NOVN: KINSOLUS: A Solution for Molluscum

NASDAQ:NOVN

READ THE FULL NOVN RESEARCH REPORT

Third Quarter 2021 Results

On November 10, 2021, Novan Inc. (NASDAQ:NOVN) reported third quarter financial results in a press release concurrent with the filing of Form 10-Q. A conference call and webcast was also held to update investors on financial and operational results. Most recently, the FDA conditionally accepted the proposed brand name for SB206: KINSOLUSTM.

Highlights for the third quarter ending September 30, 2021 and to-date include:

➢ Last patient, last visit (24-week) - B-SIMPLE4 - July 2021

➢ Tomoko Maeda-Chubachi, MD, PhD, MBA appointed Chief Medical Officer - August 2021

➢ Novan engages Syneos Health as commercialization solutions provider - September 2021

➢ Update on SB206 and announcement of intent to advance SB204 and SB019 - September 2021

➢ Safety data from B-SIMPLE4 - September 2021

➢ Brian M. Johnson appointed Chief Commercial Officer - November 2021

➢ FDA conditional acceptance of proposed brand name KINSOLUS for SB206 - November 2021

➢ Favorable preclinical safety data for SB019 in COVID-19 - November 2021

With respect to financial performance, Novan generated $0.7 million in revenue in 3Q:21, comprising license and collaboration and government research contracts and grants revenues, versus $1.3 million in the same quarter last year, and posted a net loss of ($6.5) million or ($0.34) per share compared to a loss of ($8.4) million or ($0.63) per share for the prior year period.

For the third quarter ending September 30, 2021 and versus the prior year third quarter:

➢ Revenues were $0.7 million, down 44% from $1.3 million. Amounts are related to recognition of the upfront and expected milestone payments under the Sato Agreement and grants revenue from government research contracts related to Department of Defense projects;

➢ Research & development expenses totaled $4.3 million, down 12% from $4.8 million related to a $1.1 million net decrease in SB206 spending partially offset by a $0.5 million increase in other research and development expenses;

➢ General & administrative expenses were $3.0 million, down 4% from $3.1 million on lower non-cash commitment share expense partially offset by higher directors and officers insurance, greater personnel costs and an increase in SB206 commercialization preparation costs;

➢ Net loss was ($6.5) million, or ($0.34) per basic and diluted share, compared to ($8.4) million, or ($0.63) per basic and diluted share.

As of September 30, 2021, cash and equivalents on the balance sheet totaled $60.0 million, compared to $35.9 million at the end of 2020, supported by net financing cash flows of $44 million. In June 2021, Novan raised net proceeds of $37.2 million as part of an underwriting agreement with Cantor Fitzgerald. 3,636,364 shares of common stock were issued at $11.00 per share. Cash burn for the first nine months of 2021 totaled approximately ($19.5) million versus approximately ($22.0) million in the prior year period.

Capital expenditures year to date have been ($4.5) million in part offset by landlord reimbursements of $1.0 million. The facility project includes both the corporate offices for Novan and a small scale research and development facility that can support API manufacturing, clinical trial material manufacture and limited drug product manufacturing. We expect the construction to be complete around the turn of the year; however, some cash costs will continue into 2022.

B-SIMPLE4 Safety Data

In follow up to the June release of topline results for B-SIMPLE4 and an update on September 9th, Novan reported safety data from its pivotal B-SIMPLE4 trial on September 23rd. The results were in line with previous results indicating that SB206 was well tolerated. Treatment emergent adverse events (TEAEs) through Week-24 maintained the same favorable profile as those in SB206’s previous Phase III studies, B-SIMPLE1 and B-SIMPLE2 (see here). The TEAEs reported in greater than 5% of subjects in the SB206 treated groups included pain, erythema, pruritus, exfoliation, and dermatitis at the application site. The majority of these TEAEs were of mild or moderate severity. There were no serious adverse events.

In the SB206 arm, there were 191 (43.0%) subjects with at least one TEAE, of which 163 (36.7%) experienced at least one TEAE that was deemed treatment-related. This compared to 103 (23.0%) and 54 (12.1%) subjects in the vehicle arm, respectively. Some TEAEs led to study drug discontinuation, 18 (4.1%) subjects in the SB206 arm and 3 (0.7%) in the vehicle. Study drug discontinuation in the treatment arm were all due to application site reactions.

