Do Not Give Up on Newmont

Newmont Corp. (NYSE:NEM) released its fourth-quarter and full-year 2023 earnings on Feb. 22.

It is a significant quarter because the Newcrest acquisition was finalized on Nov. 6, 2023. As a result, metal production partially reflects the merger's completion, even though more than one month of production was not included. Furthermore, the outstanding diluted shares reached 979 million, a 23% increase from the previous quarter.

Newmont also announced 2023 mineral reserves for the integrated company. Gold mineral reserves were 135.90 million ounces in 2023, up 41.50% year over year. Around 75% of the mineral reserves are located in the Americas and Australia.

Source: Newmont Presentation

However, the stock tumbled on Feb. 22, despite a bullish gold price above $2,000 per ounce, for four primary reasons:

The company announced a quarterly dividend cut of nearly 37%, from 40 cents to 25 cents per share.

The company indicated disappointing 2024 production guidance with an expected 6.93 million ounces of gold.

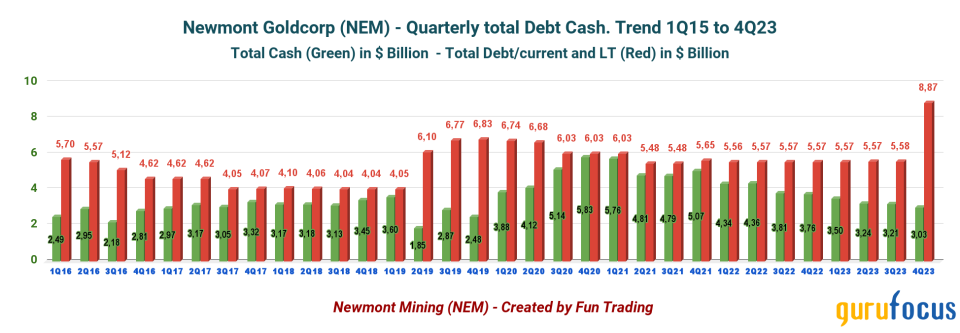

Newmont plans to sell non-tier 1 assets after acquiring Newcrest Mining for approximately $15 billion to reduce its $8.87 billion in debt.

Finally, Newmont took a $1.20 billion non-cash impairment charge related to its Penasquito mine in Mexico.

Chief Financial Officer Karyn Ovelmen said during the conference call, "Divestiture proceeds will first be allocated to maintaining our minimum cash balance of approximately $3 billion and will then be applied to reducing debt to $8 million or below."

Eanings highlights

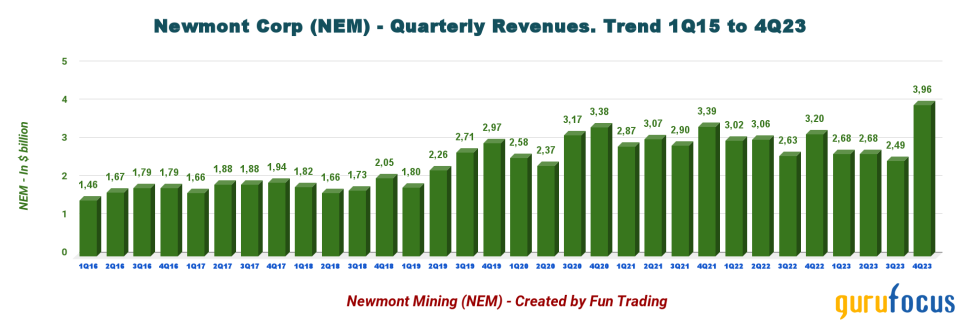

The earnings results for the fourth quarter were mixed, with better-than-expected revenue of $3.95 billion, up from $3.20 billion in the prior-year quarter, and a net loss of $3.21 per diluted share. However, adjusted income was 50 cents per share, falling short of analysts' expectations.

