Now is an Opportunistic Time to Buy These Industrial Products Stocks

Several top-rated Zacks industrial products sector stocks stand out at the moment as these companies also hold spots on the coveted dividend aristocrats list.

Raising their annual dividend payout for at least 25 consecutive years, now looks like an opportune time to buy these industrial products stocks as their outlooks have strengthened along with the plausibility of reliable income.

Caterpillar CAT: As one of the more well-known industrial products stocks on the dividend aristocrat list, Caterpillar has increased its payout for 29 consecutive years and currently sports a Zacks Rank #2 (Buy).

Even better, as a global leader in its space, it's very noteworthy that Caterpillar’s Zacks Manufacturing-Construction and Mining Industry is currently in the top 6% of over 250 Zacks industries. Annual earnings estimates for both fiscal 2023 and FY24 have continued to soar over the last quarter with Caterpillar's EPS now forecasted to expand 45% this year and rise another 6% next year at $21.35 per share.

Image Source: Zacks Investment Research

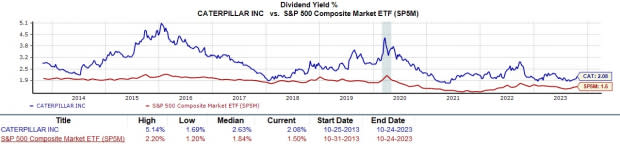

The cherry on top is that accompanying Caterpillar’s sound growth its current 2.08% annual dividend yield slightly tops its industry average and is nicely above the S&P 500’s 1.50%.

Image Source: Zacks Investment Research

Cintas CTAS: Raising its dividend for 39 consecutive years Cintas is also a familiar name among the industrial products aristocrats and sports a Zacks Rank #2 (Buy).

Renowned for providing specialized services to a wide range of businesses, Cintas’ Zacks Uniform and Related Industry is in the top 40% of all Zacks industries. Outside of its corporate uniform program, Cintas provides custodial products to its diversified business clients with earnings forecasted to rise 10% in its current FY24 and jump another 10% in FY25 at $15.82 per share.

Image Source: Zacks Investment Research

Plus, Cintas' reliable annual dividend has increased 23.39% over the last five years and is currently at a respectable 1.07% yield which slightly tops its industry average of 0.92%.

Image Source: Zacks Investment Research

Other Industrial Aristocrats to Consider

Two other industrial products aristocrats to consider are Emerson Electric EMR and Stanley Black & Decker SWK which both sport a Zacks Rank #2 (Buy).

Emerson and Stanley Black & Decker have raised their dividends for 61 and 55 consecutive years respectively classifying the companies as “dividend kings” as well (50 consecutive years). Stanley Black & Decker’s current yield of 4.08% is certainly attractive while Emerson’s 2.29% also tops the benchmark.

Following tougher-to-compete-against years, Emerson and Stanley Black & Decker are expecting dips in their bottom lines in fiscal 2023 but earnings estimates are modestly higher over the last 30 days. More importantly, annual earnings are expected to rebound for both companies in FY24 with Emerson being a global provider of a wide range of products and services to customers in a variety of markets and Stanley Black & Decker offering power tools along with fastening systems that are distributed worldwide including emerging markets.

Image Source: Zacks Investment Research

Bottom Line

Considering the volatility in the stock market as of late investors may want to shore up their investments and look at sound options. At the moment these industrial products stocks are starting to fit the bill and provide reliable dividends as aristocrats.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

Cintas Corporation (CTAS) : Free Stock Analysis Report