There are now 2 ways the Mueller probe can go for Trump

On Friday, Former Trump campaign chairman and international influence peddler Paul Manafort made a plea deal to cooperate with special counsel Robert Mueller’s investigation into Russia’s interference in the 2016 election and whether the Trump campaign cooperated with those efforts.

The latest guilty plea and cooperation agreement earned by Mueller’s team is the biggest one so far, and it indicates that the probe will go one of two ways for the president: badly or very badly, depending on what else Mueller uncovers and places in the public realm.

Even if Mueller finds no wrongdoing by the president, Manafort flipping indicates the special counsel is digging deeper into everything related to the three crucial months that Manafort served as the 2016 Trump campaign’s chairman and chief strategist. And the overall investigation — which has led to eight guilty pleas so far — will surely remain a constant source of rage for the president.

If Mueller finds wrongdoing by the president — whether it be related to deliberate collaboration with Russian meddling or obstruction of justice or Trump’s business empire — then the potential outcomes become more perilous for President Trump.

‘Manafort’s cooperating with Mueller may be the motherlode’

After nearly a year of fighting Mueller indictments and going through a trial that led to his conviction on eight counts, the 69-year-old agreed to forfeit an estimated $46 million in assets (including four properties) and to cooperate “in any and all matters as to which the Government deems the cooperation relevant.”

From an outside vantage point — given that we have little idea of what Mueller knows — Manafort flipping leads the Russia probe into a new phase: Now that the most Kremlin-linked member of Trump’s inner campaign circle is cooperating with Mueller, the public is closer to knowing whether Team Trump collaborated with Putin’s multifaceted intelligence operation to influence the 2016 presidential election.

Manafort is not only the most prolific Washington swamp figure to be targeted by Mueller, but also the only person cooperating with Mueller who was at the now-infamous June 9, 2016, meeting at Trump Tower that featured candidate Trump’s son Don Jr., Trump’s son-in-law, Jared Kushner, and Manafort meeting with a team led by a Russian government lawyer promising dirt on Democratic presidential candidate Hillary Clinton.

“Manafort’s cooperation is a tremendous achievement for the Mueller investigation — maybe the single biggest development yet,” Seth Waxman, a former federal prosecutor in Washington, D.C., told Natasha Bertrand of the Atlantic. “Manafort provides Mueller with an insider to the infamous June 2016 Trump Tower meeting and likely many other key moments.”

As Yahoo Finance’s Rick Newman said on Friday’s Final Round (video above): “The big question is: Was [the Trump Tower meeting] just a one-off kind of a bumbling effort to get some damaging information on the opponent or was that part of something that might look like a conspiracy? We don’t know. And it’s Mueller’s job to figure it out and tell us.”

Odds are that Manafort, in order to get the plea deal, has already provided valuable information to Mueller’s team. Former U.S. Attorney for the Southern District of New York (SDNY) Preet Bharara, whom Trump fired in March 2017, went so far as to assert that Mueller “likely already has all of Manafort’s information. You get the information before you offer the agreement.”

Ryan Goodman, a former special counsel for the Defense Department, tweeted that “Manafort’s cooperating with Mueller may be the motherlode.”

‘This model can greatly benefit the Putin government’

From about 2004 to 2014, Manafort worked for the Kremlin-backed Party of Regions and its leader, Viktor Yanukovych. (Yanukovych fled to Russia after being overthrown by EU-leaning Ukrainian protesters in 2014). The work brought Manafort in contact with several people with connections with the Kremlin, including Russian oligarch Oleg Deripaska and Russian military-trained linguist Konstantin Kilimnik — referred to as “Person A” in Mueller indictments.

Deripaska, president of the Russian aluminum giant Rusal, and Manafort became business partners. In 2006, Manafort signed a $10 million annual contract with Deripaska based on a plan to influence Western governments in ways that would “greatly benefit the Putin Government.” In 2007, Manafort persuaded Deripaska to provide $100 million to a private equity firm Manafort had created called Pericles. In 2010, Deripaska personally loaned Manafort $10 million. Also in 2010, Deripaska asked Rick Gates, Manafort’s (now-flipped) partner, to account for $18.9 million of Deripaska’s money that had ostensibly been used to buy a telecommunications firm in Ukraine. (In January 2018, a company tied to Deripaska sued Manafort, alleging that he had defrauded him in relation to the investment.)

Crucially, Deripaska had been a target of U.S. counterintelligence efforts before Donald Trump even announced his run for the presidency. Starting in November 2014, the New York Times recently reported, Justice Department official Bruce Ohr and former British intelligence officer Christopher Steele — both of whom later became targets of President Trump — led an attempt to turn Deripaska into an informant. The hope was that the oligarch could provide information on Russian organized crime, given the billionaire’s long-suspected links with several high-ranking members of the Russian mafia. The effort to cultivate Deripaska evolved after the FBI began looking into suspected Russian meddling and potential connections to the Trump campaign.