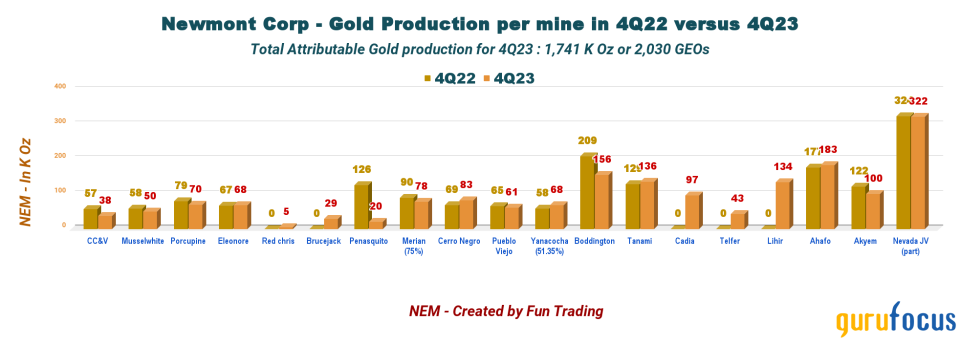

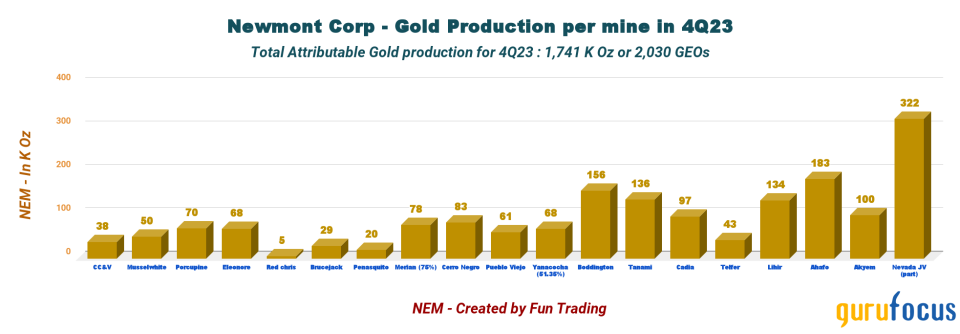

Attributable gold production was 1,741,000 ounces and attributable gold equivalent production was 2,030,000 GEOs. JV Nevada Gold Mines produced 322,000 ounces, down slightly from 324,000 ounces last year. Production numbers were better than expected.

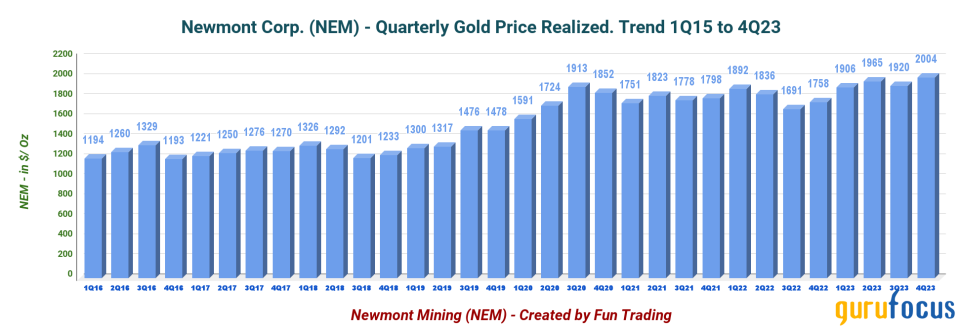

Newmont sold its gold production for a record $2,004 per ounce, compared to $1,758 a year ago.

Liquidity was strong with $3.03 billion of consolidated cash and approximately $6.10 billion in liquidity; the reported net debt-to-adjusted Ebitda ratio was 1.10.

