Northwest Pipe Co Reports Mixed Results Amid Market Challenges

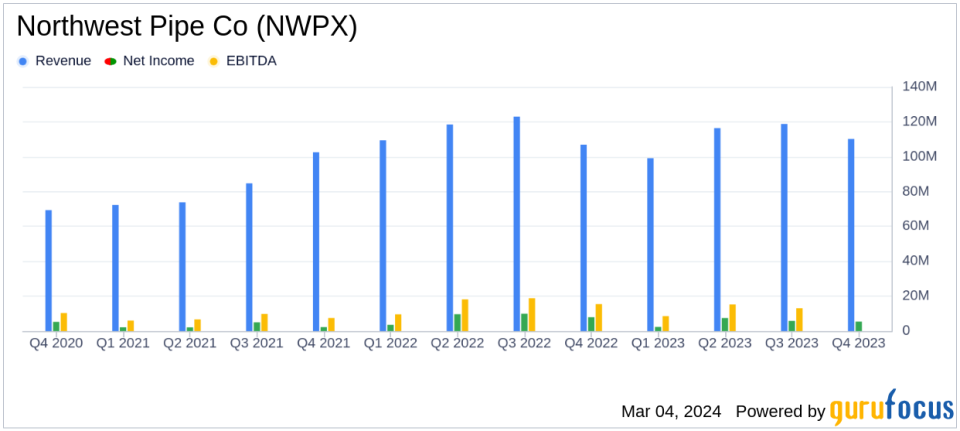

Net Sales: Fourth quarter net sales rose 3.1% year-over-year, but annual sales saw a 2.9% decrease.

Gross Profit: Annual gross profit declined by 9.6% compared to the previous year.

Net Income: Reported annual net income of $2.09 per diluted share.

Cash Flow: Strong annual cash generation with $53.5 million net cash provided by operating activities.

Backlog: Backlog for Engineered Steel Pressure Pipe segment stands at $273 million, with confirmed orders pushing it to $319 million.

Stock Repurchase: Repurchased $4.4 million of common stock through February 29, 2024.

Safety Performance: Achieved a record annual total recordable incident rate of 1.51.

On March 4, 2024, Northwest Pipe Co (NASDAQ:NWPX) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year of 2023. The company, a leading manufacturer of water-related infrastructure products, faced significant headwinds over the year, including a challenging interest rate environment and volatility in steel prices. Despite these obstacles, Northwest Pipe Co managed to maintain a strong cash flow and repurchase shares, signaling confidence in its long-term strategy.

Company Overview

Northwest Pipe Co operates in two segments: the Engineered Steel Pressure Pipe (SPP) segment, which manufactures large-diameter, high-pressure steel pipeline systems, and the Precast Infrastructure and Engineered Systems segment (Precast), which offers a range of precast and reinforced concrete products. These products serve a variety of applications, including drinking water systems, hydroelectric power systems, and wastewater management.

Financial Performance and Challenges

For the fourth quarter of 2023, Northwest Pipe Co reported a modest increase in net sales to $110.2 million, up 3.1% from the same period in the previous year. However, the annual net sales experienced a slight decline of 2.9% to $444.4 million. The company's annual gross profit also saw a decrease, falling 9.6% from the 2022 record. The SPP segment's revenue remained robust at $296.4 million, with a backlog including confirmed orders of $319 million, despite a challenging bidding environment. Conversely, the Precast segment's net sales dipped slightly by 1.4% to $148.0 million, with margins compressed due to reduced overhead absorption on lower demand.

President and CEO Scott Montross commented on the resilience displayed by the company amidst these challenges, stating,

Despite the challenging circumstances of 2023, we generated annual net sales of $444.4 million, down only moderately from 2022, demonstrating what we believe is a new level of through cycle resilience created by the growth strategy deployed over the last several years."

Financial Achievements and Importance

The company's ability to generate strong cash flow, with net cash provided by operating activities reaching $53.5 million, is particularly noteworthy. This financial achievement is crucial for Northwest Pipe Co as it allows the company to navigate through market volatility, invest in strategic growth initiatives, and return value to shareholders through stock repurchases. The repurchase of $4.4 million in common stock underscores the company's commitment to shareholder value.

Analysis of Financial Statements

Northwest Pipe Co's financial statements reveal a mixed picture. While the fourth quarter showed a slight uptick in sales, the full year results were dampened by a decrease in both net sales and gross profit. The SPP segment's backlog, a key metric indicating future revenue potential, remained strong, though it saw a decrease in confirmed orders from the previous quarter. The Precast segment's order book also declined, reflecting the impact of higher interest rates on the construction industry.

The company's balance sheet remains healthy, with a strong liquidity position enhanced by effective working capital management and debt reduction efforts. This financial stability is essential for Northwest Pipe Co's growth strategy, which focuses on expanding the Precast business to mitigate the cyclicality of the SPP operations and enhance overall margins and cash flow.

Conclusion

In conclusion, Northwest Pipe Co's 2023 financial results reflect a company navigating a complex market landscape with resilience. The company's strategic focus on cash flow generation and operational efficiency, combined with its commitment to safety and shareholder value, positions it to weather the challenges ahead and capitalize on future opportunities in the water infrastructure industry.

For more detailed information and analysis on Northwest Pipe Co's financial results, investors and interested parties are encouraged to review the full 8-K filing and join the earnings conference call scheduled for March 5, 2024.

Explore the complete 8-K earnings release (here) from Northwest Pipe Co for further details.

This article first appeared on GuruFocus.