Is Now The Time To Put AMREP (NYSE:AXR) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like AMREP (NYSE:AXR), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for AMREP

AMREP's Improving Profits

AMREP has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. AMREP's EPS skyrocketed from US$2.43 to US$4.05, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 67%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. To cut to the chase AMREP's EBIT margins dropped last year, and so did its revenue. That will not make it easy to grow profits, to say the least.

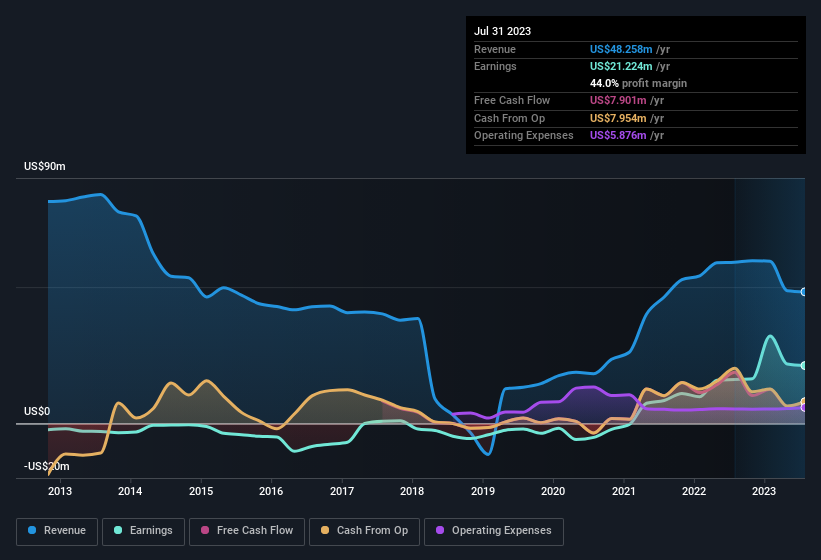

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

AMREP isn't a huge company, given its market capitalisation of US$88m. That makes it extra important to check on its balance sheet strength.

Are AMREP Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that AMREP insiders spent US$166k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by company insider James Dahl for US$111k worth of shares, at about US$16.00 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for AMREP will reveal that insiders own a significant piece of the pie. Owning 39% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at US$34m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Chris Vitale, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like AMREP with market caps under US$200m is about US$757k.

AMREP's CEO took home a total compensation package worth US$600k in the year leading up to April 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does AMREP Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into AMREP's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. It is worth noting though that we have found 2 warning signs for AMREP that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AMREP, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.