Nova Leap Health Corp. Posts Q2 2023 Results Including Record Adjusted EBITDA

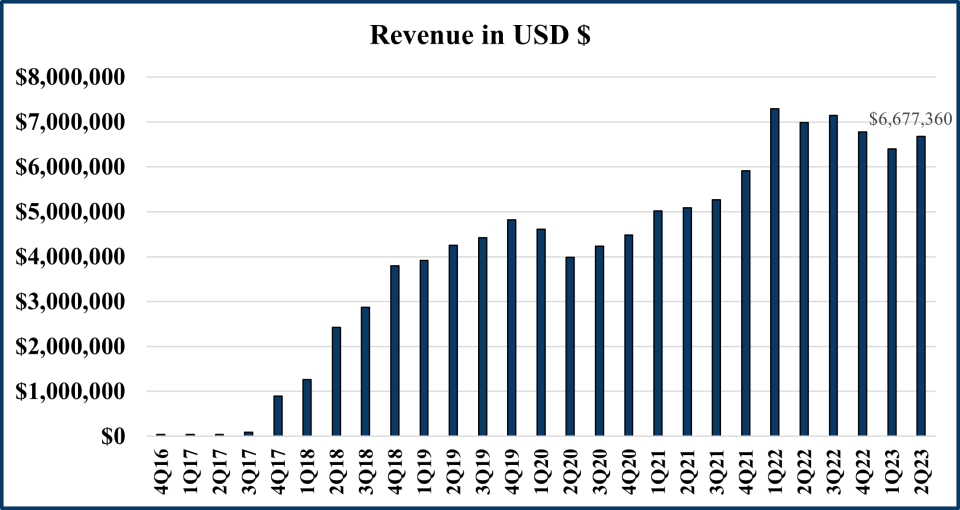

Revenue in USD

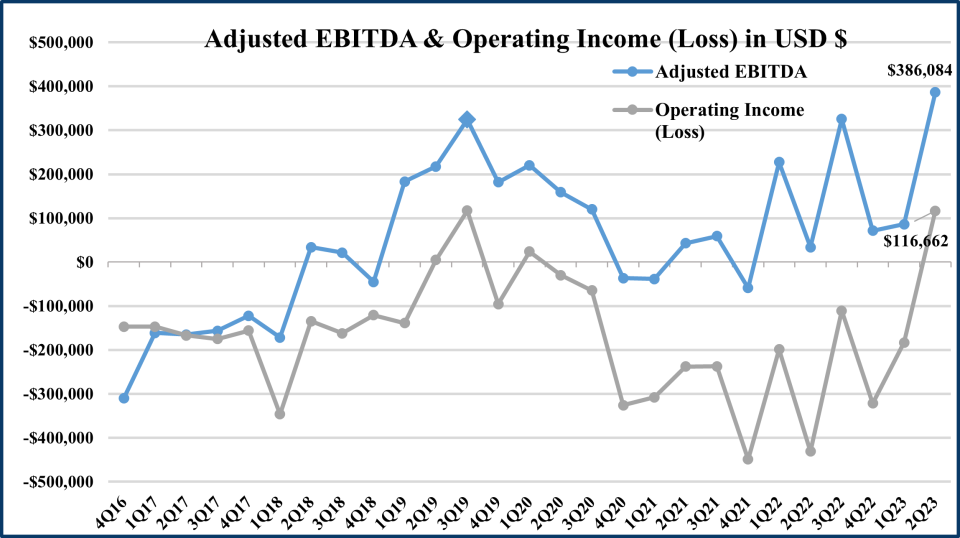

Adjusted EBITDA & Operating Income (Loss) in USD $

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

HALIFAX, Nova Scotia, Aug. 10, 2023 (GLOBE NEWSWIRE) -- NOVA LEAP HEALTH CORP. (TSXV: NLH) (“Nova Leap” or “the Company”), a growing home health care organization, is pleased to announce the release of financial results for the quarter ended June 30, 2023. All amounts are in United States dollars unless otherwise specified.

