Northrop Grumman Corp (NOC) Faces Headwinds Amid Record Backlog and Sales Growth

Backlog: Reached a record $84.2 billion, indicating sustained demand.

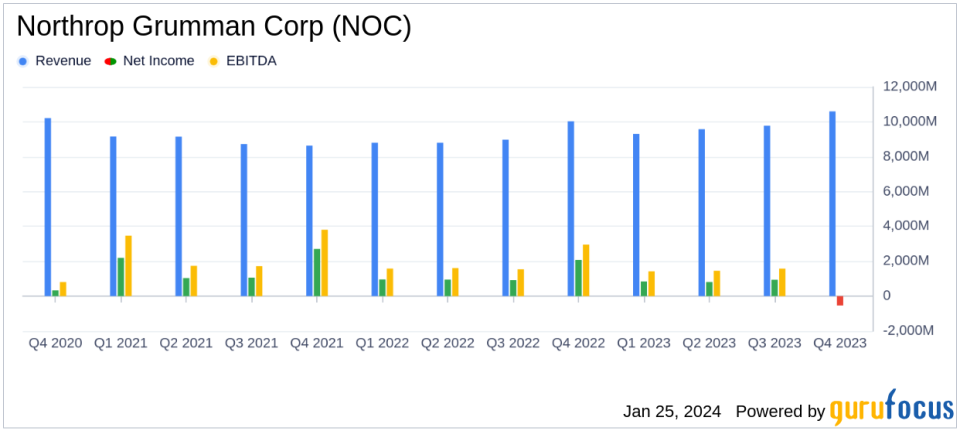

Sales: Q4 sales rose 6% to $10.6 billion; 2023 sales up 7% to $39.3 billion.

Net Earnings: 2023 net earnings at $2.1 billion, diluted EPS of $13.53.

B-21 Charge: Incurred a $1.56 billion pre-tax charge, impacting earnings.

Cash Flow: Operating cash flow for 2023 was $3.9 billion, with adjusted free cash flow of $2.1 billion.

Guidance: 2024 sales and margin guidance inline with expectations, reaffirming 2024 and 2025 free cash flow outlook.

On January 25, 2024, Northrop Grumman Corp (NYSE:NOC) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, a diversified defense contractor known for its aeronautics, defense, mission, and space systems, faced a challenging year due to a significant pre-tax charge on the B-21 program. Despite this, Northrop Grumman reported a record backlog and growth in sales, driven by robust global demand for its products and services.

Financial Performance and Challenges

The company's sales in the fourth quarter increased by 6 percent to $10.6 billion, contributing to a 7 percent increase in annual sales to $39.3 billion. However, the year was marked by a substantial pre-tax charge of $1.56 billion associated with the B-21 program, which is in the low-rate initial production (LRIP) phase. This charge led to a net loss of $535 million, or $3.54 per diluted share, in the fourth quarter. For the full year, net earnings were reported at $2.1 billion, or $13.53 per diluted share, including the B-21 charge and an after-tax mark-to-market pension and other post-employment benefits (OPB) expense.

The B-21 charge was primarily due to macroeconomic factors impacting costs and supplier negotiations. This highlights the challenges defense contractors face in managing long-term fixed-price contracts amid economic volatility. The company's performance is critical as it reflects the health of the aerospace and defense industry, which is heavily reliant on government contracts and subject to economic and political fluctuations.

Financial Achievements and Importance

Despite the B-21 charge, Northrop Grumman's financial achievements include a record backlog of $84.2 billion and a strong cash flow performance. The backlog is indicative of the company's ability to secure new contracts and the ongoing demand for its defense products. Operating cash flow for the year was $3.9 billion, with adjusted free cash flow of $2.1 billion. These metrics are vital for the company's ability to invest in new technologies, manage debt, and return capital to shareholders.

Key Financial Metrics and Commentary

Key financial metrics from the income statement and balance sheet include:

"Our team delivered a strong finish to the year in 2023. We generated free cash flow at the high end of our guidance range, significantly exceeded our sales guidance and beat EPS consensus absent the B-21 charge we identified as a possibility this time last year," said Kathy Warden, chair, chief executive officer and president.

This commentary underscores the company's resilience and the strategic importance of its products and services. The company's guidance for 2024 reflects continued strong sales and earnings growth, with free cash flow expected to grow at a greater than 15 percent compound annual growth rate through 2026.

Analysis of Company Performance

Northrop Grumman's performance in 2023 was a mix of strengths and challenges. The record backlog and sales growth are positive indicators of the company's market position and future revenue streams. However, the B-21 charge points to the risks associated with complex defense programs. The company's ability to navigate these challenges while maintaining strong cash flow is a testament to its operational efficiency and strategic planning.

For value investors, Northrop Grumman's solid backlog and projected cash flow growth suggest a potentially attractive long-term investment, provided the company can effectively manage the risks inherent in its industry. The company's commitment to returning capital to shareholders may also appeal to those looking for steady returns in a volatile market.

For more detailed insights and financial analysis, visit GuruFocus.com, where we provide in-depth research and up-to-date data for informed investment decisions.

Explore the complete 8-K earnings release (here) from Northrop Grumman Corp for further details.

This article first appeared on GuruFocus.