NRG Energy (NRG) Q2 Earnings & Revenues Surpass Estimates

NRG Energy, Inc. NRG reported second-quarter 2023 earnings of $1.10 per share, which beat the Zacks Consensus Estimate of $1.07 by 2.8%. The bottom line also improved 233.3% from the year-ago quarter’s level of 33 cents.

Revenues

Total revenues came in at $6,348 million, which surpassed the Zacks Consensus Estimate of $4,522 million by 40.4%. The figure, however, declined 12.8% from $7,282 million recorded in the prior-year quarter.

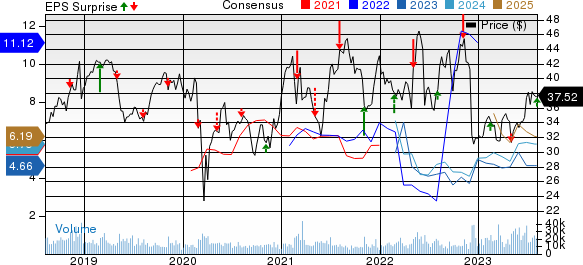

NRG Energy, Inc. Price, Consensus and EPS Surprise

NRG Energy, Inc. price-consensus-eps-surprise-chart | NRG Energy, Inc. Quote

Highlights of the Release

The company recorded adjusted EBITDA of $819 million, up 112.2% from the year-ago quarter’s figure of $386 million.

Total operating costs and expenses were $5,821 million, down 11.3% from $6,560 million in the year-ago quarter due to lower cost of operations.

Operating income totaled $530 million, down 29.7% from $754 million registered in the year-ago quarter. Our model predicted operating income of $567.4 million for the same quarter.

Financial Highlights

As of Jun 30, 2023, NRG had cash and cash equivalents worth $422 million compared with $430 million as on Dec 31, 2022.

As of Jun 30, 2023, long-term debt and finance leases amounted to $10,737 million compared with $7,976 million as on Dec 31, 2022.

Cash used by operating activities in the first six months of 2023 totaled $1,028 million against $3,189 million cash provided in the year-ago period.

Capital expenditures totaled $324 million in the first six months of 2023 compared with $150 million in the corresponding quarter of 2022.

Guidance

NRG Energy reaffirmed its 2023 adjusted EBITDA projection in the range of $3,010-$3,250 million.

The company expects cash provided by operating activities in the band of $1,610-$1,850 million.

NRG’s 2023 free cash flow before growth investment is anticipated between $1,620 million and $1,860 million.

Zacks Rank

The company has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

WEC Energy Group WEC reported second-quarter 2023 earnings of 92 cents per share, which beat the Zacks Consensus Estimate of 85 cents by 8.24%.

WEC’s long-term (three to five years) earnings growth rate is 5.76%. It delivered an average earnings surprise of 7% in the last four quarters.

Eversource Energy ES reported second-quarter 2023 adjusted earnings of $1 per share, which outpaced the Zacks Consensus Estimate of 92 cents by 8.7%.

ES’ long-term earnings growth rate is 5.7%. It delivered an average earnings surprise of 2.1% in the last four quarters.

CMS Energy CMS reported second-quarter 2023 adjusted earnings per share of 75 cents, which beat the Zacks Consensus Estimate of 69 cents by 8.7%.

CMS’ long-term earnings growth rate is 7.8%. It delivered an average earnings surprise of 3.7% in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report