November Top Growth Companies

Individual investors like stocks with a high growth potential. These companies have a strong outlook that can bring a significant upside to your portfolio, regardless of market cyclicality. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

Wix.com Ltd. (NASDAQ:WIX)

Wix.com Ltd. develops and markets an Internet service that allows users to create Web content in Latin America, Europe, North America, Asia, and internationally. Established in 2006, and now led by CEO Avishai Abrahami, the company currently employs 1,266 people and with the stock’s market cap sitting at USD $2.73B, it comes under the mid-cap stocks category.

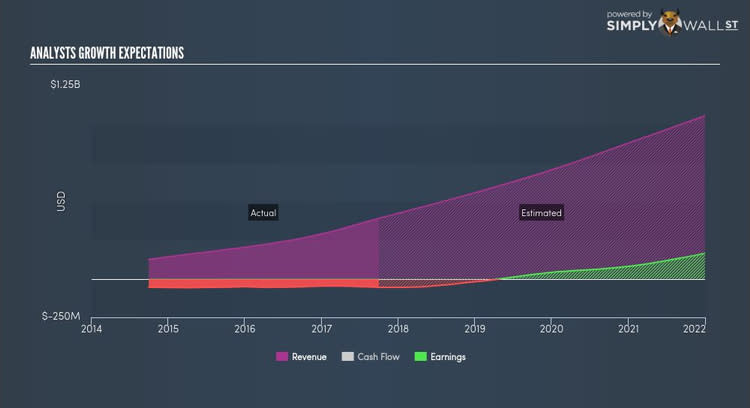

WIX’s forecasted bottom line growth is an optimistic double-digit 48.04%, driven by the underlying 70.42% sales growth over the next few years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 193.93%. WIX’s impressive outlook on all aspects makes it a worthy company to spend more time to understand.

Considering WIX as a potential investment? Take a look at its other fundamentals here.

Hudson Technologies Inc. (NASDAQ:HDSN)

Hudson Technologies Inc. operates as a refrigerant services company in the United States and internationally. Founded in 1991, and currently run by Kevin Zugibe, the company size now stands at 137 people and has a market cap of USD $244.00M, putting it in the small-cap category.

Thinking of investing in HDSN? Check out its fundamental factors here.

Amicus Therapeutics, Inc. (NASDAQ:FOLD)

Amicus Therapeutics, Inc., a biotechnology company, engages in the discovery, development, and commercialization of medicines for various rare and orphan diseases. Formed in 2002, and now run by John Crowley, the company currently employs 263 people and with the stock’s market cap sitting at USD $2.18B, it comes under the mid-cap group.

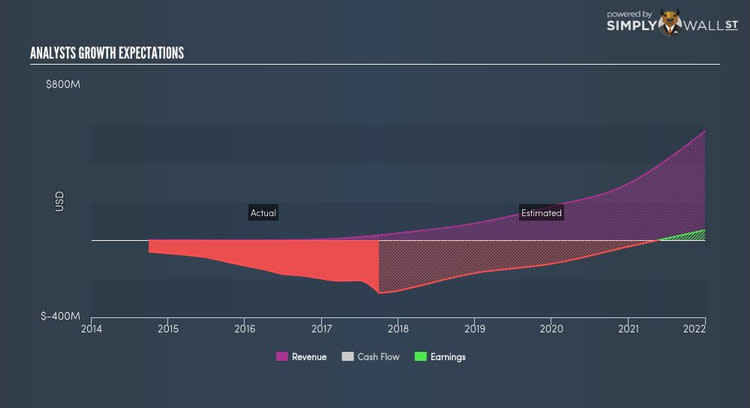

FOLD’s forecasted bottom line growth is an exceptional 50.68%, driven by underlying sales, which is expected to more than double, over the next few years. It appears that FOLD’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. Furthermore, the 28.62% growth in operating cash flows indicates that a good portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. FOLD ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Should you add FOLD to your portfolio? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.