Nova Leap Q2 2023 Financial Results

Financial results for the second quarter ended June 30, 2023 include the following:

Q2 2023 revenues of $6,677,360 increased by 4.4% relative to Q1 2023 revenues of $6,396,076 and were lower than Q2 2022 revenues of $6,986,758 by 4.4%.

Nova Leap is reporting the highest quarterly Adjusted EBITDA in Company history.

Q2 2023 Adjusted EBITDA of $386,084 was 4.5X higher than Q1 2023 Adjusted EBITDA of $86,025 and 11.4X higher than Q2 2022 Adjusted EBITDA of $33,950 (see calculation of Adjusted EBITDA below).

Q2 2023 Adjusted EBITDA for the U.S operating segment of $597,893 was the highest in the Company’s history, an increase of 90% from Q1 2023 and 132% from Q2 2022.

Gross profit margin as a percentage of revenues increased 160 basis points to 36.8% in Q2 2023 from 35.2% in Q1 2023.

Head office and operations management expense decreased by $269,953 in Q2 2023 as compared to Q2 2022 and $106,494 as compared to Q1 2023 due to the elimination of targeted support functions in Head office late in Q2 2022 and the decisions undertaken by management since Q3 2022 to streamline US operations.

The Company generated income from operating activities in Q2 2023 of $116,662, an increase of $547,545 from Q2 2022 and $299,526 from Q1 2023.

The litigation previously initiated by Nova Leap in Q2 2022 was settled in Q2 2023, resulting in a total gain of $352,789. The settlement consisted of a cash payment of $95,000 received during the quarter, forgiveness of the remaining promissory notes plus accrued interest of $257,789 and the elimination of any future earnout payments.

In Q2 2023, a goodwill impairment of $350,567 was recorded in one of the Company’s U.S. agencies. The impairment is based on the loss of client service hours and the expected longer recovery time to return to previous revenue levels.

The Company recorded a net loss of $183,501 in Q2 2023 as compared to a net loss $282,742 in Q1 2023 and a net loss of $24,746 in Q2 2022.

The Company had available cash of $888,257 as of June 30, 2023 as well as full access to the unutilized revolving credit facility of $1,132,931 (CAD$1,500,000).

President & CEO’s Comments

“This was an excellent quarter for the Company.”, said Chris Dobbin, President & CEO of Nova Leap. “The changes we have implemented over the past year have led to an increase in quarterly revenue, an increase in quarterly gross margin, an increase in quarterly gross margin percentage, and record quarterly Adjusted EBITDA.

Much of our operational focus has been dedicated to the U.S. operating segment which had been greatly impacted during the pandemic. I am pleased to report that we have made major headway and that the U.S. operating segment has produced record quarterly Adjusted EBITDA in Q2. This achievement exceeds our previous pre-pandemic record and represents quarterly U.S. operating segment Adjusted EBITDA that is more than the two previous quarters combined. We believe in continuous improvement and we are focused on building upon these record results.

In addition to improved financial performance, our balance sheet and cash profile has strengthened. As referenced in my letter to shareholders on June 27, 2023, a significant portion of bank debt and promissory notes have been extinguished and we remain on track to have less than $300,000 of bank debt by the end of 2023.

In summary, the operational focus and prudent fiscal management that I have highlighted in my commentary the past three quarters has led to record results for Q2 and positions Nova Leap well for future growth opportunities.”

This news release should be read in conjunction with the Unaudited Condensed Interim Consolidated Financial Statements for the three and six months ended June 30, 2023 and 2022 including the notes to the financial statements and Management's Discussion and Analysis dated August 10, 2023, which have been filed on SEDAR.

