Nu Skin (NUS) Down More Than 30% in 3 Months: Here's Why

Nu Skin Enterprises, Inc. NUS is bearing the brunt of continued macroeconomic hurdles, which have been marring its performance. The global integrated beauty and wellness company is battling unfavorable currency headwinds.

These factors were reflected in NUS’s second-quarter 2023 results, with the top and the bottom line declining year over year. Revenues missed the Zacks Consensus Estimate. Management trimmed the 2023 revenues and EPS view.

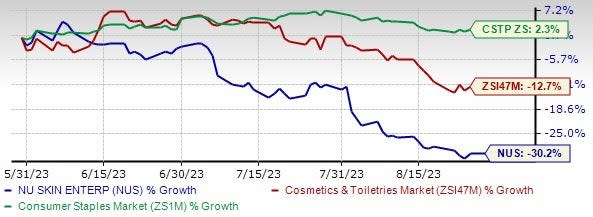

Shares of the Zacks Rank #4 (Sell) stock have slumped 30.2% in the past three months compared with the industry’s 12.7% decline. The stock has underperformed the Zacks Consumer Staples’s growth of 2.3% during this time.

Let’s delve deeper.

Image Source: Zacks Investment Research

Dismal Q2 Results

In the second quarter of 2023, Nu Skin’s adjusted earnings of 54 cents a share declined from 77 cents reported in the year-ago quarter. Revenues of $500.3 million tumbled nearly 11%. Sales leaders were down 9% to 45,807. Nu Skin’s customer base dropped 25% to 1,041,118. The company’s paid affiliates were down 23% to 187,652.

Nu Skin’s margins have been contracting year over year in the past few quarters. In the second quarter, gross profit of $364.7 million declined from the $412.5 million reported in the year-ago quarter. The gross margin was 72.9%, down from 73.6% reported in the year-ago quarter. The operating margin contracted to 8.5% from the 9.2% reported in the year-ago quarter.

Nu Skin faced difficult year-over-year comparisons and continued macroeconomic hurdles. Macroeconomic factors and related price increases have affected certain key markets, leading to a slowdown in consumer spending and customer acquisition.

Unfavorable Currency Movements Hurt

Nu Skin’s strong international presence exposes it to the risk of volatile currency movements. Any adverse currency fluctuation is likely to weigh on the company’s operating performance. In second-quarter 2023, revenues included a negative impact of 3% from foreign currency fluctuations. The company envisions unfavorable foreign currency impacts of 3-2% on 2023 revenues.

Lowered View

For 2023, Nu Skin anticipates revenues of $2.00-$2.08 billion, suggesting a 10-6% decline from the year-ago period’s reported figure. Earlier, revenues were expected to be $2.03-$2.18 billion. Management envisions an adjusted earnings per share (EPS) of $2.30-$2.60 compared with the $2.41-$2.81 stated earlier. The projection suggests a decline from the adjusted earnings of $2.90 reported last year.

Final Thoughts

Nu Skin is on track with its Nu Vision 2025 strategy to become the world’s leading integrated beauty and wellness company driven by a dynamic affiliate opportunity platform. With the help of advanced technology and well-strategized product programs, Nu Skin tries to capture more significant market share and maintain growth momentum. The company’s long-term strategies stand on three key pillars — Products, Programs and Platforms.

That being said, whether these upsides can help Nu Skin stay afloat amid hurdles is yet to be seen.

Some Better-Ranked Staple Bets

Here, we have highlighted three better-ranked stocks, namely Post Holdings POST, Utz Brands Inc. UTZ and The J. M. Smucker Company SJM.

Post Holdings, a consumer-packaged goods holding company, currently sports a Zacks Rank #1 (Strong Buy). POST has a trailing four-quarter earnings surprise of 59.6% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current fiscal year sales and earnings suggests growth of 13.5% and 184.5%, respectively, from the corresponding year-ago reported figures.

Utz Brands manufactures a diverse portfolio of salty snacks and has a Zacks Rank #2 (Buy). UTZ’s expected EPS growth rate for three to five years is 11.4%.

The Zacks Consensus Estimate for Utz Brands’ current fiscal year sales suggests growth of 3.7% from the year-ago reported numbers. UTZ has a trailing four-quarter earnings surprise of 12.3% on average.

The J. M. Smucker, which manufactures and markets branded food and beverage products, currently carries a Zacks Rank of 2. SJM has a trailing four-quarter earnings surprise of 14% on average.

The Zacks Consensus Estimate for The J. M. Smucker’s current financial-year earnings suggests growth of 6.8% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report