Not Many Are Piling Into FireAngel Safety Technology Group plc (LON:FA.) Stock Yet As It Plummets 27%

To the annoyance of some shareholders, FireAngel Safety Technology Group plc (LON:FA.) shares are down a considerable 27% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

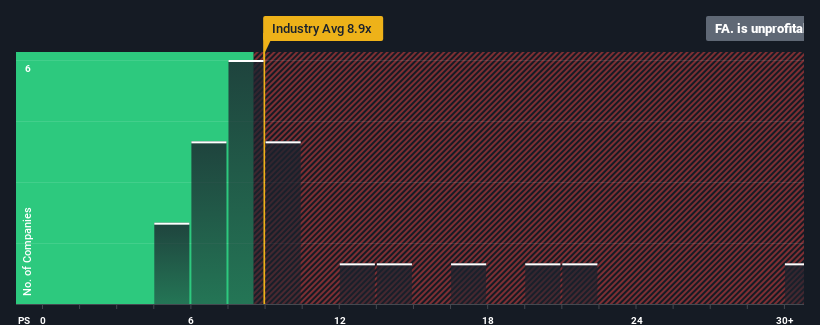

Since its price has dipped substantially, FireAngel Safety Technology Group's price-to-earnings (or "P/E") ratio of -1.7x might make it look like a strong buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 15x and even P/E's above 29x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, FireAngel Safety Technology Group's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for FireAngel Safety Technology Group

Want the full picture on analyst estimates for the company? Then our free report on FireAngel Safety Technology Group will help you uncover what's on the horizon.

Is There Any Growth For FireAngel Safety Technology Group?

There's an inherent assumption that a company should far underperform the market for P/E ratios like FireAngel Safety Technology Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 58%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 69% as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 7.3%, which is noticeably less attractive.

With this information, we find it odd that FireAngel Safety Technology Group is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Having almost fallen off a cliff, FireAngel Safety Technology Group's share price has pulled its P/E way down as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that FireAngel Safety Technology Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for FireAngel Safety Technology Group you should be aware of, and 2 of them are a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here