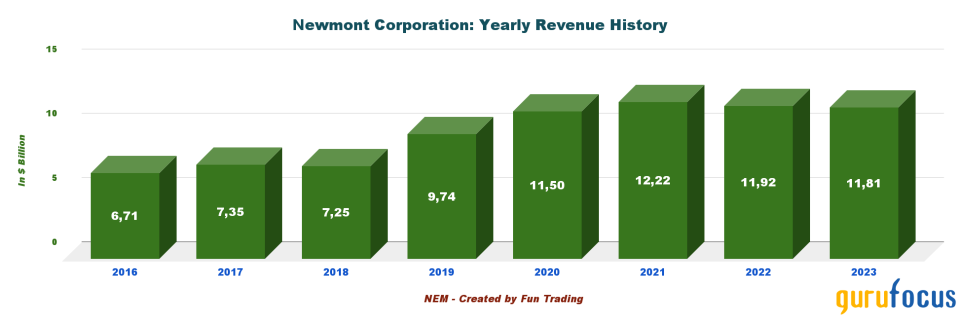

Revenue in 2023 was $11.81 billion, slightly lower than in 2022 ($11.92 billion). 2023 GEO production was 6,433,000, compared to 7,231,000 in 2022.

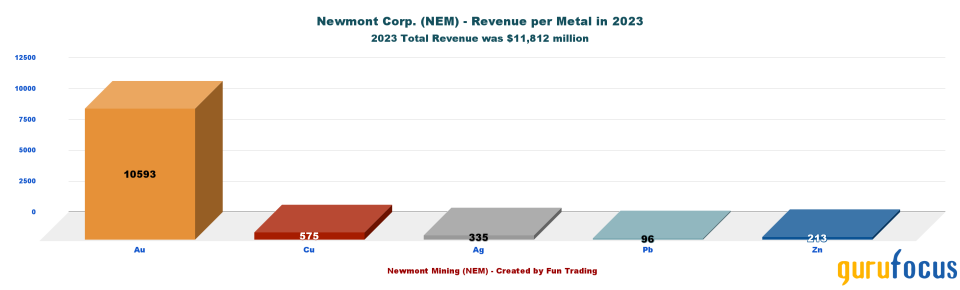

During the conference call, CEO Tom Palmer said, "Newmont finished the year with a solid fourth quarter, putting us in line with the revised stand-alone outlook that we issued following the resolution of the strike at Penasquito. In summary, we produced 5.5 million ounces of gold at all-in sustaining costs of $1,444 an ounce. In addition to gold, we produced nearly 900,000 gold equivalent ounces from copper, silver, lead, and zinc over the course of the year."

Gold production per mine

Newmont's attributable gold production increased significantly in the fourth quarter of 2023 compared to the fourth quarter of 2022, owing primarily to the Newcrest acquisition, which added five new producing assets.

However, the production loss at the Penasquito mine was significant and painful this quarter, as shown below.

