Not Many Are Piling Into Mondee Holdings, Inc. (NASDAQ:MOND) Just Yet

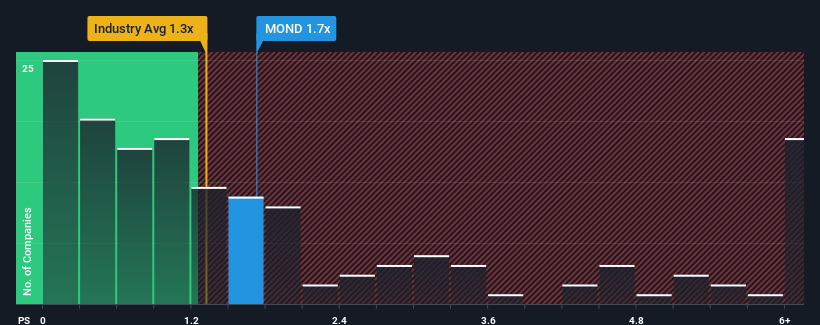

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Hospitality industry in the United States, you could be forgiven for feeling indifferent about Mondee Holdings, Inc.'s (NASDAQ:MOND) P/S ratio of 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Mondee Holdings

How Has Mondee Holdings Performed Recently?

Mondee Holdings could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Mondee Holdings will help you uncover what's on the horizon.

Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Mondee Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen an excellent 197% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 30% each year over the next three years. With the industry only predicted to deliver 13% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Mondee Holdings' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Mondee Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Mondee Holdings has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If you're unsure about the strength of Mondee Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.