NovoCure Ltd (NVCR) Reports Mixed Financial Results for Q4 and Full Year 2023

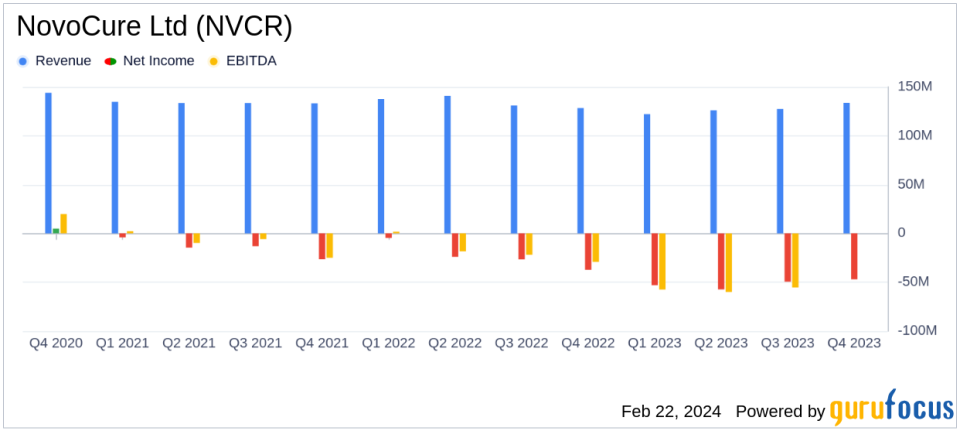

Net Revenues: Full year net revenues decreased by 5% to $509.3 million, while Q4 saw a 4% increase to $133.8 million.

Gross Margin: Gross margin for Q4 stood at 76%, with investments in patient support and new arrays impacting margins.

Operating Expenses: Research and development expenses slightly decreased by 1%, while sales and marketing expenses rose by 19% in Q4.

Net Loss: Q4 net loss widened to $47.1 million, with a loss per share of $0.45.

Adjusted EBITDA: Q4 Adjusted EBITDA was negative at $(31.6) million.

Liquidity Position: Cash, cash equivalents, and short-term investments totaled $910.6 million as of December 31, 2023.

Active Patients: A 9% year-over-year growth in active patients, totaling 3,755 as of December 31, 2023.

On February 22, 2024, NovoCure Ltd (NASDAQ:NVCR) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, a key player in the healthcare sector of the United States, specializes in the development, manufacture, and commercialization of Tumor Treating Fields (TTFields) devices for the treatment of solid tumor cancers.

Financial Performance and Challenges

NovoCure's financial performance in 2023 was a mixed bag, with a full-year net revenue decline of 5% to $509.3 million, primarily due to reduced collections from denied or appealed claims in the U.S. However, the company experienced a 4% increase in net revenues for the fourth quarter, amounting to $133.8 million. The U.S., Germany, and Japan were significant contributors to the quarterly net revenues. The company's gross margin for the quarter was affected by increased investments in patient support and the rollout of next-generation arrays, although it remains optimistic about future efficiencies and scale within its supply chain.

Operating expenses showed a mixed trend, with research, development, and clinical studies expenses slightly decreasing by 1%, while sales and marketing expenses increased by 19% due to geographic expansion and pre-launch activities. General and administrative expenses also saw a modest increase of 4%. The net loss for the quarter widened to $47.1 million, translating to a loss per share of $0.45. Adjusted EBITDA for the quarter was negative at $(31.6) million, reflecting the financial challenges faced by the company.

Operational Highlights and Future Outlook

Operationally, NovoCure saw a 14% increase in prescriptions received during the quarter, with a 9% year-over-year growth in active patients, indicating a solid demand for its TTFields therapy. The company also made significant strides in its clinical and product development programs, including the submission of a Premarket Approval (PMA) application for TTFields in non-small cell lung cancer (NSCLC) and the completion of enrollment in the phase 3 TRIDENT trial. These milestones, along with the anticipated clinical data from ongoing trials, are expected to be pivotal for NovoCure's future growth and success.

NovoCure's liquidity position remains strong, with cash, cash equivalents, and short-term investments totaling $910.6 million. This financial stability is crucial as the company focuses on growing its glioblastoma multiforme (GBM) business, launching TTFields therapy in NSCLC, and delivering on its clinical trial and product development pipelines.

"2024 will be a pivotal year for NovoCure," said William Doyle, NovoCures Executive Chairman. "We are laser-focused on achieving three core objectives growing our GBM business, launching TTFields therapy in non-small cell lung cancer, and delivering the promise of our clinical trial and product development pipelines. Achieving our goals should position NovoCure for sustained success for years to come."

For value investors and potential GuruFocus.com members, NovoCure's commitment to innovation in cancer treatment and its robust pipeline of clinical trials present a company with potential for long-term growth, despite the short-term challenges reflected in the latest earnings report.

Explore the complete 8-K earnings release (here) from NovoCure Ltd for further details.

This article first appeared on GuruFocus.