Now is a ‘once-in-a-lifetime’ chance to invest in US pot companies, investor says

With some Canadian pot stocks posting triple-digit return rates this year, many retail investors have looked north to pour cash into cannabis. But individual investors should consider keeping their capital in American companies, according to at least one investor.

U.S. cannabis companies are worth a lot more than their current valuations suggest since federal illegality has put undue pressure on the industry, said David Wenger, a New York attorney and senior editor of the Cannabis Law Digest. But given current social and state-wide legislative action, cannabis’s illicit status in the U.S. isn’t going to last much longer — creating a huge earning potential for investors who get in now, Wenger said.

“There’s a once-in-a-lifetime opportunity that we have here for early investors in the US cannabis industry to profit from an enormous valuation gap,” Wenger said Thursday at the Cannabis World Congress and Business Exposition in Boston. “The value suppression because of federal illegality is artificial, it’s not real. It’s there, but it’s not deserved.”

In the United States, the legal cannabis market is expected to reach $11 billion in consumer spending in 2018, according to a report from Arcview Market Research and BDS Analytics. That figure will reach $23.4 billion in 2022, ballooning at a 22% compound annual growth rate over that five-year forecast period, the researchers wrote.

‘Come back to me when it’s legal’

Marijuana’s classification as a Schedule I narcotic — the most restrictive class of controlled substances, on par with LSD and ecstasy — has created a cascade of social and regulatory factors weighing on the domestic industry. But these burdens will immediately lift when — not “if,” Wenger believes — weed becomes legal.

Since marijuana is still federally illicit, major U.S. stock exchanges have shunned American plant-touching cannabis companies from listing, while allowing Canadian companies including Canopy Growth Corporation (CGC) and Tilray (TLRY) to make their initial public offerings. A handful of American weed companies have taken steps to tap into the public equity market despite being orphaned by major US stock exchanges. California-based MedMen (MMNFF), currently traded on the OTC market in the U.S., has a market capitalization of around $3 billion. New York-based Acreage Holdings announced its intention to go public via a reverse takeover with Ontario’s Applied Inventions Management Corporation on the Canadian Securities Exchange by November. Acreage Holdings said earlier this year it raised $119 million in what it called the largest funding round for an American cannabis company to date.

Many potential institutional investors “look at the U.S. industry and make a U-turn,” Wenger said. “They hear it’s federally illegal and they say, ‘Come back to me when it’s legal.’” Canadian businessman Kevin O’Leary, Shark Tank host and chairman of O’Shares ETF Investments, said in an interview on Yahoo Finance’s Market Movers on Wednesday that he would “never” invest in cannabis stocks given product’s labeling as a Schedule I narcotic in the US. Finding a major American bank willing to price in the risk of federal illegality — and potential charges of aid and abetting — presents a major challenge for cannabis entrepreneurs.

Since many institutional investors are sticking to the sidelines for now, there’s room for individual investors to claim a larger-than-usual piece of the pie in the budding industry, Wenger said. Investors can get in “even with fewer than $100,000 in kinds of deals that would never be open” in most cases for growing companies, whose attention would typically shift to institutional investors capable of writing larger checks.

Plant-touching cannabis companies also face steep tax rates due to the product’s federally illegal status. Even cannabis companies operating in states such as Colorado or California where the goods are licit have to report their income as illegal at the federal level, triggering a set of profit-denting tax rules. Federal legality will lift the tax burden, instantly improving profits and margins, Wenger said.

‘Inevitable’

“Federal legalization is inevitable — it’s a certainty,” Wenger said. “It’s going to happen sooner than many people expect.”

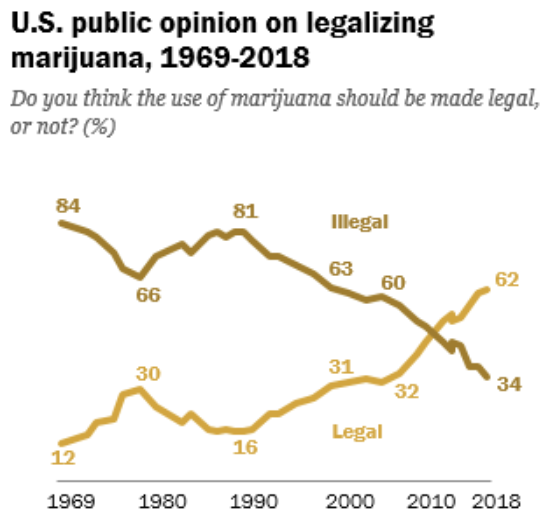

Wenger bases his bullishness in large part on pot’s improved public perception. A Pew study earlier this month found that 62% of Americans say that marijuana use should be legalized, or double the percentage from 2000. Thirty-one states and Washington, D.C. allow medical marijuana, with nine states and D.C. allowing for recreational use. And Americans are already consuming the substance by the truckload, with New York City residents alone taking in 77.44 metric tons per year.

Explosive existing demand makes cannabis unlike many other up-and-coming industries, where companies often have to define a new product to customers, said John Kagia, an analyst for cannabis research firm New Frontier Data.

“You don’t have to explain to a cannabis consumer why they should try cannabis,” Kagia said at the conference in Boston. “They already know why they like to consume cannabis. They just need to know why your product is better than the one they already have.”

Aside from its obvious means of consumption, cannabis is at the precipice of disrupting a number of industries, some analysts believe. Vivien Azer, an analyst with Wall Street firm Cowen, wrote in a recent research note that she sees cannabis expanding into adult use, beauty and nutraceuticals, over-the-counter pain and sleep products and pharmaceuticals.

While Kagia also sees upside to the industry, his advice for investment timing is slightly less urgent.

“It can seem like in this industry, if you don’t get in now, you’re going to miss this boat,” Kagia said. “But … we have a long, long road ahead. This industry is literally in the 200-yard mark of a marathon.”

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more about pot stocks: