The Norvista Capital (CVE:NVV) Share Price Is Down 47% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It is doubtless a positive to see that the Norvista Capital Corporation (CVE:NVV) share price has gained some 43% in the last three months. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 47% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Norvista Capital

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

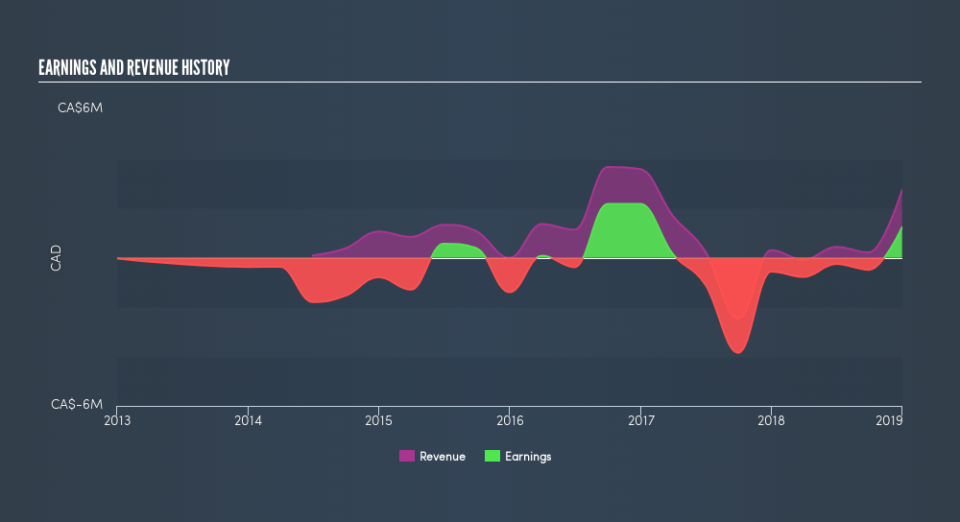

During five years of share price growth, Norvista Capital moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Arguably the revenue decline of 22% per year has people thinking Norvista Capital is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on Norvista Capital's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Norvista Capital's total shareholder return last year was 5.3%. This recent result is much better than the 19% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. Is Norvista Capital cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Norvista Capital may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.