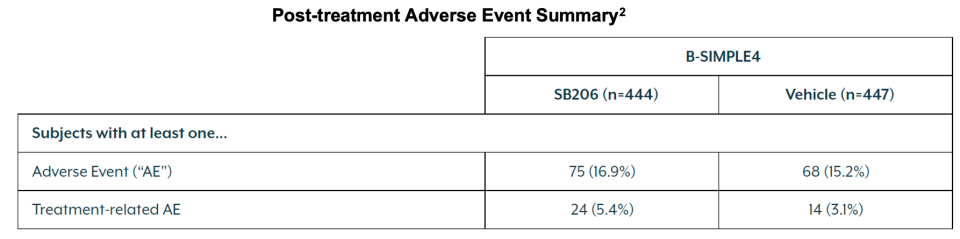

75 (16.9%) and 24 (5.4%) subjects experienced at least one adverse event and treatment-related adverse event, respectively, post treatment in SB206 administered patients. This compared to 68 (15.2%) and 14 (3.1%) subjects in vehicle arm post-treatment.

The incidence of scarring in the SB206 arm was lower than in the vehicle group at 4.7% and 6.3%, respectively. In the Week-24 visit, subjects treated with SB206 also exhibited lower occurrence of scarring compared to vehicle at 2.7% vs 4.0%, respectively. Though a subtle effect and less pronounced than what was observed in the B-SIMPLE1 and 2 safety assessment, the potential added benefit of reduced scarring can be a motivator and of benefit to patients to undergo treatment. Equipped with strong statistically significant endpoints and favorable safety profile, Novan plans to share the data with the FDA in a pre-NDA meeting targeted for 1H:22.

Kinsolus Regulatory Submission and Commercialization

Novan’s lead program is expected to produce an NDA submission by 3Q:22. There is an unmet medical need for an at-home, topical solution to treat molluscum contagiosum. Prevalence is estimated at approximately 5-11% of the US population under the age of 16. Novan estimates the addressable market at 6 million individuals, believes payors will reimburse SB206 and the product will appear on formularies for this in-home solution.

Near term milestones related to Novan’s portfolio include:

➢ SB206 Week 24 readout - September 2021

➢ Launch pre commercial activities for SB206 (Kinsolus) – 3Q:21

➢ Kinsolus Pre-NDA meeting with the FDA - 1H:22

➢ Kinsolus NDA-enabling stability testing - 1H:22

➢ Kinsolus NDA submission - 3Q:22

➢ SB019 Phase I – 1H:22

➢ SB204 pivotal Phase III study - 2023

➢ SB204 NDA submission – 2024

➢ SB019 NDA submission - 2024

➢ SB206 approval in Japan (Sato) - 2027

Commercialization with Syneos Health

On September 8, 2021, Novan announced that it had selected Syneos Health (NASDAQ: SYNH) as a commercial solutions provider for SB206. The strategic partnership will focus on implementing SB206 prelaunch strategy and commercial preparation, followed by commercialization and sales pending FDA approval. Novan and Syneos began work together in 2019 to assess the molluscum market. Since then, the relationship has grown and Syneos has assembled a leadership team and incorporated full-service commercialization solutions to support Novan’s program. In addition, company leadership emphasized Syneos’ abilities as a proven end-to-end commercial solution provider with successful commercial launches. Syneos provides immediate access to commercial infrastructure and commercial execution strategically guided by a small group of internal experts. Novan’s new partner will develop a holistic, three-phase approach to marketing SB206 that is expected to build awareness and drive sales.

Favorable Preclinical Safety Data for SB019

On November 9, 2021, Novan announced promising preclinical safety results with its COVID-19 candidate, SB019, in a 14-day, in vivo, Good Laboratory Practice (GLP) repeat dose intranasal toxicity study. Dosing was five times per day and after the 14-day dosing period, a 7-day recovery period, without drug exposure, followed. There were no treatment-related adverse events up to the highest dose tested, 14 mg/day. The results support Novan’s further pursuit of the candidate in human trials. The data showed that intranasal administration of SB019 was well tolerated and safe. Novan is currently preparing for an IND with submission expected no later than 2Q:22, and is targeting a Phase I study, pending additional financing or strategic partnership. Novan has made the FDA aware of its SB019 program through engagement with the FDA’s Coronavirus Treatment Acceleration Program (CTAP).

In the same release, Novan informed that it had completed additional dose-range finding studies in SARS-CoV-2 infected golden Syrian hamsters through work conducted at the Institute for Antiviral Research at Utah State University. Significant reduction in the amount of virus in lung or nasal tissue of SARS-CoV-2 infected animals was observed and was found to be dependent on both concentration and dosing regimen (e.g., once daily vs. twice daily).

