Norwegian Cruise Line's (NYSE:NCLH) Q4 Sales Top Estimates, Stock Soars

Cruise company Norwegian Cruise Line (NYSE:NCLH) reported Q4 FY2023 results topping analysts' expectations , with revenue up 30.8% year on year to $1.99 billion. It made a non-GAAP loss of $0.18 per share, improving from its loss of $1.04 per share in the same quarter last year.

Is now the time to buy Norwegian Cruise Line? Find out by accessing our full research report, it's free.

Norwegian Cruise Line (NCLH) Q4 FY2023 Highlights:

Revenue: $1.99 billion vs analyst estimates of $1.96 billion (1.2% beat)

EPS (non-GAAP): -$0.18 vs analyst expectations of -$0.14 (33.3% miss)

EPS (non-GAAP) Guidance for Q1 2024 is $0.12 at the midpoint, above analyst estimates of -$0.20

Free Cash Flow was -$388.7 million compared to -$918.4 million in the previous quarter

Gross Margin (GAAP): 33.5%, up from 19.7% in the same quarter last year

Passenger Cruise Days: 5.86 million (beat vs. expectations of 5.80 million)

Market Capitalization: $6.78 billion

“Throughout the year, we successfully implemented measures to rightsize our cost base. Notably, the fourth quarter of 2023 marked our fourth consecutive quarter of improved Adjusted Net Cruise Costs Excluding Fuel per Capacity Day, this resulted in a substantial 21% reduction in 2023 compared to 2022,” said Mark A. Kempa, executive vice president and chief financial officer of Norwegian Cruise Line Holdings Ltd.

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE:NCLH) is a premier global cruise company.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

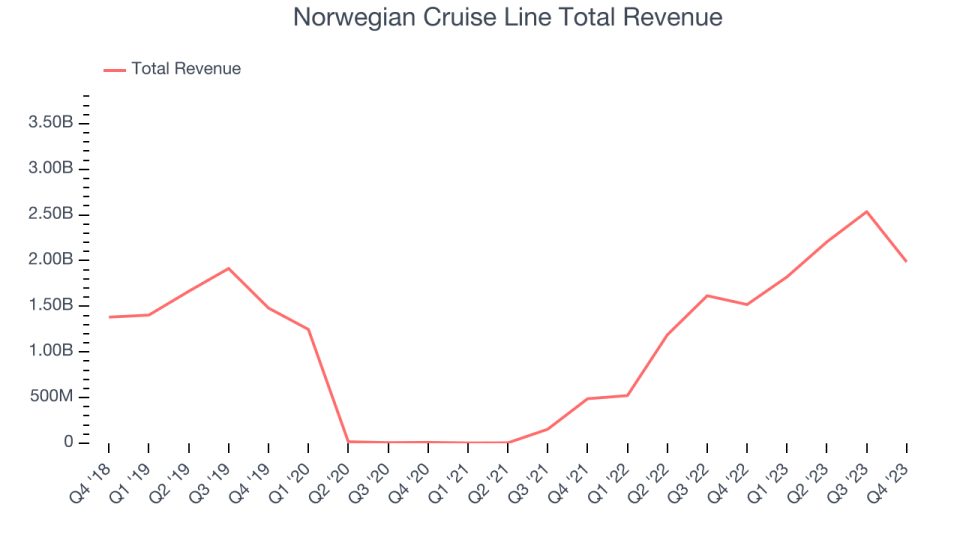

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Norwegian Cruise Line's annualized revenue growth rate of 7.1% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Norwegian Cruise Line's annualized revenue growth of 263% over the last two years is above its five-year trend, suggesting some bright spots.

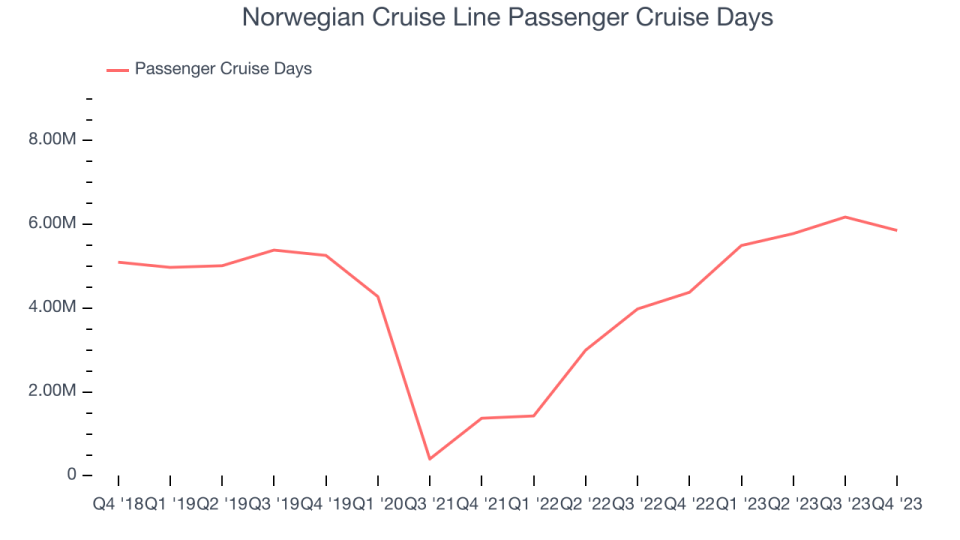

We can better understand the company's revenue dynamics by analyzing its number of passenger cruise days, which reached 5.86 million in the latest quarter. Over the last two years, Norwegian Cruise Line's passenger cruise days averaged 262% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company's monetization was fairly consistent.

This quarter, Norwegian Cruise Line reported wonderful year-on-year revenue growth of 30.8%, and its $1.99 billion of revenue exceeded Wall Street's estimates by 1.2%. Looking ahead, Wall Street expects sales to grow 8.4% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Norwegian Cruise Line's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 17.3%.

Norwegian Cruise Line burned through $388.7 million of cash in Q4, equivalent to a negative 19.6% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter.

Key Takeaways from Norwegian Cruise Line's Q4 Results

We were impressed by Norwegian Cruise Line's optimistic earnings forecast for next quarter, which blew past analysts' expectations. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its passenger cruise days unfortunately missed and its EPS fell short of Wall Street's estimates. Overall, this was a mixed quarter for Norwegian Cruise Line, but the outlook is sure to draw some optimism. The stock is up 6.1% after reporting and currently trades at $16.9 per share.

So should you invest in Norwegian Cruise Line right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.