Is Now The Time To Put HSBC Holdings (LON:HSBA) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like HSBC Holdings (LON:HSBA). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for HSBC Holdings

How Fast Is HSBC Holdings Growing Its Earnings Per Share?

Over the last three years, HSBC Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, HSBC Holdings' EPS soared from US$0.72 to US$1.20, over the last year. That's a commendable gain of 66%.

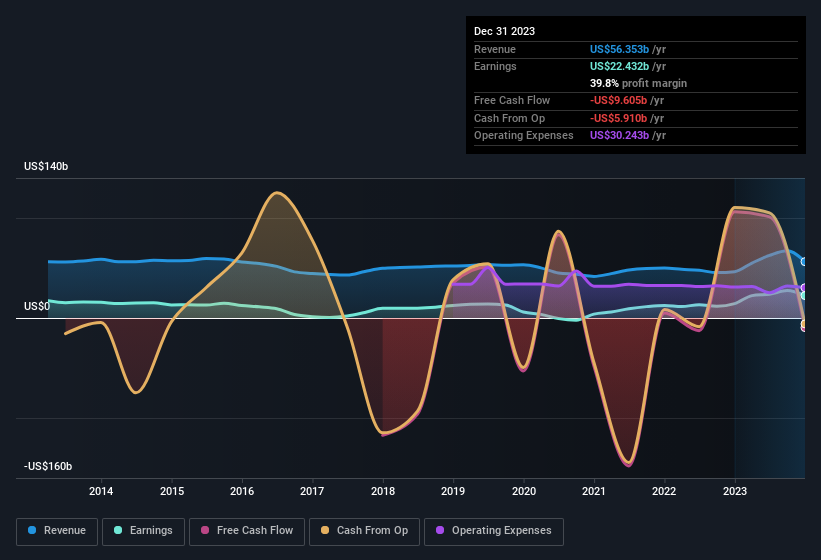

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that HSBC Holdings' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for HSBC Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 22% to US$56b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of HSBC Holdings' forecast profits?

Are HSBC Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold US$1.8m worth of shares. But that's far less than the US$4.3m insiders spent purchasing stock. We find this encouraging because it suggests they are optimistic about HSBC Holdings'future. Zooming in, we can see that the biggest insider purchase was by Group CFO Georges Bahjat Elhedery for UK£4.0m worth of shares, at about UK£5.97 per share.

On top of the insider buying, it's good to see that HSBC Holdings insiders have a valuable investment in the business. Given insiders own a significant chunk of shares, currently valued at US$67m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Is HSBC Holdings Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into HSBC Holdings' strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with HSBC Holdings (at least 1 which is concerning) , and understanding these should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, HSBC Holdings isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.