Stock performance and commentary

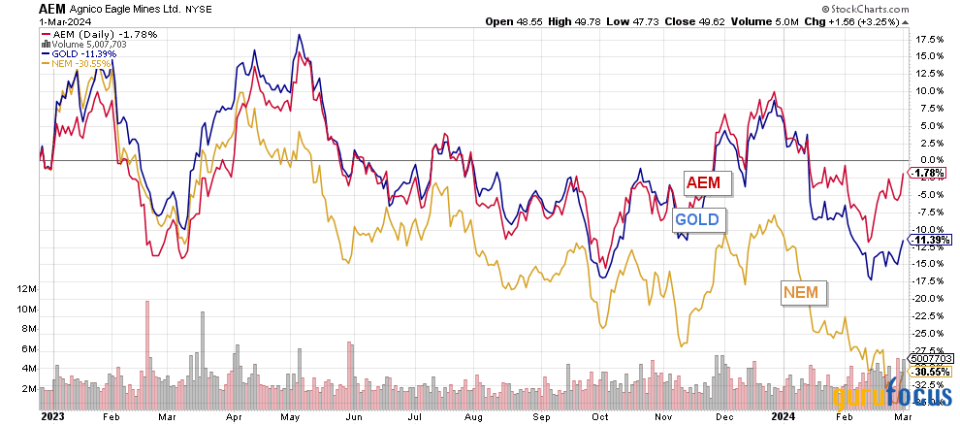

Newmont is one of my long-term gold miners, along with Barrick Gold (NYSE:GOLD), Agnico Eagle (NYSE:AEM) and Kinross Gold (NYSE:KGC). Unfortunately, the company has consistently underperformed the group over the past year, and recent dividend cuts have not helped. The stock is down over 30% on a one-year basis.

Three critical issues emerged in 2023, significantly impacting the stock.

The 120-day illegal labor dispute at Penasquito significantly impacted the stock, resulting in a loss of 100,000 gold ounces in the fourth quarter.

Second, there were concerns about asset integrity at the Ahafo mine.

The wildfires in Canada had an impact on Eleonore.

Finally, the recent delay and extra cost of the Tanami project.

Note: Graph created by Fun Trading/StockCharts

Many investors have given up on Newmont, which is a major mistake. According to Baron Rothschild, "the time to buy is when there is blood on the streets," precisely what this gold miner encountered.

Selling at this level is absurd and demonstrates your emotions have influenced your judgment. Even with a reduced quarterly dividend of 25 cents per share, investors receive a 3.13% yield and have the potential for significant stock appreciation from those levels, with gold spot trading at a record of $2,127 per ounce today.

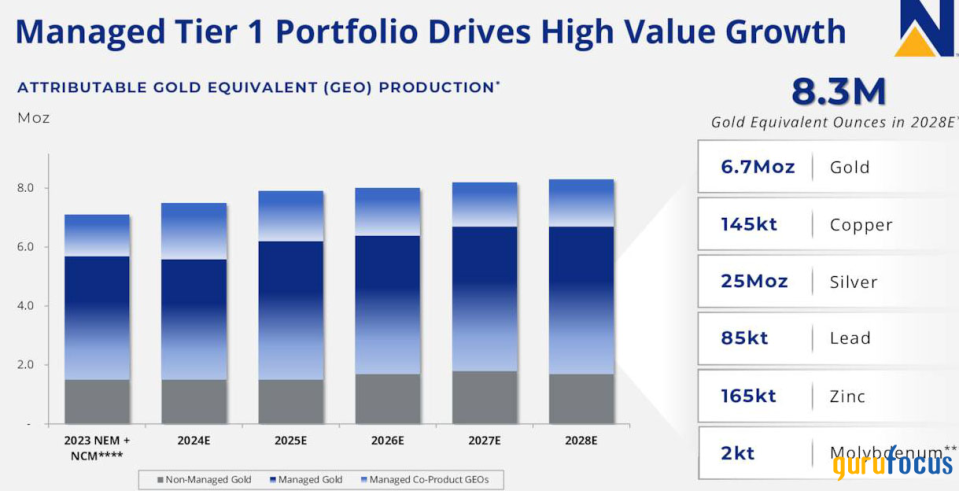

The most important aspect of investing is to tailor your trading strategy to the stock you have invested in. The company is financially stable and expects to produce 8.3 million gold equivalent ounces in 2028, as shown in the presentation below. Thus, why sell now rather than continue a slow accumulation?

Source: Newmont presentation

The most straightforward trading strategy is to trade LIFO and use 40% to 50% of your total position to trade short-term using technical analysis. It is a simple strategy that allows you to accumulate a recurring short-term gain while enabling you to keep a long-term position, often underwater, until the stock turnarounds.

