Novavax (NVAX) Q2 Earnings Beat, Stock Down 4% on '23 Sales Cut

Novavax, Inc. NVAX reported second-quarter 2023 earnings of 58 cents per share, which beat the Zacks Consensus Estimate of a loss of $1.24. In the year-ago quarter, the company posted a loss of $6.53 per share.

Revenues in the quarter amounted to $424.4 million, topping the Zacks Consensus Estimate of $257.6 million. In the year-ago quarter, the company reported revenues of $185.9 million.

Quarter in Detail

Novavax is currently marketing different versions of its protein-based COVID-19 vaccine — one marketed in partnership with the Serum Institute of India (Serum) under the trade name Covovax and another version produced by Novavax that is marketed under the trade name Nuvaxovid. In the United States, the vaccine is marketed as Novavax COVID-19 Vaccine, Adjuvanted.

During the quarter, the company recorded product sales of $285.2 million of product sales, which were significantly higher than the product sales of $55.5 million in the year-ago quarter. In a recent interview with CNBC, Novavax’s chief executive officer (CEO) John Jacobs stated that some expected third-quarter sales from prior COVID vaccine purchase agreements might have been recognized in the second quarter.

The reported product sales beat the Zacks Consensus Estimate and our model estimates of $167 million and $143 million, respectively.

Grant revenues rose 27% year over year to $137.1 million for the same period.

Novavax recorded $2.2 million of revenues from royalties and adjuvant sales to licensing partners, a substantial decline from the year-ago quarter’s revenue of $22.7 million.

In the reported quarter, research and development (R&D) expenses were $219 million, down 24% year over year. The downside was primarily caused by reduced clinical and manufacturing spending during the quarter.

Selling, general and administrative (SG&A) expenses were down 13% year over year to $94 million. The downside can be attributed to the company’s spending reduction following the cost reduction plan initiated during the second quarter.

As of Jun 30, 2023, Novavax had $518 million of cash and cash equivalents compared with $637 million as of Mar 31, 2023.

2023 Guidance

Management revised its sales guidance for the full year 2023.

Novavax lowered its total revenues forecast to $1.3-$1.5 billion, down from the previously issued guidance of $1.4-$1.6 billion. This guidance includes product sales, which are now expected to be between $0.96-$1.14 billion, a $100 million cut from the previously issued guidance of $1.06-$1.24 billion. Grant revenues are forecasted in the range of $340-$360 million (maintained). The Zacks Consensus Estimate for full-year 2023 revenues stood at $1.44 billion.

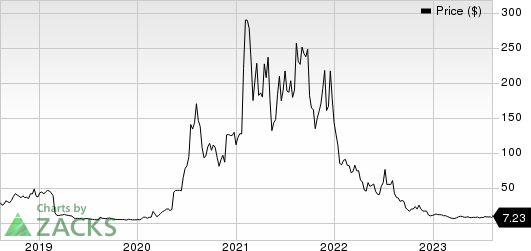

Noavavax’s shares lost 3.9% on Aug 8 likely due to the lowering of the revenue guidance. In the year so far, Novavax’s stock has declined 29.7% compared with the industry’s 13.1% fall.

Image Source: Zacks Investment Research

Management guidance for combined R&D and SG&A expenses remained unchanged at $1.3-$1.4 billion.

During the Q2 earnings call, Novavax’s chief financial officer (CFO) James Kelly stated that if the 2023 guidance is successfully achieved, it expects the current cash balance and expected cash flow to fund its business operations for the next 12 months.

In the interview with CNBC, CEO Jacobs also noted that Novavax expects to generate minimal product sales in third-quarter 2023. Management expects to record product sales during the fourth quarter, provided the FDA authorizes/approves its updated COVID vaccine.

Deal With SK bioscience

Alongside its second-quarter results, Novavax also announced that it has signed a new strategic partnership agreement with SK bioscience, one of the contract-based manufacturers of the company’s COVID vaccines.

By entering into this agreement, Novavax settled $195 million in manufacturing liabilities with SK bioscience. In return, the former will issue 6.5 million of its common stock to the latter along with a net cash payment of $65 million. Management has also extended the exclusive commercial rights granted to SK bioscience for its COVID-19 vaccine in South Korea till February 2029.

Recent Updates

Management is focused on delivering an updated COVID-19 vaccine, targeting the XBB subvariant, for the upcoming 2023 fall vaccination season, which is consistent with public health recommendations. Alongside its Q2 results, Novavax announced that it has initiated a filing for the updated vaccine with the FDA, with similar applications expected to be filed in Europe and Canada in the coming weeks.

In May, Novavax reported positive top-line results from a phase II study of its investigational COVID-19-influenza combination (CIC) vaccine. Based on this data, Novavax has decided to make strategic stage gate investments in 2023 and 2024 to advance the CIC vaccine to late-stage development. It intends to enter into strategic collaborations and/or available financing alternatives to finance the late-stage development of the CIC candidate.

Last month, Novavax announced that it had received full authorization for Nuvaxovid in the European Union as a primary series in individuals aged 12 years and older and as a booster in adults aged 18 years and older. Management has recently initiated a rolling biologics license application (BLA) with the FDA seeking full approval for using its COVID-19 vaccine in individuals aged 12 years and older.

Novavax, Inc. Price

Novavax, Inc. price | Novavax, Inc. Quote

Zacks Rank and Stocks to Consider

Currently, Novavax has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Caribou Biosciences CRBU, Johnson & Johnson JNJ and Novo Nordisk NVO, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Caribou Biosciences’ loss estimates for 2023 have narrowed from $1.88 to $1.63 per share in the past 30 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.47 to $1.72. Year to date, Caribou Biosciences’ stock has risen 4.1%.

Caribou Biosciences beat earnings estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a negative earnings surprise of 1.36%. In the last reported quarter, CRBU delivered an earnings surprise of 4.17%.

In the past 30 days, estimates for J&J’s 2023 earnings per share have increased from $10.66 to $10.74. During the same period, the earnings estimates per share for 2024 have risen from $11.01 to $11.29. Shares of J&J are down 2.0% in the year-to-date period.

Earnings of J&J beat estimates in each of the last four quarters, witnessing an average earnings surprise of 5.58%. In the last reported quarter, J&J’s earnings beat estimates by 7.28%.

In the past 30 days, the estimates for Novo Nordisk’s 2023 and 2024 EPS have increased from $5.07 to $5.27 and $5.95 to $6.10, respectively. Shares of Novo Nordisk are up 39.8% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in two of the last four quarters, met the mark on one occasion and missed the mark on another. On average, the company witnessed an average earnings surprise of 0.35%. In the last reported quarter, Novo Nordisk’s earnings met our estimates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Novavax, Inc. (NVAX) : Free Stock Analysis Report

Caribou Biosciences, Inc. (CRBU) : Free Stock Analysis Report