Nostrum Oil & Gas PLC (LON:NOG) Looks Inexpensive But Perhaps Not Attractive Enough

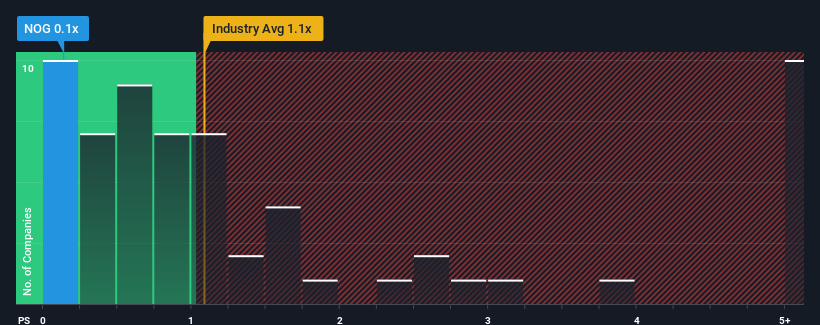

When close to half the companies operating in the Oil and Gas industry in the United Kingdom have price-to-sales ratios (or "P/S") above 1.1x, you may consider Nostrum Oil & Gas PLC (LON:NOG) as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Nostrum Oil & Gas

How Nostrum Oil & Gas Has Been Performing

Nostrum Oil & Gas could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nostrum Oil & Gas.

Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nostrum Oil & Gas' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 38% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company are not good at all, suggesting revenue should decline by 21% per year over the next three years. The industry is also set to see revenue decline 1.8% per year but the stock is shaping up to perform materially worse.

With this in consideration, it's clear to us why Nostrum Oil & Gas' P/S isn't quite up to scratch with its industry peers. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Nostrum Oil & Gas' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Nostrum Oil & Gas' analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. Given the current circumstances, it's difficult to envision any significant increase in the share price in the near term.

We don't want to rain on the parade too much, but we did also find 6 warning signs for Nostrum Oil & Gas (3 are significant!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.