Novo Nordisk (NVO) Posts Upbeat Once-Weekly Insulin Icodec Data

Novo Nordisk A/S NVO announced new data from its phase IIIa ONWARDS 1 and 3 studies, currently evaluating the company’s once-weekly variant of basal insulin icodec.

The ONWARDS 1 study is evaluating the efficacy and safety of investigating once-weekly basal insulin icodec against once-daily basal insulin glargine U100, both in combination with non-insulin anti-diabetic treatment, in insulin-naïve adults with type II diabetes. On the other hand, the ONWARDS 3 study is evaluating the same candidate against insulin degludec, both in combination with non-insulin anti-diabetic treatment.

The primary endpoints of both the late-stage studies were the change in HbA1C from the baseline against the change observed in patients treated with the comparison therapies at week 52 and week 26, respectively. Common secondary endpoints of both the studies include a change in fasting plasma glucose from baseline at week 52 and 26, respectively, along with the number of clinically significant or severe hypoglycemia episodes. The ONWARDS 1 study has an additional confirmatory secondary endpoint of time in the target blood glucose range (70–180 mg/dL).

Novo Nordisk’s ONWARDS 1 study is a 78-week study of icodec. The 52-week main phase of the study was followed by a 26-week extension phase. The extended study aimed to further assess the safety of basal insulin icodec, which now stands confirmed.

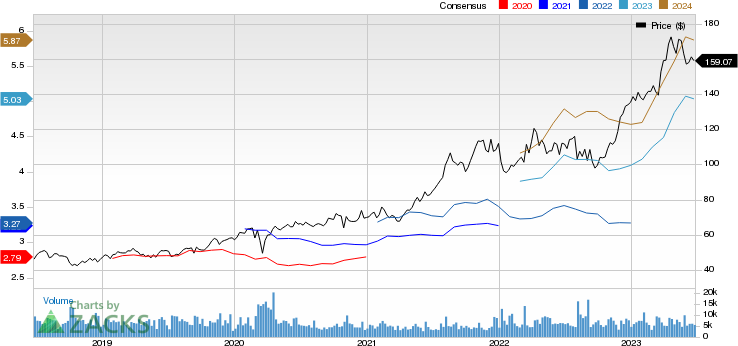

Year to date, shares of Novo Nordisk have gained 17.5% compared with the industry’s 1.9% rise.

Image Source: Zacks Investment Research

Per the data readout, both studies met their primary endpoints with statistical significance, simultaneously reducing injections from seven to one per week compared with once-daily basal insulin. It was also observed that in the ONWARDS 1 and 3 studies, a greater number of patients among the total population achieved the HbA1c target of <7.0% with the once-weekly basal insulin icodec. The portion of the patient population who achieved the HbA1c target did so without experiencing clinically significant or severe hypoglycemia compared with once-daily basal insulin comparators at 52 and 26 weeks.

Novo Nordisk also reported that the ONWARDS 1 study met its confirmatory secondary endpoint, observing a superior time in the glucose range,from week 48-52, as compared with the once-daily basal insulin glargine U100, while the Time Below Range metric remained comparable, during the same period. Notably, both values are in line with internationally recommended targets.

However, differences in mean weekly insulin dose (week 50-52 and week 24-26) and body weight change from baseline metrics did not meet statistical significance in both studies. Adverse safety concerns with respect to hypoglycemia episodes were low in both the ONWARDS 1 and 3 studies.

Novo Nordisk has already submitted applications to respective regulatory bodies, seeking approval for insulin icodec in several countries, namely, the United States, Canada, Europe, China, Australia, Switzerland and Brazil. The company anticipates first decisions in the first half of 2024.

Insulin icodec, if approved, will become the first and only once-weekly basal insulin option for adults with diabetes, thereby satisfying an unmet medical need in the current standard-of-care daily basal insulin treatments.

Novo Nordisk A/S Price and Consensus

Novo Nordisk A/S price-consensus-chart | Novo Nordisk A/S Quote

Zacks Rank and Stocks to Consider

Novo Nordisk currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall medical sector are Novartis NVS, Adaptimmune Therapeutics ADAP and Akero Therapeutics AKRO, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for Novartis’ 2023 earnings per share has increased from $6.55 to $6.74. During the same period, the estimate for Novartis’ 2024 earnings has increased from $7.04 to $7.28. Year to date, shares of Novartis have gained by 11%.

NVS beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 5.15%.

In the past 90 days, the Zacks Consensus Estimate for Adaptimmune Therapeutics’ 2023 loss per share has narrowed from 63 cents to 46 cents. During the same period, the estimate for Adaptimmune Therapeutics’ 2024 loss per share has narrowed from 59 cents to 56 cents. Year to date, shares of ADAP have fallen by 34.9%.

ADAP beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 36.89%.

In the past 90 days, the Zacks Consensus Estimate for Akero Therapeutics’ 2023 loss per share has narrowed from $2.96 to $2.80. During the same period, the estimate for Akero Therapeutics’ 2024 loss per share has narrowed from $3.40 to $3.27. Year to date, shares of AKRO have lost 7.3%.

AKRO beat estimates in three of the trailing four quarters, missing the mark on one occasion, delivering an average earnings surprise of 7.96%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Adaptimmune Therapeutics PLC (ADAP) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report