NRx Pharma (NRXP) to Initiate Clinical Study on NRX-101, Stock Up

NRx Pharmaceuticals’ NRXP shares rallied 10% on Oct 2, as the FDA cleared the investigational new drug (IND) application of its lead candidate, NRX-101, for treating chronic pain.

Chronic pain affects more than one in five adults in the United States. The current treatment for the same often relies on opioids that carry a risk of addiction and debilitating side effects. NRXP aims to provide a safer and more effective alternative with NRX-101.

The company plans to initiate registrational studies for chronic pain in 2024, depending on the recently completed early-stage study of NRX-101 for chronic pain (funded by the U.S. Department of Defense).

NRX-101 is a fixed dose combination of D-cycloserine (DCS) and lurasidone. Unlike some NMDA antagonists, DCS has demonstrated no possibility for addiction, making it a safer alternative for long-term pain management. Pre-clinical studies indicate that DCS can modulate the neural chain of pain at various points, from spinal cord transmission to pain perception in the brain and memory processing, showing the potential to reduce opioid cravings.

Based on the preliminary efficacy data of DCS’ use in chronic pain, management plans to seek Fast Track Designation, Priority Review and Breakthrough Therapy Designation from the FDA for NRX-101 for the same indication. These designations will provide NRXP with additional market exclusivity and expedite development and review of drugs.

With the chronic pain industry estimated to be worth $72 billion at present and projected to grow to $120 billion by 2033, the successful development of NRX-101 could be a huge boost for the company.

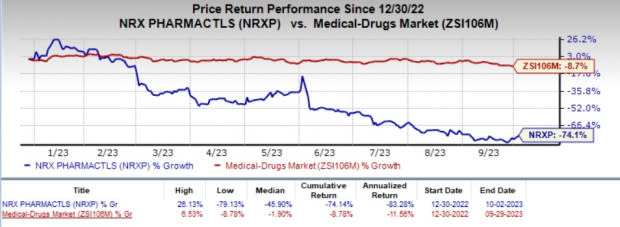

NRx Pharma’s shares have lost 74.1% year to date compared with the industry's 8.7% decline.

Image Source: Zacks Investment Research

NRX-101 is also being evaluated in multiple studies targeting central nervous system disorders. A phase IIb/III evaluating NRX-101 is currently enrolling patients for suicidal treatment-resistant bipolar depression (S-TRBD).

The candidate has been granted the Fast Track Designation, Breakthrough Therapy Designation, a Special Protocol Agreement and a Biomarker Letter of Support by the FDA for S-TRBD.

NRx Pharmaceuticals, Inc. Price and Consensus

NRx Pharmaceuticals, Inc. price-consensus-chart | NRx Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

NRx Pharma currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same industry are Anika Therapeutics ANIK, Annovis Bio ANVS and Corcept Therapeutics CORT. While Anika Therapeutics currently sports a Zacks Rank #1 (Strong Buy), both Annovis Bio and Corcept Therapeutics carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 90 days, the Zacks Consensus Estimate for Anika Therapeutics has narrowed from a loss of $1.41 per share to a loss of $1.24 for 2023. The bottom-line estimate has widened from a loss of 79 cents to a loss of 82 cents for 2024 during the same time frame. Shares of the company have lost 36.8% year to date.

ANIK’s earnings beat estimates in one of the trailing four quarters and missed the mark in the remaining three, delivering an average negative surprise of 32.12%.

In the past 90 days, the Zacks Consensus Estimate for Annovis Bio has narrowed from a loss of $4.89 per share to a loss of $4.38 for 2023. The bottom-line estimate has narrowed from a loss of $3.18 to a loss of $2.77 for 2024 during the same time frame. Shares of the company have lost 32.2% year to date.

ANVS’ earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 13.40%.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings has gone up from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 29.4% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Anika Therapeutics Inc. (ANIK) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

NRx Pharmaceuticals, Inc. (NRXP) : Free Stock Analysis Report