Deripaska turned down the offer and denied having knowledge of Russian organized crime or Russian meddling. In April 2018, the U.S. Treasury Department sanctioned Deripaska, citing allegations of money laundering, threatening the lives of business rivals, illegally wiretapping a government official, taking part in extortion and racketeering, bribery of a government official, ordering the murder of a businessman, and links to a prominent Russian organized crime group. (On Sept. 15, the U.S. softened those sanctions, which had rocked the global aluminum industry.)

‘How do we use to get whole?’

Manafort and Deripaska were apparently still communicating during the 2016 campaign. And the apparent conduit between the two was a mysterious Russian-Ukrainian political operative named Konstantin Kilimnik.

Kilimnik served in the GRU, the Russian military intelligence agency that allegedly hacked the Democratic National Committee and stole emails that were published by WikiLeaks to damage the presidential candidacy of Hillary Clinton. Known as “Manafort’s Manafort,” Kilimnik worked as Manafort’s translator, fixer, and operations manager in Ukraine. Manafort called Kilimnik his “Russian brain,” and Kilimnik said that the two exchanged “millions of emails.” Mueller’s team asserted in court filings that Kilimnik (aka Person A) “has ties to a Russian intelligence service and had such ties in 2016.” Manafort likely knew that as well: According to court filings, Gates acknowledged to associates that Kilimnik was a former GRU intelligence officer.

When joining Trump’s presidential campaign, Manafort knew that he was indebted to Deripaska and worked with Kilimnik to leverage his newfound position in Trump’s inner circle. A few days after being hired as a campaign strategist, Manafort asked Kilimnik: “Has OVD [Oleg Vladimirovich Deripaska] seen?” and “How do we use to get whole?” In a July 2016 email, then-campaign-chief Manafort told Kilimnik: “If he needs private briefings we can accommodate.” Also in July, Kilimnik wrote that he had met that day with the person “who gave you the biggest black caviar jar several years ago.”

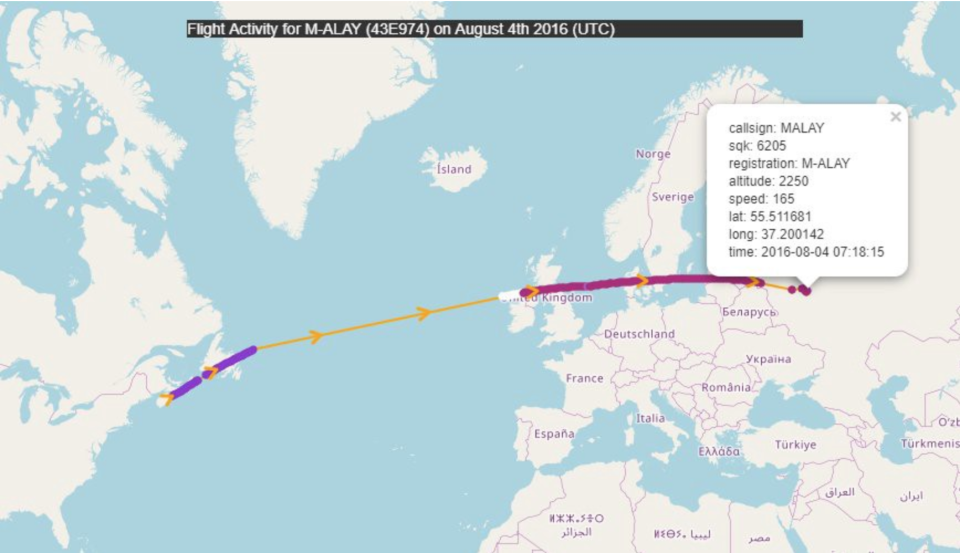

Manafort and Kilimnik met at least twice while Manafort worked for Trump. In August 2016, one of Deripaska’s private jets landed in Newark from Moscow a few hours after Manafort and Kilimnik met in Manhattan. (A spokesman for Deripaska denied that his client “directly or indirectly communicated with Mr. Manafort in 2016.”)

It’s not clear what Kilimnik was up to beyond his work for Manafort. Politico reported that after one of his trips to the U.S. in the summer of 2016, “Kilimnik suggested that he had played a role in gutting a proposed amendment to the Republican Party platform that would have staked out a more adversarial stance toward Russia, according to a Kiev operative.” In June 2018, Mueller charged Kilimnik and Manafort with obstruction of justice and conspiracy to obstruct justice after revelations that the two men attempted to tamper with witnesses.