Appointments

Tomoko Maeda-Chubachi, MD, PhD, MBA Appointed CMO

On August 24, 2021, Novan announced that Dr. Tomoko Maeda-Chubachi had been promoted from Senior Vice President, Medical, to Chief Medical Officer. Dr. Maeda-Chubachi was instrumental in the execution of B-SIMPLE4. Dr. Maeda-Chubachi joined Novan as VP, Medical Dermatology in September of 2017 and was promoted to SVP, Medical in March of 2021. Prior to joining, Dr. Maeda-Chubachi served as Senior Medical Director at Glaxo Smith Kline (GSK), leading clinical development projects for psoriasis, atopic dermatitis, pemphigus, and androgenic alopecia. Prior to GSK, she held clinical and medical affairs roles at Eli Lilly and Pfizer. Before then, Dr. Maeda-Chubachi was an academic physician and dermatologist for ten years before making the switch into industry. She received her MD and PhD from Osaka University.

Brian M. Johnson Appointed Chief Commercial Officer

On November 2nd, Novan announced that Brian M. Johnson had been appointed its Chief Commercial Officer, featuring intimate knowledge of Novan and expertise in dermatology to support SB206’s pre-launch and commercialization efforts. Johnson brings more than three decades of commercialization experience for products in multiple therapeutic areas. His successful track record includes Ortho Pharmaceutical Corporation, Medicis, and Galderma. Most recently, he served as Principal at Two Hearts Group, a pharma and life science consulting firm where he acted as UCB’s Head, Digital Marketing, Psoriasis in the Global Mission for bimekizumab. During his time at Galderma, he served as Vice President of Prescription Marketing and Chief Digital Officer, where he and his team successfully launched seven products and quadrupled sales from $275 million to over $1 billion, namely with Epiduo®, Clobex® and Oracea® products. In the past he also served as President, Revian, Inc and Director, Peer to Peer Marketing at Novartis. Johnson had served before as Chief Commercial Officer of Novan from 2015 to 2018 where he led pre-commercialization activities including assessment of molluscum and acne markets. Johnson holds an MBA from Southern Methodist University and a BS in business administration from the University of Kansas. He is a member of American Acne and Rosacea Society, Masters of Dermatologic Society, Women’s Dermatology Society and the American Academy of Dermatology.

Valuation

We adjust our discounted cash flow model to reflect the July 2021 change by Sato in its estimated development plan and updated expenditures related to development and commercialization. Previously, Sato had estimated that it would complete its SB206 and SB204 programs in 2026; however, SB206 is now expected to be complete in 2027. We anticipate that Sato will begin Phase I work for SB206 in 2022. We also update our R&D estimates for 2022 to reflect increased spend for regulatory activities for SB206 and clinical trial preparatory expenditures for SB204. Novan is also expected to ramp up its selling function in 2022 and we further consider increased selling costs in 2022. The net of these changes to our model reflecting a delay to Sato’s development plan and increased near term spending reduces our valuation from $72 to $70.

Summary

Novan’s third quarter 2021 saw the reporting of B-SIMPLE4’s safety data, the appointment of Tomoko Maeda-Chubachi as its Chief Medical Officer, and the engagement of Syneos Health as a commercialization solutions provider. Brian Johnson returned to Novan and holds the position of Chief Commercial Officer. The FDA also conditionally accepted SB206’ brand name: KINSOLUS. With this candidate targeting commercialization, Novan also informed investors that candidates SB204, in acne vulgaris, and SB019, in COVID-19, would now progress towards an NDA. Equipped with B-SIMPLE4 safety data and strongly statistically significant primary endpoints, Novan is now preparing for its pre-NDA meeting with the FDA regarding KINSOLUS, expected in 1H:22 and for NDA submission in 2H:22.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

1. Novan Reports Safety Data from B-SIMPLE4 Pivotal Phase 3 Study of SB206 - Novan, Inc. (gcs-web.com)

2. Novan Reports Safety Data from B-SIMPLE4 Pivotal Phase 3 Study of SB206 - Novan, Inc. (gcs-web.com)

3. Novan Corporate Presentation, Third Quarter Update 2021

4. Novan Corporate Presentation, Third Quarter Update 2021

5. Novan Corporate Presentation September 2021

6. Novan Corporate Presentation September 2021