About Nova Leap

Nova Leap is an acquisitive home health care services company operating in one of the fastest-growing industries in the U.S. & Canada. The Company performs a vital role within the continuum of care with an individual and family centered focus, particularly those requiring dementia care. Nova Leap achieved the #42 ranking on the 2021 Report on Business ranking of Canada’s Top Growing Companies, the #2 ranking on the 2020 Report on Business ranking of Canada’s Top Growing Companies and the #10 Ranking in the 2019 TSX Venture 50™ in the Clean Technology & Life Sciences sector. The Company is geographically diversified with operations in 10 different U.S. states within the New England, Southeastern, South Central and Midwest regions as well as in Nova Scotia, Canada.

NON-IFRS AND OTHER MEASURES:

This release contains references to certain measures that do not have a standardized meaning under IFRS as prescribed by the International Accounting Standards Board (“IASB”) and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement IFRS measures by providing a further understanding of operations from management’s perspective. Accordingly, non-IFRS financial measures should not be considered in isolation or as a substitute for analysis of financial information reported under IFRS. The Company presents non-IFRS financial measures, specifically Adjusted EBITDA (as such term is hereinafter defined), as well as supplementary financial measures such as annualized revenue. The Company believes these non-IFRS financial measures are frequently used by lenders, securities analysts, investors and other interested parties as a measure of financial performance, and it is therefore helpful to provide supplemental measures of operating performance and thus highlight trends that may not otherwise be apparent when relying solely on IFRS financial measures.

Adjusted Earnings before interest, taxes, amortization and depreciation (“Adjusted EBITDA”), is calculated as income from operating activities plus amortization and depreciation and stock-based compensation expense. The most directly comparable IFRS measure is income from operating activities.

Annualized revenue is calculated as actual revenue extrapolated from the beginning of the year or date of acquisition over 365 days.

The reconciliation of Adjusted EBITDA to the income from operating activities is as follows:

| Three months ended June 30 | Q1 | Six months ended June 30 | ||||

| 2023 | 2022 | 2023 | 2023 | 2022 | ||

| $ | $ | $ | $ | $ | ||

Income from operating activities | 116,662 | (430,883) | (182,864) | (66,202) | (629,712) | ||

Add back: |

|

|

|

|

| ||

Amortization and depreciation | 256,835 | 373,676 | 234,027 | 490,862 | 704,564 | ||

Stock-based compensation | 12,587 | 91,157 | 34,862 | 47,449 | 186,660 | ||

Adjusted EBITDA | 386,084 | 33,950 | 86,025 | 472,109 | 261,512 | ||

FORWARD LOOKING INFORMATION:

Certain information in this press release may contain forward-looking statements, such as statements regarding future expansions and cost savings and plans regarding future acquisitions and business growth, including anticipated annualized revenue or annualized recurring revenue run rate growth and anticipated consolidated Adjusted EBITDA margins. This information is based on current expectations and assumptions, including assumptions described elsewhere in this release and those concerning general economic and market conditions, availability of working capital necessary for conducting Nova Leap’s operations, availability of desirable acquisition targets and financing to fund such acquisitions, and Nova Leap’s ability to integrate its acquired businesses and maintain previously achieved service hour and revenue levels, that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Risks that could cause results to differ from those stated in the forward-looking statements in this release include the impact of the COVID-19 pandemic or any recurrence, including staff and supply shortages, regulatory changes affecting the home care industry or government programs utilized by the Company, other unexpected increases in operating costs and competition from other service providers. All forward-looking statements, including any financial outlook or future-oriented financial information, contained in this press release are made as of the date of this release and included for the purpose of providing information about management's current expectations and plans relating to the future, and these statements may not be appropriate for other purposes. The Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward-looking statements unless and until required by securities laws applicable to the Company. Additional information identifying risks and uncertainties is contained in the Company's filings with the Canadian securities regulators, which filings are available at www.sedar.com.

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d3b6b35-f992-4a6f-9bbd-ba709d9da225

https://www.globenewswire.com/NewsRoom/AttachmentNg/d1d033ad-5e6c-4860-a77c-5a0ad7158135

CONTACT: For further information: Chris Dobbin, CPA, CA, ICD.D Director, President and CEO T: 902 401 9480 E:cdobbin@novaleaphealth.com