Novo Nordisk's (NVO) Wegovy Gets FDA Nod to Reduce Heart Risk

Novo Nordisk NVO announced that the FDA has approved its supplemental new drug application (sNDA) seeking label expansion for Wegovy (semaglutide 2.4 mg) to reduce the risks of major adverse cardiovascular events (MACE), including cardiovascular death, non-fatal heart attack or stroke in adults with either overweight or obesity and established cardiovascular disease.

Wegovy, a GLP-1 agonist, is Novo Nordisk’s blockbuster chronic weight management injection approved for adults with obesity or overweight. The drug received FDA approval in 2021 and has been witnessing solid uptake ever since, driven by increasing demand worldwide. In 2023, Wegovy generated sales worth DKK 31.3 billion, representing year-over-year growth of 407% on a reported basis and 420% at a constant exchange rate.

The approval of the Wegovy for the cardiovascular indication was based on positive results from the company’s SELECT cardiovascular outcomes study which showed that treatment with the drug, in adjunction to standard-of-care therapy, reduced the risk of MACE by 20% compared with placebo, with statistical significance.

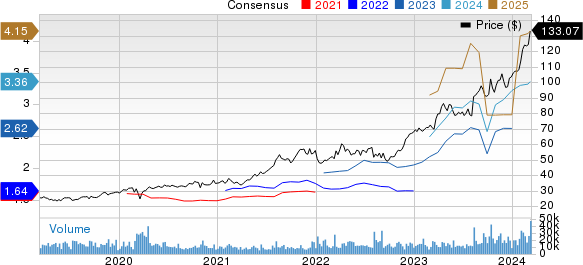

In the past year, shares of Novo Nordisk have rallied 89.4% compared with the industry’s 34% growth.

Image Source: Zacks Investment Research

Furthermore, in the SELECT study, it was also observed that risk reductions achieved in MACE upon treatment with Wegovy were not affected by baseline age, sex, race, ethnicity, body mass index and level of renal function impairment for up to five years,

Data from the SELECT study showed a risk reduction in cardiovascular death by 15% and a risk reduction of death from any cause by 19%, both compared with placebo. Per Novo Nordisk, other additional clinical data from the SELECT outcomes study has also been added to the drug’s label.

Notably, the label expansion of Wegovy for the MACE indication now reaffirms that it is not just a cosmetic drug used to improve one’s appearance. Hence, the sNDA approval is expected to improve insurance coverage for Wegovy, which could make it more accessible and affordable to patients.

A regulatory filing seeking label expansion for Wegovy for the MACE indication is also currently under review in the EU. A decision from the regulatory body in the EU is expected in 2024.

Novo Nordisk’s Wegovy currently competes with Eli Lilly’s LLY Mounjaro/Zepbound in the diabetes and obesity care market.

Eli Lilly received FDA approval for tirzepatide under the brand name Mounjaro, a dual GIP and GLP-1 receptor agonist, in 2022 to treat adults with type II diabetes. In November 2023, LLY received FDA approval for the same tirzepatide formulation, under the brand name Zepbound, for chronic weight management in adults with obesity or overweight.

Neither Mounjaro nor Zepbound has yet been approved for cardiovascular indications, which gives Novo Nordisk a significant edge over Lilly in the diabetes/obesity care market.

Novo Nordisk A/S Price and Consensus

Novo Nordisk A/S price-consensus-chart | Novo Nordisk A/S Quote

Zacks Rank and Stocks to Consider

Novo Nordisk currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry worth mentioning are FibroGen FGEN and Adicet Bio, Inc. ACET, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for FibroGen’s 2024 loss per share has narrowed from $1.14 to $1.09. During the same period, the estimate for FibroGen’s 2025 loss per share is pegged at 6 cents. Over the past year, shares of FGEN have plunged 91%.

FGEN beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 2.26%.

In the past 30 days, the Zacks Consensus Estimate for Adicet Bio’s 2023 loss per share has remained constant at $3.39. During the same period, the consensus estimate for Adicet’s 2024 loss per share has widened from $1.80 to $1.81. In the past year, shares of ACET have plunged 68.6%.

ACET beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 8.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Adicet Bio, Inc. (ACET) : Free Stock Analysis Report

FibroGen, Inc (FGEN) : Free Stock Analysis Report