Is Now The Time To Put G8 Education (ASX:GEM) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like G8 Education (ASX:GEM). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for G8 Education

G8 Education's Improving Profits

G8 Education has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. G8 Education's EPS shot up from AU$0.036 to AU$0.053; a result that's bound to keep shareholders happy. That's a fantastic gain of 46%.

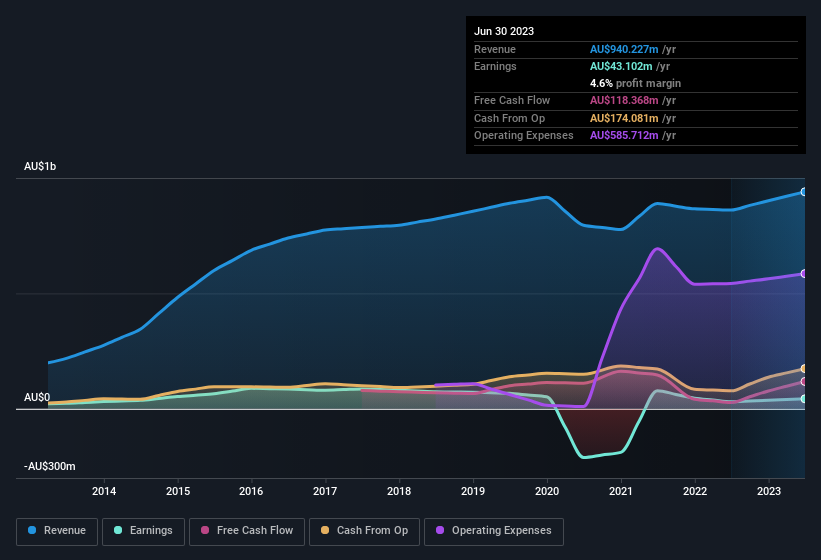

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. G8 Education shareholders can take confidence from the fact that EBIT margins are up from 9.8% to 12%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of G8 Education's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are G8 Education Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While G8 Education insiders did net AU$23k selling stock over the last year, they invested AU$415k, a much higher figure. An optimistic sign for those with G8 Education in their watchlist. Zooming in, we can see that the biggest insider purchase was by CEO, MD & Director Pejman Okhovat for AU$108k worth of shares, at about AU$1.08 per share.

Does G8 Education Deserve A Spot On Your Watchlist?

You can't deny that G8 Education has grown its earnings per share at a very impressive rate. That's attractive. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. So on this analysis, G8 Education is probably worth spending some time on. It is worth noting though that we have found 1 warning sign for G8 Education that you need to take into consideration.

The good news is that G8 Education is not the only growth stock with insider buying. Here's a list of growth-focused companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.