What to Note Ahead of Farmer Brothers (FARM) in Q4 Earnings

Farmer Bros. Co. FARM is expected to have registered a top-line decline in its fourth-quarter fiscal 2023 numbers, to be released on Sep 12. The Zacks Consensus Estimate for fiscal fourth-quarter revenues is pegged at $85.2 million, indicating a decline of 30.7% from the prior-year quarter’s reported figure.

The consensus estimate for the company’s bottom line is pegged at a loss of 61 cents per share, suggesting a decline of 190.5% from the prior-year quarter’s reported figure. The Zacks Consensus Estimate for the bottom line has been unchanged in the past 30 days.

In the last reported quarter, the company's loss of 57 cents missed the Zacks Consensus Estimate by 42.5%. It has delivered a negative earnings surprise of 11.2%, on average, in the trailing four quarters.

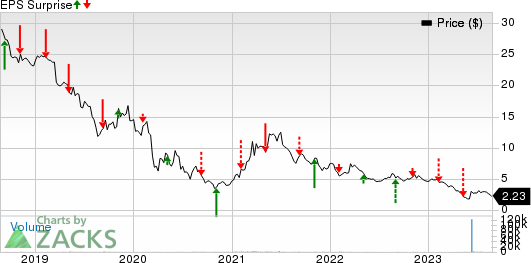

Farmer Brothers Company Price and EPS Surprise

Farmer Brothers Company price-eps-surprise | Farmer Brothers Company Quote

Key Aspects to Note

Farmer Brothers recently divested its direct ship business and the Northlake, TX, facility to concentrate its efforts on core operations and key growth channels. Although this is expected to optimize its operations in the long run, the move is likely to get reflected in the company’s top-line performance in the fiscal fourth quarter. Macroeconomic headwinds, an inflationary environment and supply chain issues might have also hurt its quarterly performance.

Rising sales and operating expenses have been a concern for the company over the past few quarters. For instance, in the third quarter of fiscal 2023, its cost of sales surged 14.1% year over year while selling expenses increased by 2.9%. In the first nine months of fiscal 2023, the metrics increased by 19.8% and 2%, respectively, on a year-over-year basis. Also, the impacts of volatility in coffee prices and inflationary effects on input costs might have affected its margin and profitability in the to-be-reported quarter.

The company’s high debt level might also have hurt its margins and profitability. For instance, FARM exited the fiscal third quarter with $67 million in revolving credit facility and $45.4 million of debt outstanding under its term loan facility. Its interest expenses in the fiscal third quarter surged 162.5% year-over-year.

However, leveraging its robust DSD business, Farmer Brothers is likely to have boosted sales of coffee, tea, spices and breakfast products through its comprehensive national network. FARM is also expected to have benefited from its strong emphasis on operational efficiency and higher-margin product lines.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Farmer Brothers this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, but that’s not the case here, as elaborated below.

Farmer Brothers has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

FARM currently has a Zacks Rank #4 (Sell).

Stocks With the Favorable Combination

Here are three companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases:

American Eagle Outfitters AEO currently has an Earnings ESP of +8.52% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is expected to report bottom-line growth when it releases second-quarter fiscal 2023 results. The Zacks Consensus Estimate for earnings is pinned at 15 cents per share, indicating an increase of 275% from the year-ago quarter’s reported level.

The company’s revenues are anticipated to have declined year over year. The consensus mark for the same is pegged at $1.19 billion, implying a 0.9% decrease from that reported in the prior-year period.

Casey's General Stores CASY presently has an Earnings ESP of +1.03% and a Zacks Rank #3. The company is expected to register a bottom-line decline when it reports first-quarter fiscal 2024 results. The Zacks Consensus Estimate for earnings is pinned at $3.39 per share, indicating a fall of 17.1% from the year-ago quarter’s reported number.

The company’s revenues are anticipated to decrease year over year. The consensus mark for the same is pegged at $3.85 billion, indicating a deterioration of 13.5% from that reported in the year-ago quarter. CASY has a trailing four-quarter average earnings surprise of 7.5%.

lululemon athletica LULU currently has an Earnings ESP of +1.05% and a Zacks Rank #3. LULU is likely to record top-line growth when it reports second-quarter fiscal 2023 results.

The Zacks Consensus Estimate for revenues is pegged at $2.2 billion, indicating a 16.1% improvement from the prior-year quarter’s actual. The consensus mark for earnings is pinned at $2.53 per share, implying a 15% increase from that reported in the comparable period of 2022. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Farmer Brothers Company (FARM) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report