NovoCure (NVCR): A Smart Investment or a Value Trap? An In-Depth Exploration

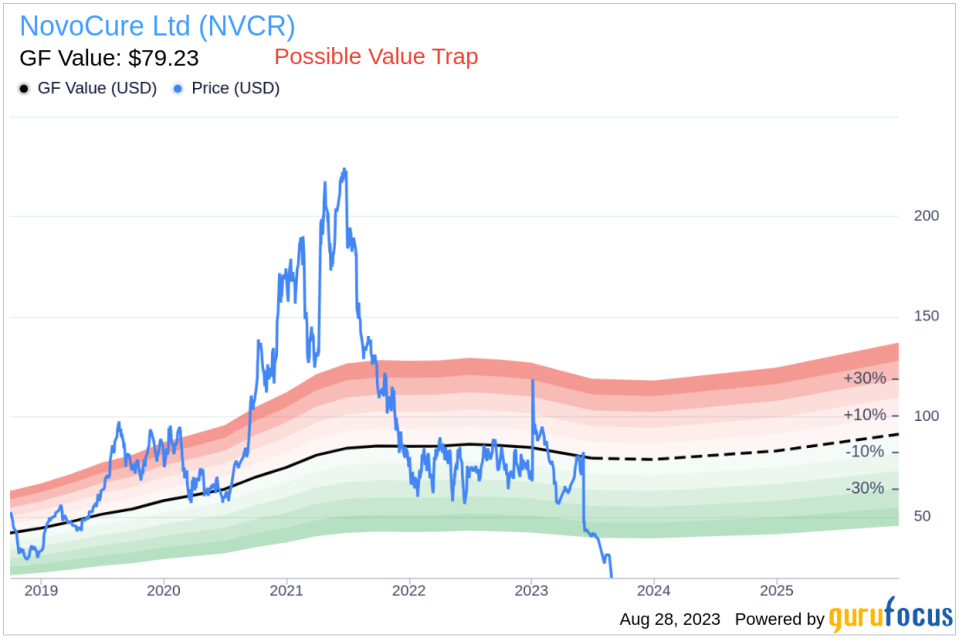

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is NovoCure Ltd (NASDAQ:NVCR). The stock, which is currently priced at 20.45, recorded a loss of 31.31% in a day, and a 3-month decrease of 72.65%. The stock's fair valuation is $79.23, as indicated by its GF Value.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors: historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

Delving Deeper

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with NovoCure should not be ignored. These risks are primarily reflected through its low Piotroski F-score of 2, which suggests that NovoCure, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

What is the Piotroski F-score?

The Piotroski F-score, created by accounting professor Joseph Piotroski, is a tool used to assess the strength of a company's financial health. The score is based on nine criteria that fall into three categories: profitability, leverage/liquidity/ source of funds, and operating efficiency. The overall score ranges from 0 to 9, with higher scores indicating healthier financials. NovoCure's current Piotroski F-Score, however, falls in the lower end of this spectrum, indicating potential red flags for investors.

A Snapshot of NovoCure Ltd (NASDAQ:NVCR)

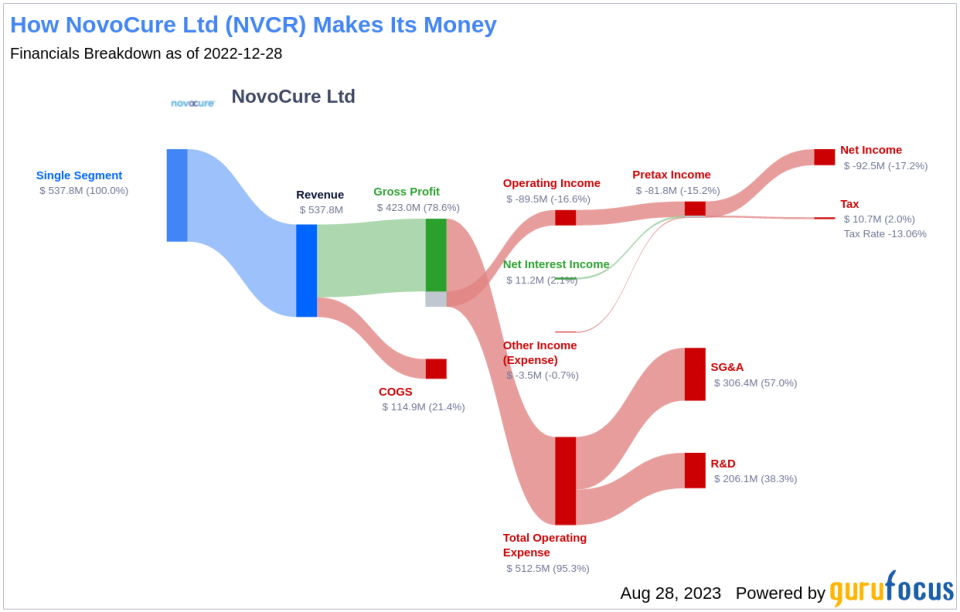

NovoCure Ltd serves in the healthcare sector of the United States. Its business involves the development, manufacture, and commercialization of Tumor Treating Fields (TTFields) devices, including Optune and Optune Lua, for the treatment of solid tumor cancers. Its pipeline consists of Ovarian Cancer, Pancreatic Cancer, Non-Small Cell Lung Cancer, and Brain Metastasis. Products are comprised of two main components: electric field generator and arrays and related accessories. NovoCure derives its major revenues in the United States.

This article first appeared on GuruFocus.