Manafort’s insights into all of these connections are relevant as Mueller’s probe attempts to finish what the FBI started when it reached out to Deripaska in 2014 to get insight on Russian organized crime. In 2017, Ohr used an intermediary to urge Deripaska to “give up Manafort.” Now Mueller will want Manafort to give any and all information he can on Deripaska, as well as any insight into the Russian effort to influence the 2016 election.

One of the relevant subjects could be “intercepted communications that U.S. intelligence agencies collected among suspected Russian operatives discussing their efforts to work with Manafort … to coordinate information that could damage Hillary Clinton’s election prospects, the US officials say,” as reported by CNN. “The suspected operatives relayed what they claimed were conversations with Manafort, encouraging help from the Russians.”

‘For the principal purpose of influencing the election’

Manafort is the latest member of Trump’s inner circle to assist federal prosecutors.

And while Manafort seems to have relatively little knowledge about Trump’s business empire, which the president considers out of the scope of Mueller’s mandate, others do.

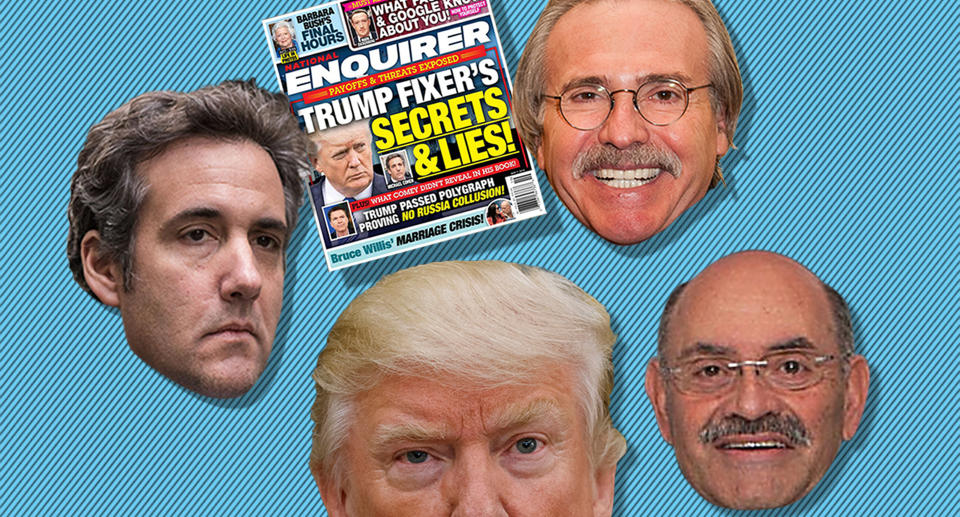

On Aug. 21, Trump’s former personal attorney Michael Cohen made the extraordinary admission, speaking under oath to a judge in U.S. District Court in Manhattan, that he illegally paid for the silence of two women “in coordination with and at the direction of” then-candidate Trump, “for the principal purpose of influencing the election.” Cohen is now reportedly speaking with Mueller’s team in addition to SDNY prosecutors.

Trump Organization chief financial officer Allen Weisselberg and David Pecker, a longtime Trump friend who runs the historically Trump-friendly National Enquirer, were granted immunity by federal authorities to provide information in relation to Cohen’s case. The 71-year-old Weisselberg, described by the Wall Street Journal as a “reserved accountant associates say is prized by Mr. Trump for his loyalty” who became “the most senior person in the organization that’s not a Trump,” would be able to provide unique insight into Trump’s business empire if his cooperation expanded.

The SDNY is not finished looking into the Trump Organization, and the Manhattan district attorney’s office is also considering criminal charges related to Cohen’s hush money payments. If any of this reaches Mueller’s purview, Manafort’s first trial showed that the former FBI Director’s team is highly adept at forensic analysis of complex financial matters.

The opposite of a ‘rigged witch hunt’

In any case, all signs point to an increasing headache for Trump.

At the very least, the list of Trump allies speaking to federal prosecutors about some aspect of Trump’s world include his former national security adviser, Michael Flynn, a Manafort protégé who worked on the Trump campaign and inauguration, Trump’s former personal attorney, the current chief financial officer of both Trump’s for-profit and ostensibly not-for-profit empires, a top media ally who helped Trump get rid of potential PR problems over the years, and now candidate Trump’s Kremlin-linked former campaign manager.

No matter what happens next, it’s going to continue to reflect poorly on the president’s assertions that Mueller’s investigation is a “rigged witch hunt.” In reality, Mueller’s probe appears to be a highly professional investigation by a war hero and dedicated public servant who is deliberately following the mandate given to him by the current Department of Justice in May 2017.

And the next phases, including the one we’ve now entered with Manafort’s plea deal, will determine just how bad things are going to get for Donald J. Trump.

Read more: