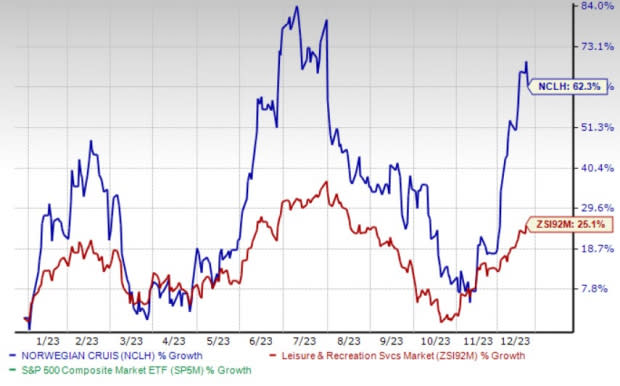

Norwegian Cruise (NCLH) Gains 62% YTD: Will it Continue?

Norwegian Cruise Line Holdings Ltd. NCLH has performed exceptionally well so far this year, with the stock gaining 62.3% compared with the industry’s 25.1% growth. NCLH has been benefiting from strong demand and booking volume growth.

The Zacks Rank #3 (Hold) company’s earnings and sales in 2024 are likely to witness 57.9% and 9.1% year-over-year growth, respectively. However, Norwegian Cruise has been bearing the brunt of high expenses for quite some time now.

Let’s delve deeper.

Growth Drivers

The company is gaining from robust booking. As of Sep 30, 2023, advance ticket sales balance came in at $3.1 billion, reflecting nearly 59% rise from 2019 levels. It stated pricing levels to be elevated. Management intends to focus on strategic marketing efforts to drive demand and high-value bookings in the upcoming periods.

NCLH emphasizes its booking window to drive the top line. Along with evaluating the extent and willingness of consumers to spend on cruise travel the initiative provides better visibility for price increases and moderating marketing expenses. During the second quarter, the company extended its booking window 51 days (or 20% compared with 2019 levels) to enhance future visibility and reduce exposure to volatile bookings. It anticipates the indicator to be a driving factor in the upcoming periods.

Norwegian Cruise is constantly looking to expand its fleet size, which is currently at 31. It has plans to introduce six more ships through 2028. A majority of them are on order for the Norwegian Cruise Line, while the rest are for Oceania Cruises and Regent Seven Seas Cruises.

For the Oceania Cruises brand, the company has one Allura Class Ships to be delivered in 2025. For the Norwegian brand, it has four Prima Class Ships on order, with scheduled delivery dates from 2025 through 2028.

As expected before, the Regent brand welcomed its newest fleet addition, Seven Seas Grandeur, in November 2023. After this delivery, NCLH announced no specific delivery lined up until spring 2025. The company’s new build pipeline is likely to pave a path for approximately 50% capacity growth by 2028, registering a CAGR of approximately 5% (from 2019 levels).

Image Source: Zacks Investment Research

Concerns

Norwegian Cruise has been bearing the brunt of high expenses for quite some time now. During the third quarter of 2023, total cruise operating expenses were $1.48 billion, up from $1.24 billion a year ago. It reported a rise in payroll, fuel, direct variable costs of fully-operating ships along with delivery costs associated with new ship deliveries in 2022 and 2023.

Management anticipates inflation and global supply-chain constraints to pressurize margins in the near term. Also, it is cautious of increased expense in terms of fuel and capacity additions. For 2023, Norwegian Cruise anticipates total cruise operating expenses to rise 29.3% year over year to $5.52 billion.

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. Shares of RCL have surged 143.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 57.7% and 187.9%, respectively, from the year-ago levels.

Live Nation Entertainment, Inc. LYV flaunts a Zacks Rank #1 at present. It has a trailing four-quarter earnings surprise of 37.5% on average. Shares of LYV have gained 28.4% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests a jump of 29.5% and 132.8%, respectively, from the prior-year numbers.

JAKKS Pacific, Inc. JAKK currently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 61.8% on average. Shares of JAKK have climbed 107.9% in the past year.

The Zacks Consensus Estimate for JAKK’s 2024 sales implies an improvement of 3.6% from the year-earlier figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report