Is Now The Time To Put ConnectOne Bancorp (NASDAQ:CNOB) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like ConnectOne Bancorp (NASDAQ:CNOB). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for ConnectOne Bancorp

How Quickly Is ConnectOne Bancorp Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. ConnectOne Bancorp managed to grow EPS by 16% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

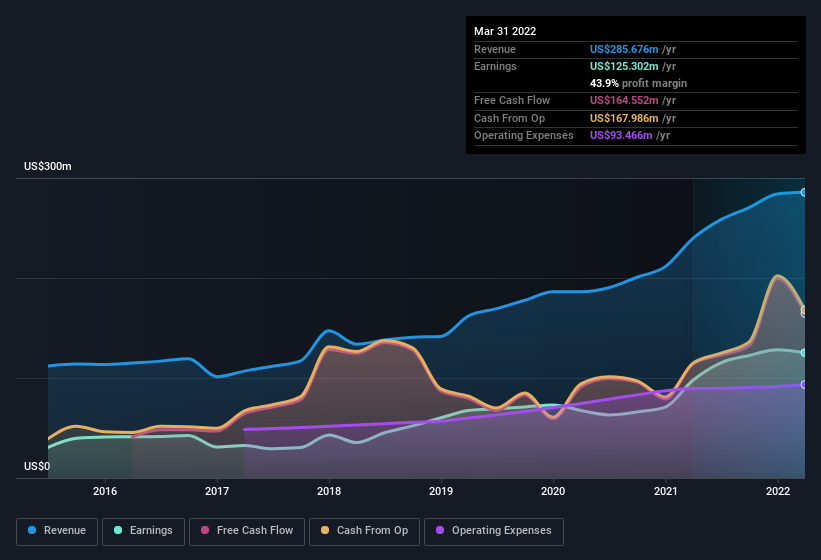

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of ConnectOne Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note ConnectOne Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 19% to US$286m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of ConnectOne Bancorp's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are ConnectOne Bancorp Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that ConnectOne Bancorp insiders have a significant amount of capital invested in the stock. Notably, they have an enormous stake in the company, worth US$108m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations between US$400m and US$1.6b, like ConnectOne Bancorp, the median CEO pay is around US$3.9m.

The ConnectOne Bancorp CEO received US$3.1m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add ConnectOne Bancorp To Your Watchlist?

One important encouraging feature of ConnectOne Bancorp is that it is growing profits. Earnings growth might be the main game for ConnectOne Bancorp, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Now, you could try to make up your mind on ConnectOne Bancorp by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.