Novo Integrated Sciences'(NASDAQ:NVOS) Share Price Is Down 69% Over The Past Three Years.

Novo Integrated Sciences, Inc. (NASDAQ:NVOS) shareholders should be happy to see the share price up 13% in the last quarter. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 69% in that period. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for Novo Integrated Sciences

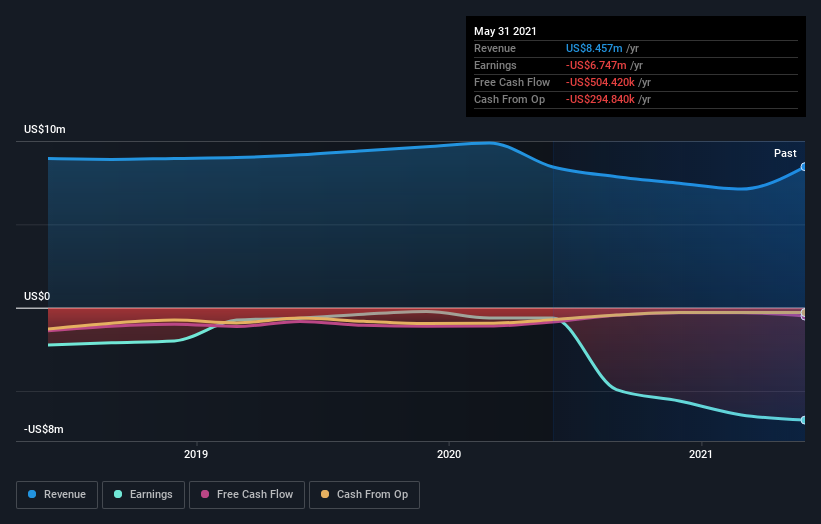

Given that Novo Integrated Sciences didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Novo Integrated Sciences' revenue dropped 5.6% per year. That is not a good result. The share price decline of 19% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Over the last year, Novo Integrated Sciences shareholders took a loss of 25%. In contrast the market gained about 40%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 19% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Novo Integrated Sciences is showing 4 warning signs in our investment analysis , and 1 of those is potentially serious...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.