Nu Skin (NUS) Lowers 2023 Guidance Despite Q2 Earnings Beat

Nu Skin Enterprises, Inc. NUS posted second-quarter 2023 results, wherein the top and bottom lines declined year over year. Although earnings beat the Zacks Consensus Estimate, revenues missed the same. The company faced difficult year-over-year comparisons and continued macroeconomic hurdles. Notably, management lowered its revenue and earnings per share (EPS) guidance for 2023.

That said, Nu Skin’s second-quarter performance showed sequential improvement and was within the expected range. The performance was largely influenced by significant year-over-year progress in Mainland China and the Rhyz segment. However, certain key markets have been adversely affected by macroeconomic factors and related price increases, leading to a slowdown in consumer spending and customer acquisition.

Management is encouraged about the second half of 2023, wherein it plans to launch ageLOC WellSpa iO — its next connected device system. It also plans to continue developing its social commerce business model to enhance connections with consumers and affiliates. Apart from this, Nu Skin is making steady progress toward the Nu Vision 2025 strategy.

Image Source: Zacks Investment Research

Q2 in Detail

Nu Skin’s adjusted earnings of 54 cents a share declined from the 77 cents reported in the year-ago quarter. However, the metric surpassed the Zacks Consensus Estimate of 53 cents.

Revenues of $500.3 million tumbled roughly 11% year over year. Revenues included a negative impact of 3% from foreign currency fluctuations. The top line missed the Zacks Consensus Estimate of $512 million.

Sales leaders were down 9% year over year to 45,807. Nu Skin’s customer base dropped 25% to 1,041,118. The company’s paid affiliates were down 23% to 187,652.

Nu Skin Enterprises, Inc. Price, Consensus and EPS Surprise

Nu Skin Enterprises, Inc. price-consensus-eps-surprise-chart | Nu Skin Enterprises, Inc. Quote

The gross profit of $364.7 million declined from the $412.5 million reported in the year-ago quarter. The gross margin came in at 72.9%, down from the 73.6% reported in the year-ago quarter. The Nu Skin business’ gross margin came in at 77.2%, up 20 basis points year over year, which was impacted by revenue growth in Rhyz Manufacturing.

Selling expenses declined to $185.2 million from the $219.4 million reported in the prior-year quarter. As a percentage of revenues, the metric was 37%, down from the 39.1% reported in the year-ago quarter. Nu Skin business’ selling expenses were 40.2% compared with 42% in the prior-year quarter.

General and administrative expenses of $137 million declined from $141.6 million in the year-ago quarter. As a percentage of revenues, general and administrative expenses came in at 27.4%, up from 25.3% in the year-ago period.

The operating income of $42.5 million declined from $51.5 million in the year-ago quarter. The operating margin contracted to 8.5% from the 9.2% reported in the year-ago quarter.

Regional Results

Region-wise, revenues (at cc) declined 10%, 30%, 19%, 4%, 9% and 3% in the Americas, Southeast Asia/Pacific, South Korea, Japan, the EMEA and Hong Kong/Taiwan, respectively. In Mainland China, revenues rose 8% at cc.

Other Financial Details

Nu Skin ended the quarter with cash and cash equivalents of $235.6 million, long-term debt of $367.8 million, and total stockholders' equity of $895.3 million. In the reported quarter, the company paid out dividends of $19.5 million, while making no repurchases. NUS has $175.4 million remaining under the current share repurchase authorization.

Guidance

Considering the first-half results, a stronger-than-expected U.S. dollar and recent acquisitions, management adjusted its 2023 guidance. Despite a tough global macro landscape, the guidance indicates sequential improvements in the second half of the year, with a return to year-over-year growth in the fourth quarter.

Nu Skin anticipates revenues of $2.00-$2.08 billion for 2023, suggesting a 10-6% decline from the year-ago period’s reported figure. Earlier, revenues were expected to be $2.03-$2.18 billion. The company envisions unfavorable foreign currency impacts of 3-2% on 2023 revenues.

Management envisions an adjusted EPS of $2.30-$2.60 compared with the $2.41-$2.81 stated earlier. The projection suggests a decline from the adjusted earnings of $2.90 reported last year. EPS on a reported basis is anticipated to be $2.15-$2.45, down from the earlier stated $2.27-$2.67.

For the third quarter, Nu Skin expects revenues between $500 million and $540 million, including an unfavorable foreign currency impact of 1-2%. The current revenue projection suggests a decline of 7% to a 0.5% rise from the year-ago quarter’s reported level. The company expects earnings of 54-69 cents a share for the third quarter.

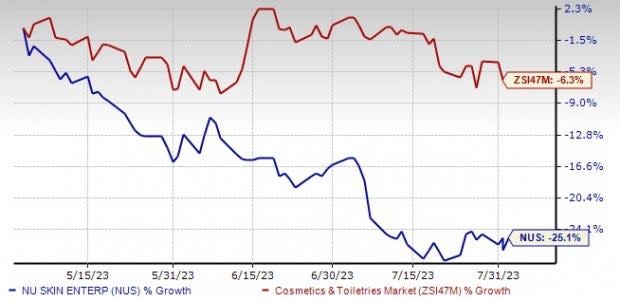

Shares of this Zacks Rank #4 (Sell) company have dipped 25.1% in the past three months compared with the industry’s decline of 6.3%.

Some Solid Picks

Some better-ranked stocks are e.l.f. Beauty, Inc. ELF, Coty Inc. COTY and Inter Parfums, Inc. IPAR.

e.l.f. Beauty, which operates as a cosmetic company, currently sports a Zacks Rank #1 (Strong Buy). ELF has a trailing four-quarter earnings surprise of 103.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for e.l.f. Beauty’s current fiscal-year sales and EPS suggests increases of 25.9% and 10.2%, respectively, from the year-ago reported numbers.

Coty, which manufactures, markets and distributes beauty products worldwide, currently has a Zacks Rank #2 (Buy). COTY has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Coty’s current fiscal-year sales and earnings suggests growth of 4.2% and 92.9%, respectively, from the year-ago reported figures.

Inter Parfums, which is engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products, currently carries a Zacks Rank #2. IPAR has a trailing four-quarter earnings surprise of 37.2%, on average.

The Zacks Consensus Estimate for Inter Parfums’ current fiscal-year sales and earnings suggests an increase of 21.2% and 10.1%, respectively, from the year-ago reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report