Quarterly financials as of the fourth quarter

Newmont Corporation | 4Q22 | 1Q22 | 2Q22 | 3Q23 | 4Q23 |

Total Revenues in $ Million | 3,200 | 2,679 | 2,683 | 2,493 | 3,957 |

Net income in $ Million | -1,477 | 351 | 155 | 158 | -3,139 |

EBITDA $ Million | -759 | 1,065 | 835 | 760 | -2,338 |

EPS diluted in $/share | -1.86 | 0.44 | 0.19 | 0.20 | -3.21 |

Cash from operations in $ Million | 1,010 | 481 | 663 | 1,003 | 616 |

Capital Expenditure in $ Million | 646 | 526 | 616 | 604 | 920 |

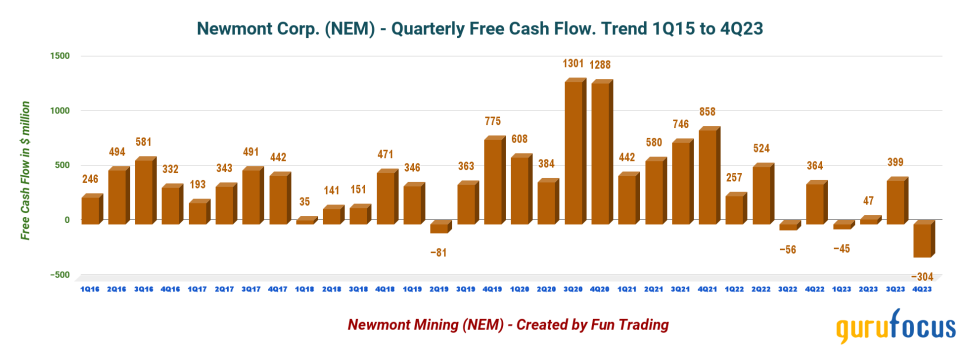

Free Cash Flow In $ Million | 364 | -45 | 47 | 399 | -304 |

Total Cash in $ Million | 3,757 | 3,504 | 3,238 | 3,214 | 3,025 |

Long-term debt in $ millions | 5,571 | 5,572 | 5,574 | 5,575 | 8,874 |

Quarterly Dividend per share in $/share | 0.40 | 0.40 | 0.40 | 0.40 | 0.25 |

Shares Outstanding (diluted) Million | 797 | 795 | 795 | 796 | 979 |

Source: Company 10-k filing.

More production numbers to consider

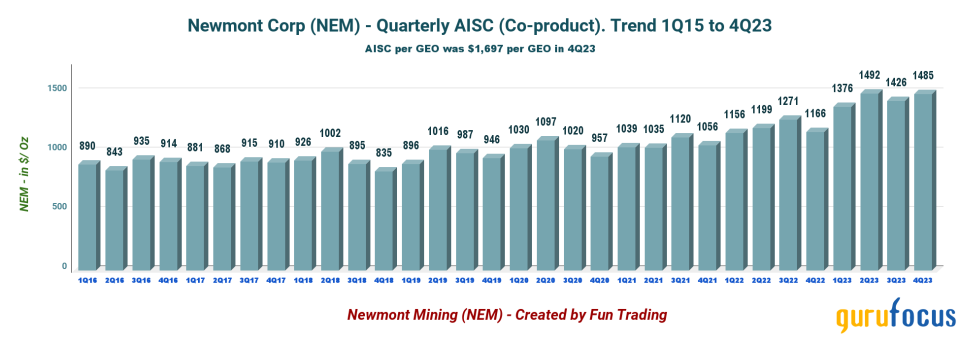

All-in sustaining costs increased quarter to $1,485 per ounce from $1,166 per ounce a year ago. The AISC is too high, but will drop after fully integrating the Newcrest acquisition.

Palmer said during the conference call, "Newmont will produce a significant amount of copper, along with silver, lead, zinc and molybdenum with our global diversified Tier 1 portfolio. Driven by this high metal production and with a focus on improving costs, we expect to deliver all-in sustaining costs bringing our go-forward portfolio down to $1,150 per ounce by 2027."

