Nu Skin (NUS) Gears Up for Q2 Earnings: What's in Store?

Nu Skin Enterprises, Inc. NUS is likely to register a top-and bottom-line decline when it reports second-quarter 2023 earnings on Aug 1. The Zacks Consensus Estimate for quarterly revenues is pegged at $512.4 million, suggesting a decline of 8.6% from the prior-year fiscal quarter’s reported figure.

The Zacks Consensus Estimate for quarterly earnings has remained unchanged in the past 30 days at 53 cents per share. This indicates a plunge of 31.2% from the figure reported in the prior-year quarter.

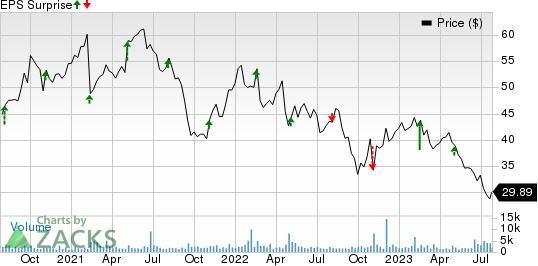

This beauty and wellness product company has a trailing four-quarter earnings surprise of 9.4%, on average. NUS delivered a negative earnings surprise of 12.1% in the last reported quarter.

Nu Skin Enterprises, Inc. Price and EPS Surprise

Nu Skin Enterprises, Inc. price-eps-surprise | Nu Skin Enterprises, Inc. Quote

Things To Note

Nu Skin is battling persistent macroeconomic challenges like rising global inflation. Escalated inflationary environment has been hurting NUS’s margins. Its international presence keeps it exposed to unfavorable currency translations. In the last earnings call, management highlighted that, though curbs are being relaxed and things are opening up across China, it expects the first half of 2023 to remain tough.

For the second quarter of 2023, Nu Skin expects revenues between $485 million and $525 million. The revenue projection suggests a 6-14% decline from the year-ago quarter’s reported level. The company expects adjusted earnings of 45-55 cents a share for the to-be-reported quarter, reflecting a year-over-year decline.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Nu Skin this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Nu Skin carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%.

Stocks With a Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Coty COTY currently has an Earnings ESP of +28.57% and a Zacks Rank #2. The company’s top and the bottom line are expected to increase year over year when it reports fourth-quarter fiscal 2023 results. The Zacks Consensus Estimate for Coty’s quarterly revenues is pegged at $1.3 billion, suggesting a rise of 13.4% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for the quarterly EPS is pegged at 2 cents, indicating a 300% growth from the year-ago period’s figure. COTY has a trailing four-quarter earnings surprise of 145%, on average.

Church & Dwight Co., Inc. CHD currently has an Earnings ESP of +1.14% and a Zacks Rank #2. The company is expected to register top- and bottom-line growth when it reports second-quarter 2023 numbers. The Zacks Consensus Estimate for CHD’s quarterly revenues is pegged at $1.42 billion, calling for an increase of 7.3% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for CHD’s quarterly earnings is unchanged at 79 cents in the past 30 days, suggesting an almost 4% rise from the year-ago quarter’s reported number. CHD has delivered an earnings beat of 9.8%, on average, in the trailing four quarters.

Clorox CLX currently has an Earnings ESP of +5.64% and a Zacks Rank of 3. CLX is anticipated to register top-line growth when it reports fourth-quarter fiscal 2023 results. The Zacks Consensus Estimate for Clorox’s quarterly revenues is pegged at $1.88 billion, indicating a rise of 4.4% from the figure reported in the prior-year quarter.

The consensus estimate for Clorox’s bottom line is pegged at $1.15 per share, suggesting a decline of 23.7% from the year-ago quarter’s reported figure. CLX has delivered an earnings beat of 25.5%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Clorox Company (CLX) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report