Novanta Inc (NOVT) Posts Full Year 2023 Revenue Growth Amidst Market Challenges

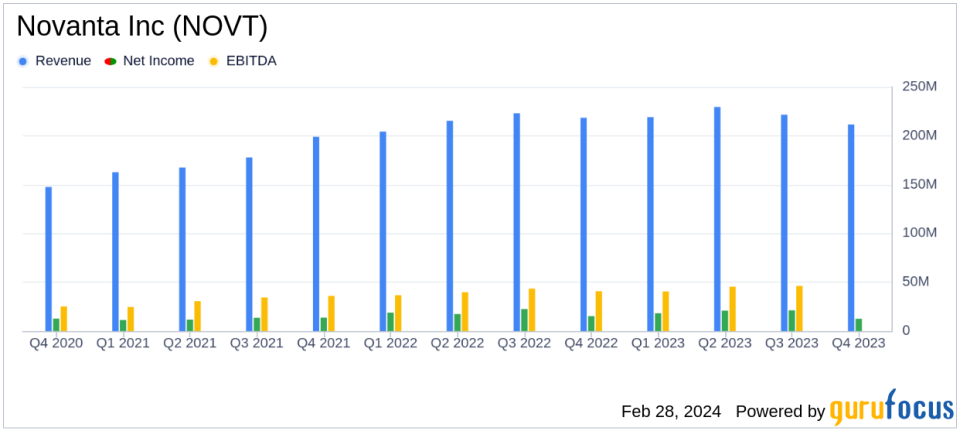

Revenue: Full Year 2023 GAAP Revenue increased to $882 million, up 2.4% from 2022.

Net Income: Full Year GAAP Net Income reported at $73 million, with a slight decrease from the previous year.

Earnings Per Share: GAAP Diluted EPS for 2023 stood at $2.02, with Adjusted EPS at $3.02.

Adjusted EBITDA: Reached $196 million for the full year, showing robust profitability.

Cash Flow: Operating cash flow for the full year 2023 was $120.1 million, a significant increase from 2022.

Debt and Cash: Ended the year with approximately $354.4 million in total debt and $105.1 million in total cash.

Guidance: For 2024, Novanta expects GAAP revenue of approximately $975 million to $1 billion and Adjusted EBITDA between $215 million to $225 million.

On February 28, 2024, Novanta Inc (NASDAQ:NOVT), a leading provider of core technology solutions for medical and advanced industrial equipment manufacturers, announced its financial results for the fourth quarter and full year 2023. The company released its 8-K filing, detailing a year of growth despite a challenging market environment.

Novanta operates through three segments: photonics, vision, and precision motion. The photonics segment offers products like carbon dioxide lasers and laser scanning, while the vision segment provides medical-grade technologies and contributes the majority of revenue. The precision motion segment delivers optical encoders and motion control technology. The company has a strong presence in the United States and Europe, which are its primary revenue-generating regions.

Performance and Challenges

For the fourth quarter of 2023, Novanta reported a slight decrease in GAAP revenue to $211.6 million, a 3.1% drop from the fourth quarter of 2022. The full year, however, saw an increase in GAAP revenue to $881.7 million, marking a 2.4% rise from the previous year. The company's acquisition activities contributed an increase in revenue of $8.1 million, or 0.9%, and changes in foreign currency exchange rates had a favorable impact of $1.3 million, or 0.2%, in 2023.

Despite the revenue growth, Novanta faced a decrease in GAAP net income, which was $72.9 million for the full year 2023, slightly down from $74.1 million in 2022. GAAP diluted EPS also saw a marginal decrease to $2.02 for the full year 2023, compared to $2.06 for 2022. Adjusted EBITDA, however, increased to $196.2 million for the full year 2023, up from $184.1 million for 2022, reflecting the company's ability to maintain profitability amidst market fluctuations.

Financial Achievements and Importance

Novanta's financial achievements in 2023, particularly the growth in revenue and adjusted EBITDA, underscore the company's resilience and strategic execution in a dynamic operating environment. The increase in operating cash flow to $120.1 million from $90.8 million in 2022 demonstrates strong cash generation capabilities, which is critical for ongoing investments and managing debt, which stood at a net amount of $253.0 million at the end of the year.

CEO Matthijs Glastra commented on the results, stating,

Novanta delivered for the full year a record $882 million in revenue, adjusted gross margin of 46.8%, and adjusted EBITDA of $196 million... our playbook will continue to deliver predictable, consistent, long-term growth and shareholder value."

Looking Ahead

Looking forward to 2024, Novanta is positioned to continue delivering innovative products and expects GAAP revenue of approximately $975 million to $1 billion. The company anticipates an adjusted gross profit margin of approximately 46.0% to 47.0% and adjusted EBITDA in the range of $215 million to $225 million. These projections reflect confidence in Novanta's market position and growth strategy.

For investors and potential GuruFocus.com members, Novanta's financial results indicate a company that is navigating market challenges effectively, with a clear strategy for growth and value creation. The company's focus on innovation and expansion in the medical and precision medicine space, as evidenced by its recent acquisition of Motion Solutions, positions it well for future success.

For more detailed financial information and analysis, readers are encouraged to visit GuruFocus.com and explore the comprehensive investment tools and resources available.

Explore the complete 8-K earnings release (here) from Novanta Inc for further details.

This article first appeared on GuruFocus.