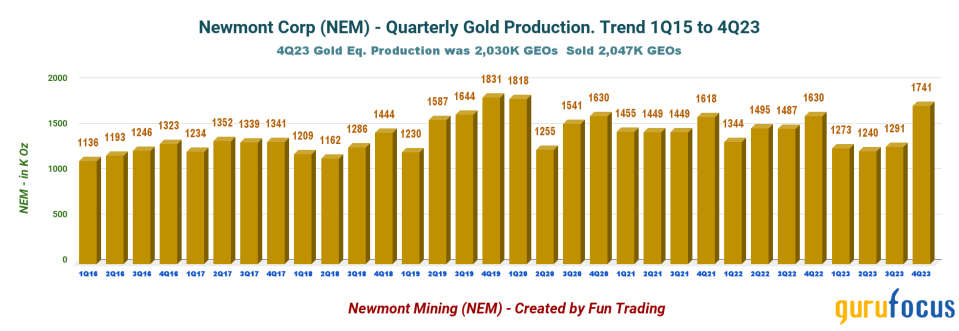

The quarter was solid for gold production after adding production from Newcrest. Gold production was 1,741,000 ounces and total gold equivalent production was 2,030,000 gold equivalent ounces. As we can see in the chart below, it was a big jump from the preceding quarter.

The chart below shows gold production per producing mine, including Goldcorp, Newcrest and the Barrick/Newmont joint venture (of which Newmont owns 38.50%).

Balance Sheet and Commentary

Newmont's revenue totaled $3.96 billion for the fourth quarter.

Revenue was $3.96 billion, with a net loss of $3.14 billion, or $3.21 per diluted share, in the fourth quarter, compared to a loss of $1.47 million, or $1.86 per diluted share, in the same quarter last year. The adjusted net income was 50 cents per diluted share. Adjusted net income was 50 cents per diluted share.

Revenue repartition per metal mined

As shown below, Nemont's gold production accounted for 89.70% of its total revenue. The recent Newcrest acquisition, which will increase copper production, will likely cause the ratio to shift slightly downward.

The company also reported a $304 million free cash flow deficit.

Its trailing 12-month free cash flow was $97 million, with a disappointing deficit of $304 million in the fourth quarter. Capital expenditures were particularly high at $920 million, while cash from operations decreased to $616 million from $1.01 billion a year ago.

It is likely why management decided to reduce the quarterly dividend from 40 cents to 25 cents per share.

The miner's long-term debt (including current debt) was $5.57 billion at the end of June.

The total cash is $3.02 billion, with a long-term debt of $8.87 billion. This debt profile has changed significantly since the Newcrest acquisition in November 2023. The net debt-to-adjusted Ebitda ratio is 1.10.

On March 4, Newmont launched a private offering for notes due in 2026 and 2034. The company said the notes will be guaranteed on an unsecured senior basis by Newmont USA Ltd., a wholly-owned subsidiary of Newmont. According to the press release:

"The Issuers intend to use a portion of the net proceeds from the Offering to repay all outstanding borrowings under the Company's revolving credit facility, with the remaining proceeds for general corporate purposes. The Company previously used borrowings under its revolving credit facility, along with cash on hand, to repay approximately US$1.9 billion aggregate principal amount of bilateral credit debt acquired by Newmont as part of its acquisition of Newcrest Mining Limited."

Technical snalysis (short term) and commentary

Note: The chart has been adjusted for dividends.

Newmont trades in a descending channel pattern, with resistance at $34 and support at $29.25.

Technical analysts use bearish chart formations, known as descending channel patterns, to detect potential market downtrends. However, these formations frequently result in a breakout.

The short-term trading strategy is to trade LIFO for approximately 45% of your position while holding a core long-term amount for a significantly higher payout.

I recommend selling between $33.50 and $35, with possible higher resistance at $38.20, and then waiting for a retracement between $30.75 and $29.25, with possible lower support at $29.

This article first appeared on GuruFocus.