Is Now the Time to Invest in Annaly and AGNC? What You Need to Know About Mortgage REITs

While ideally investors like to find companies that are attractive long-term investments that can be held for many years, some type of stocks are good investments only during certain cycles. One investment class that fits this category is agency mortgage REITs (real estate investment trusts).

These firms invest in mortgage-backed securities ("MBS") that are backed by government or government-sponsored agencies such as Ginnie Mae, Fannie Mae, and Freddie Mac. Two firms that employ this strategy are AGNC Investment (NASDAQ: AGNC) and Annaly Capital Management (NYSE: NLY). Both have attractive yields of over 13% and are leaders in the space.

So, is now the right time to be buying these high-yielding stocks? Let's find out why the answer could be yes.

What the heck is a mortgage REIT?

Mortgage REITs are essentially investment firms that own portfolios of mortgages. The companies generate returns by earning a spread between their funding costs (short-term debt used to buy the MBS) and the yields of the mortgages in their portfolios. For example, if a firm bought a mortgage with a 6% yield and its funding costs were 3%, it would generate a spread of 3%. These firms then use leverage to boost their returns.

The firms typically use hedges to lock in these short-term rates over the same period that matches the duration of their portfolios. This helps eliminate the risk of funding costs going up, reducing the spread, or short-term rates becoming higher than long-term rates.

Given that agency backed mortgage securities are backed by government agencies, investments in agency MBS carry limited credit risk, since these investments are backstopped by the government. Over 88% of Annaly's portfolio and 97% of AGNC's portfolio are in agency backed MBS, so Annaly does carry slightly more credit risk.

However, limited credit risk doesn't mean investing in agency MBS is risk free.

A difficult period

While agency mortgage REITs face minimal credit risk and lock in their funding costs through hedges, mortgage REITs do face other risks. Since mortgages are fixed income investments, they carry interest rate risk. As with any type of bond, when interest rates go up, the price of the bond, or in this case MBS, goes down. Why? Because if newly issued MBS is yielding a higher rate, the value of older MBS needs to go down to match the current rate.

In March 2022, the Federal Reserve started to aggressively increase interest rates from a range of 0.25-0.50% to 5.25-5.50% by the summer of 2023. Not surprisingly, mortgage rates also surged higher.

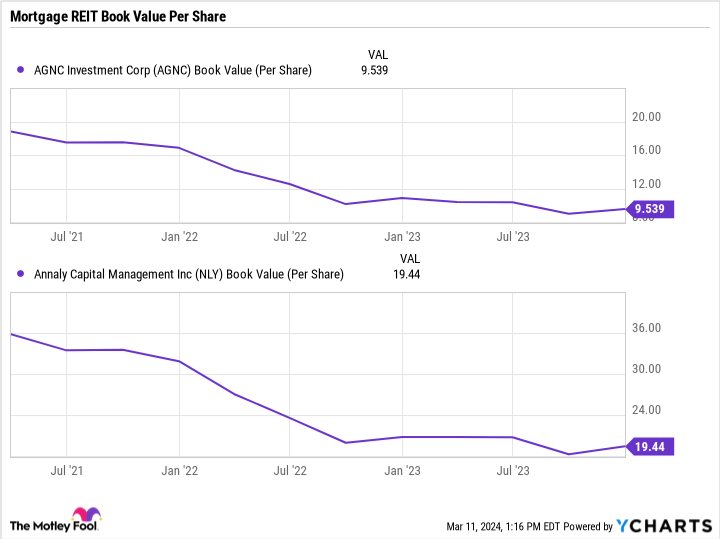

Mortgage REITs, meanwhile, saw the value of their portfolios, as reflected in their book value, crushed during this period. For example, AGNC saw its book value decline by nearly -50% from the start of 2022 until the end of 2023, while others saw similar declines. Given that book value is essentially the value of a mortgage REIT's portfolio, these stocks typically are valued at a slight premium or discount to their book value. Both Annaly and AGNC currently trade slightly above their book values.

AGNC Book Value (Per Share) data by YCharts

Over this same period, mortgage REITs were also hurt by the spread between agency MBS and 10-Year Treasury yields widening. Bond yields, including agency MBS, typically trade at a premium to Treasury yields. The spread between Treasury and other bond yields can narrow and widen depending on the environment.

Better times ahead

Not surprisingly, 2022 and 2023 were bad years to own mortgage REITs, as higher interest rates combined with spreads moving from historically low levels to historically high levels, hurt the stocks.

However, there are a few reasons why 2024 could be the perfect time to own stocks like Annaly and AGNC over the next several years. First, the Fed has signaled that it plans to cut interest rates this year, while Fed officials are generally looking for the Fed Funds rate to move back down to 2.5% by 2026. This is important because while increased rates drive down a mortgage REIT's book value, lower rates boost book value.

Spreads, meanwhile, remain at historically high levels. This does two things. First it makes current investments attractive, as the REITs can get higher yields and spreads. Second, if spreads narrow, it will help book value.

Annaly and AGNC also have less leverage than they've used in the past before the pandemic. For example, Annaly had economic leverage, which takes in account the volatility of the assets, of 5.7x at the end of 2023 versus 7.0x at the end of 2018, while AGNC had leverage of 7.0x compared to 9.0x at the end of 2018.

Why is this important? Because the firms have an opportunity to add leverage and increase MBS purchases to generate more net investment income. Net investment income comes from the spread income it makes and helps support their robust dividends.

After these catalysts unfold over the new few years, mortgage REITs should then enjoy just being in a more normal rate environment thereafter. And investors can enjoy collecting the robust dividends they pay. The biggest risk for investors would be if mortgage rates climbed to higher levels from here.

Time to buy

The market is currently set to shift from a very difficult environment for mortgage REITs to potentially a great period for the sector. If the Fed embarks on the rate cutting cycle it has signaled, these could be great investments over the next several years.

While the entire sector should benefit, Annaly and AGNC are two top stocks to look at given their long track records in the space.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

Geoffrey Seiler has positions in Annaly Capital Management. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Now the Time to Invest in Annaly and AGNC? What You Need to Know About Mortgage REITs was originally published by The Motley Fool