segments, reported a decrease in net income for both the quarter and the year, attributing the decline to lower net income in the Home Mortgage Lending segment, increased interest expense, and higher salaries and personnel expenses.

Financial Performance and Challenges

Northrim BanCorp's Q4 net income fell to $6.6 million, or $1.19 per diluted share, from $8.6 million, or $1.48 per diluted share, in the same quarter of the previous year. The full-year net income also saw a decline, dropping 17% to $25.4 million, or $4.49 per diluted share, compared to $30.7 million, or $5.27 per diluted share, for the full year of 2022. The company cited a decline in mortgage originations and a decrease in the fair value of mortgage servicing rights as primary factors for the downturn.

Despite these challenges, Northrim BanCorp's Community Banking segment experienced loan and deposit growth, which supported earnings in 2023. However, increased operating expenses and a higher provision for credit losses due to loan growth compared to the previous year partially offset these gains.

Financial Achievements and Industry Importance

Northrim BanCorp's financial achievements in the face of industry headwinds demonstrate the company's resilience and strategic growth. The expansion of its branch network into new markets and the enhancement of its treasury management capabilities have allowed the company to gain market share and maintain liquidity. These achievements are particularly important for banks, as they reflect the ability to attract and retain customers, grow assets, and manage risks effectively.

Income Statement and Balance Sheet Summary

The company's net interest income for Q4 increased slightly from the previous quarter but decreased compared to the same quarter last year. The net interest margin on a tax equivalent basis (NIMTE) decreased both quarter-over-quarter and year-over-year. Total assets grew modestly to $2.81 billion, while portfolio loans saw a significant increase, reflecting new customer relationships and market share expansion.

Northrim BanCorp's balance sheet strength is evident in its total deposits growth and the quality of its loan portfolio. The company's asset quality remained solid, with nonperforming assets net of government guarantees standing at $5.8 million at the end of Q4.

Management Commentary

"We are pleased with our 2023 results," said Joe Schierhorn, President and Chief Executive Officer of Northrim BanCorp. "We have continued to gain market share as we expand our branch network, upgrade our treasury management capabilities, and attract talented new individuals to the Northrim team. Market share gains have fueled solid loan and deposit growth and allowed us to maintain enhanced liquidity to ensure our stability in a range of economic scenarios."

Analysis of Company Performance

Northrim BanCorp's performance in 2023 reflects a mixed financial landscape. While the company has successfully grown its loan and deposit base and maintained a stable market share, the challenges in the Home Mortgage Lending segment and increased operating expenses have impacted its bottom line. The company's ability to navigate these challenges while continuing to grow in strategic areas suggests a focus on long-term stability and market presence.

For a detailed view of Northrim BanCorp's financial performance and to access the full 8-K filing, visit the SEC website.

Explore the complete 8-K earnings release (here) from Northrim BanCorp Inc for further details.

This article first appeared on GuruFocus.